Drinks maker Diageo’s (LSE:DGE) share price has slumped 10% in the year to date. It’s a descent I think makes it one of the FTSE 100’s most attractive contrarian stocks to buy.

The broader market doesn’t share my enthuiasm for the Captain Morgan and Smirnoff maker. And at first glance it’s easy to see why. At £32.90 per share the company still trades on a forward price-to-earnings (P/E) ratio of 20 times. That’s some way above the FTSE index average of 14 times.

Should you invest £1,000 in Segro Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Segro Plc made the list?

However, dig a little deeper and suddenly Diageo shares don’t look so expensive.

P/E ratio

Comparing the cost of the stock to the broader FTSE 100 doesn’t tell the whole story. Diageo’s blend of defensive qualities — such as its strong pricing power, wide geographic footprint and non-cyclical operations — aren’t shared across that many UK blue-chip shares.

Investors are prepared to pay a premium for this. And especially so in uncertain economic times such as today. Therefore, a better comparison to make would be with other international stocks that operate in the same sector.

On this basis the British company doesn’t appear expensive. Okay, the firm trades at a slight premium to Anheuser-Busch InBev and Heineken. These brewers trade on forward P/E ratios of 18.6 times and 17.9 times, respectively.

But Diageo shares are on a lower earnings multiple than certain other diversified alcohol manufacturers. Pernod Ricard, for example, carries a P/E ratio of 20.7 times times for this year. Constellation Brands meanwhile trades on a reading of 23.9 times.

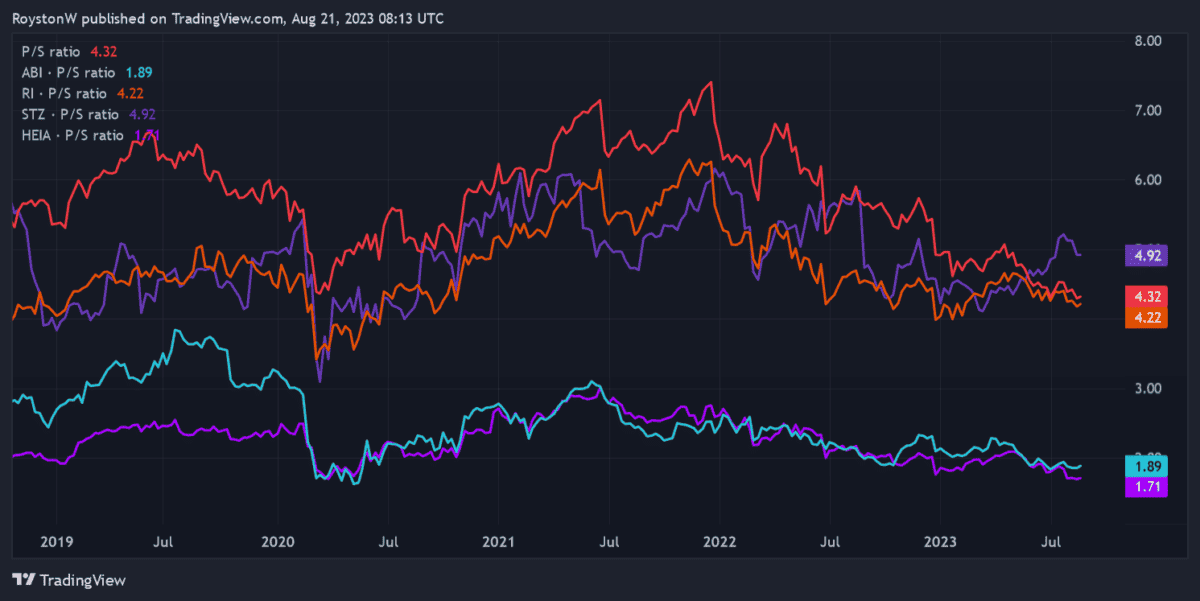

P/S ratio

The same pattern is exhibited when comparing the companies on a price-to-sales (P/S) ratio basis. As the chart above shows, Diageo is also more expensive on this ratio compared with those dedicated beer specialists. In fact the margin is quite wide.

However, Diageo’s rating is broadly consistent with those of Constellation Brands and Pernod Ricard. It sits below the former’s ratio near five times, and just above the latter’s reading of 4.22.

One may ask why these three firms trade on higher ratios than the beermakers. Well there are several good reasons for their better valuations. These include:

- A broader range of market-leading brands.

- Exposure to the fast-growing premium end of the alcohol market.

- Less competition in the spirits market versus the beer segment.

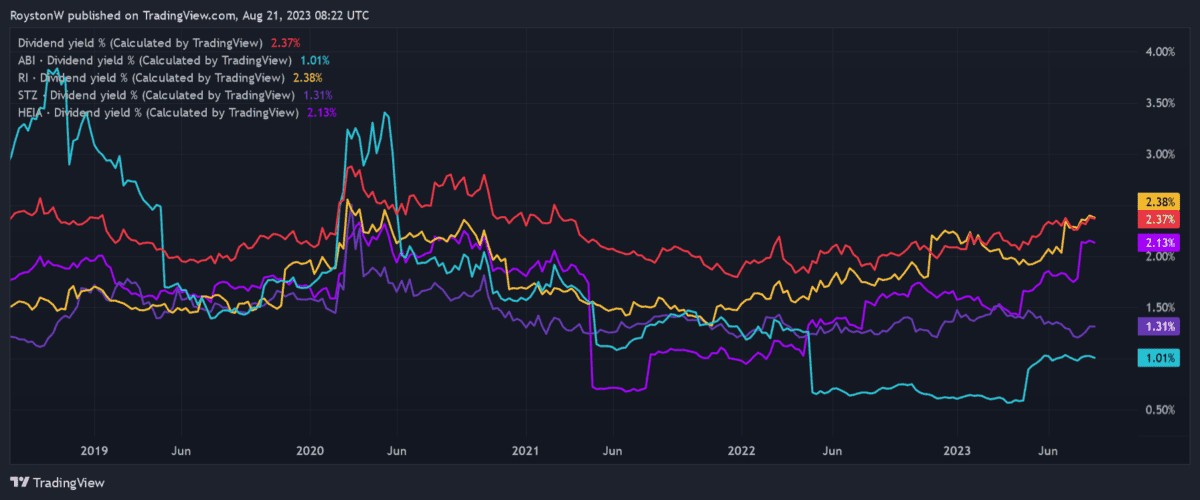

Dividend yield

The final metric I’m looking at is dividend yield. As the chart shows, Diageo sits at the top of the tree with Pernod Ricard. It’s also streets ahead of beer makers AB Inbev and Heineken.

Diageo’s generous dividend policy is one reason why I bought its shares for my own portfolio. As well as offering one of the industry’s largest yields, the company has raised the annual dividend every year for more than 30 years.

The verdict

As I said, Diageo’s shares trade on a higher P/E ratio than most FTSE 100 companies. But this only tells part of the story. On the whole, I think the drinks giant offers decent value for money. And I’ll be looking to pick up more of its shares when I have extra cash to invest.