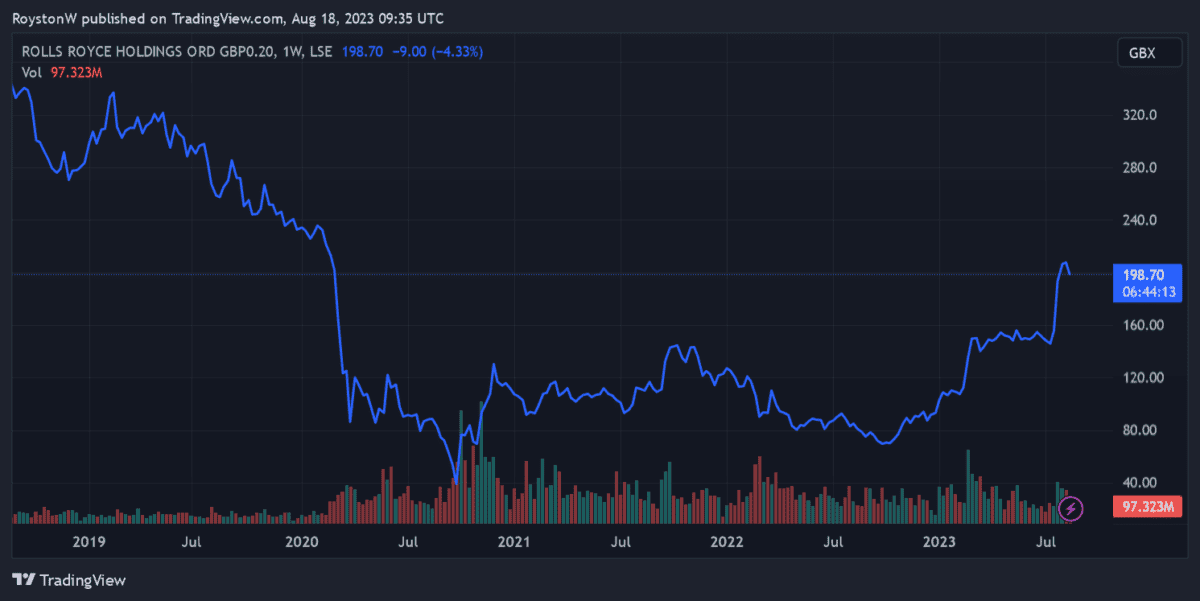

The Rolls-Royce (LSE:RR) share price is climbing once again. In fact, it recently reclaimed the 200p per share marker for the first time since early 2020.

Does the FTSE 100 stock still offer value for money though? Let’s take a look.

P/E ratio

The first thing to consider is the company’s price-to-earnings (P/E) ratio for 2023. At 25.5 times, this sits way ahead of the forward average of 14 times for FTSE 100 shares.

Should you invest £1,000 in Rolls-Royce right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Rolls-Royce made the list?

Rolls shares have pulled back thanks to rebounding conditions in key markets. A travel sector revival is powering revenues higher at its Civil Aerospace unit again. Its Defence division is also performing strongly as global weapons spending spikes.

The business doesn’t look overwhelmingly expensive compared to its peers though. Though it must be said that investors can get better value elsewhere, based on this metric.

Airbus trades on a forward-looking P/E ratio of 22.7 times. Pratt & Whitney owner RTX Corporation (which was known as Raytheon Technologies until July) trades on an earnings multiple of 17 times.

However, fellow engine builder Safran trades on a heavier P/E ratio of 27.8 times.

PEG ratio

That said, Rolls-Royce shares seem to offer compelling value when it comes to the price-to-earnings (PEG) ratio. City analysts expect annual profits to rocket around 300% this year, leaving it trading on a multiple of 0.1.

Any reading below 1 indicates that a share is undervalued. Only RTX (which trades on a PEG ratio of 0.4) sits within this bargain benchmark. Airbus carries a reading of 8, while Safran doesn’t generate a reading, having reported losses in 2022.

Dividend yield

It’s also important to consider Rolls’ dividend yield when assessing value. And on this score, it doesn’t score highly. In fact, it isn’t expected to pay a dividend at all in 2023 as work continues to repair the balance sheet. This puts it on the same holding pattern as Boeing.

By contrast, the average forward yield on FTSE 100 stock sits at a meaty 3.7%. RTX leads the aerospace businesses with a 2.7% dividend yield for 2023, while Safran and Airbus each offer a 1.5% yield.

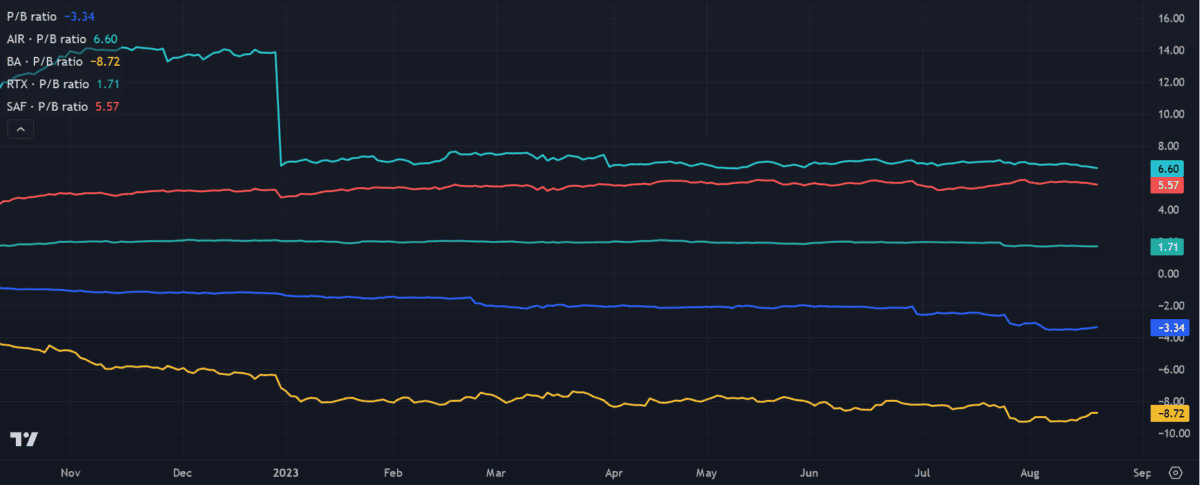

P/B value

Finally, it’s worth considering whether Rolls shares look cheap, according to the value of its tangible assets. I can do this by calculating the firms price-to-book (P/B) ratio.

On this front, the company scores badly, as the chart above shows. A negative reading of 3.34 shows its liabilities are higher than the value of its assets. Only Boeing (with a ratio of 8.72) posts a worse reading.

The verdict on Rolls shares

Based on all of the above, I don’t think the engineer offers decent value for money, at current prices.

Rolls’ recent turnaround has been impressive. But a sudden downturn in its end markets could send its share price plummeting again. As a potential investor, I’m also concerned about its large £2.8bn net debt pile, and the fact a significant portion of this needs to be repaid in the next two years.

On balance, I’d rather buy other FTSE shares today.