RC365 (LSE:RCGH) shares have fallen some distance from their highs in July. However, despite the 40% drop, the stock is still up a phenomenal 496% over 12 months, making it one of the best performing UK-listed companies.

AI boom?

In the early summer, shares in RC365 experienced an unexpected surge, leaving many baffled about the reasons behind this sudden phenomenon.

One reason could be a flurry business deals, including a memorandum of understanding signed with Hatcher Group, a Hong Kong-listed entity with a strategic emphasis on providing innovative artificial intelligence (AI) solutions. After all, AI is a buzzword in 2023.

This was followed by an article, possibly sponsored, entitled ‘Missed Nvidia? This London AI stock could jump over 1,000%.’ This article, credited to various authors, could be a key catalyst for the increased interest in RC365’s shares.

There’s been other activity too, including a partnership with APEC Business Services and the successful acquisition of Mr Meal Production Limited.

In a more recent development, RC365 has entered into a non-binding letter of intent (LOI) with YouneeqAI Technical Services Inc, a US-based entity. This agreement gives exclusive rights to RC365 for the utilisation of YouneeqAI’s advanced AI-driven cookieless personalisation platform within the UK.

A new Nvidia

The surge in Nvidia shares stands out as one of the most intriguing investment stories of 2023. Nvidia’s earnings are projected to experience a significant increase this fiscal year, propelled by the robust sales of chips for data centres and artificial intelligence applications.

The fabless chipmaker is diversifying its operations. It has announced moves into burgeoning sectors, including automated electric cars and cloud gaming.

However, RC365 has little in common with Nvidia. We have seen revenue double over the last financial year to HKD16.9m (£1.5m) but this company is small-fry. And it’s still loss-making. Losses amounted to HKD5.4m (£530k) in the 12 months to the end of June, up from HKD3.9m in the previous year.

Better value than Nvidia?

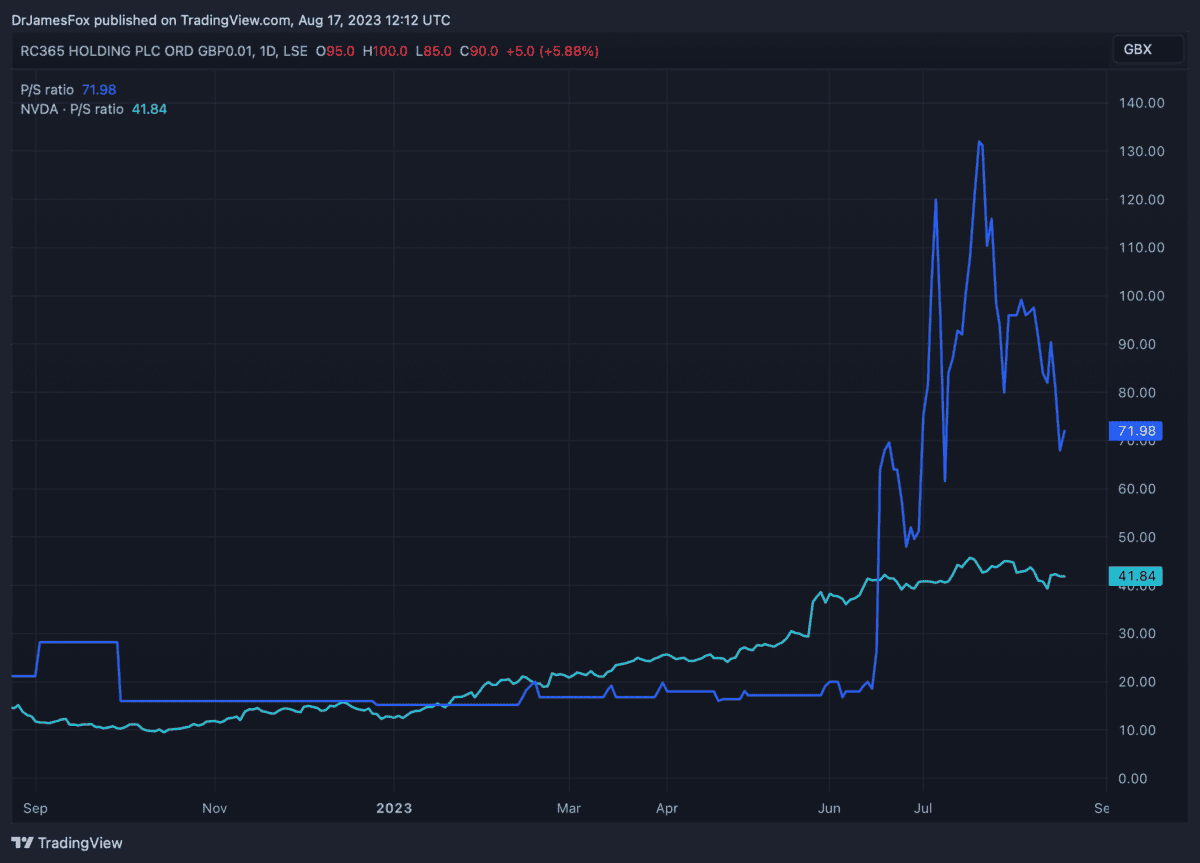

Presently, Nvidia’s valuation appears to be notably high. With a price-to-sales (P/S) ratio standing at 41.8 times and a forward P/S ratio at 24 times, its current pricing is steep. Typically, a P/S ratio exceeding 10 is often deemed expensive.

In comparison, when we observe RC365 trading at a P/S ratio of 71 times, it looks incredibly expensive. This disparity in valuation is clearly highlighted in the chart below, emphasising the substantial variance in the pricing between these two stocks.

Well, personally, I’m not going to invest in either. While Nvidia undoubtedly will play an important part in all our futures, it’s valuation has gone wild this year. Even if the future is bright for Nvidia, there’s a lot of room for it to fall following the surge.

Meanwhile, RC365 appears uninvestable. It’s incredibly expensive and I don’t like that fact that CEO Chi Kit Law holds 69.75% of issued shares — what happens if he decides to cash in?