Investor appetite for UK banking stocks has weakened since the start of 2023. The 8% drop in Lloyds Banking Group’s (LSE:LLOY) share price during the past eight-and-a-half months underlines how these cyclical businesses have fallen out of fashion.

Lloyds shares look incredibly cheap at current levels of 42.6p. But just how cheap are they, and could this be a great buying opportunity for value investors?

Should you invest £1,000 in Lloyds Banking Group right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Lloyds Banking Group made the list?

P/E ratio

The first thing to look at is the company’s price-to-earnings (P/E) ratio. At the moment it trades on a forward-looking earnings multiple of 5.6 times. This is far below an average of 14 times for FTSE 100 shares.

However, Lloyds shares don’t look especially cheap compared with banks that also focus on the UK. Barclays, for example, trades on a ratio of 4.4 times forward earnings. NatWest sits on a P/E ratio of 5 times.

It’s worth mentioning that Lloyds trades more cheaply than HSBC and Standard Chartered though. These operators trade on P/E ratios of 6 times and 7.1 times respectively for 2023.

Some would argue though, that these firms deserve a higher rating due to their focus on Asia and Africa. A combination of low product penetration and faster GDP growth compared with Britain give them the chance to deliver far superior long-term earnings growth.

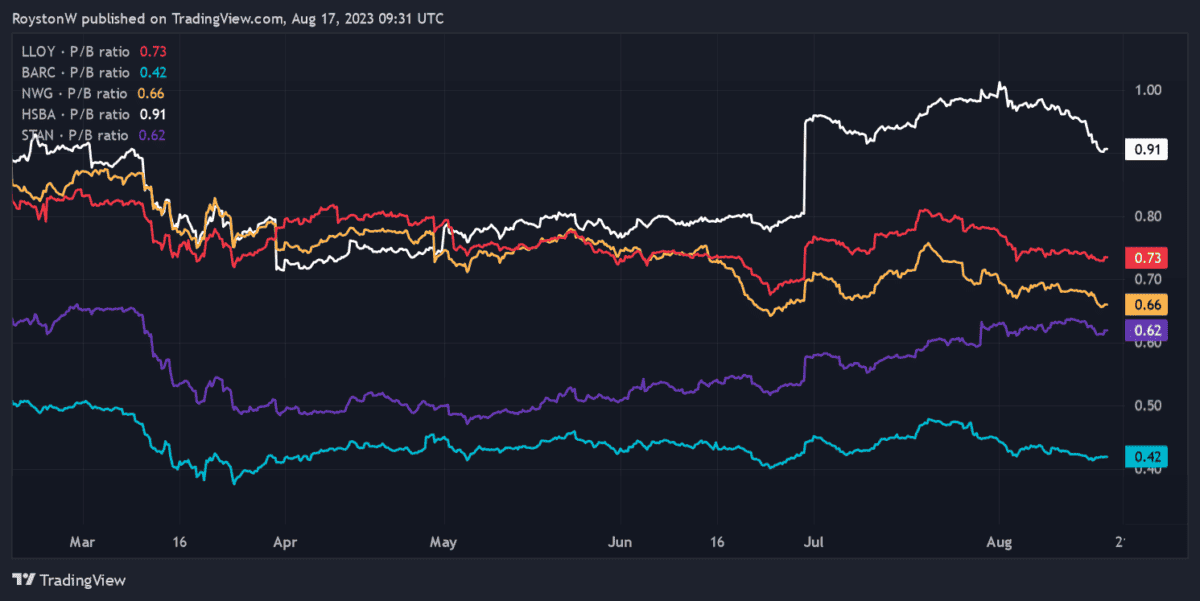

P/B ratio

Another way to evaluate the cheapness of Lloyds shares is to consider its price-to-book (P/B) value compared to other banks. This reveals how well the firm is in relation to the value of its assets. Like the P/E ratio, the lower the reading the better.

As the chart shows, Lloyds trades on a higher P/B ratio than Standard Chartered, NatWest and Barclays. Only HSBC is more expensive than the Black Horse Bank.

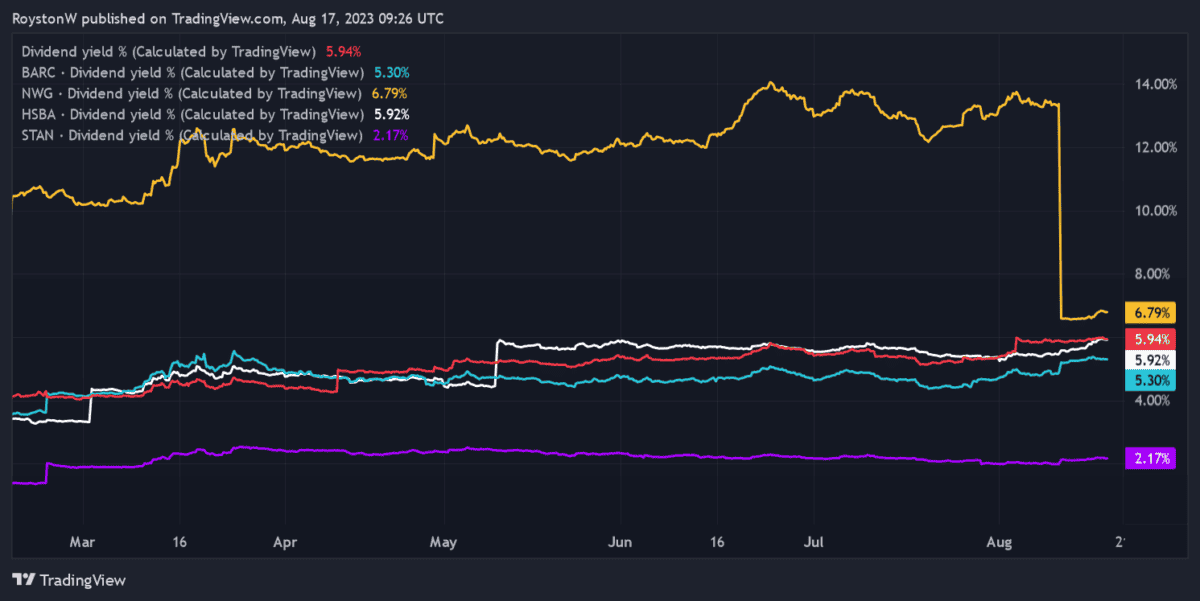

Dividend yields

Finally, it’s worth looking at the value different banks offer when it comes to dividends. As the chart below shows, each of the FTSE 100 banks (bar Standard Chartered) have forward-looking dividend yields that beat the 3.7% FTSE average.

On this front, Lloyds looks very attractive. Its dividend yield for 2023 is beaten only by NatWest.

Should I buy Lloyds shares?

On balance, the bank doesn’t seem that cheap compared with its industry rivals. But its low P/E ratio and large dividend yield might suggest it’s great value in contrast to the broader FTSE 100.

However, it’s my opinion that Lloyds’ share price is deserving of a lower rating than most other blue-chip shares. That’s even though stubbornly high inflation means UK interest rates are tipped to keep rising, boosting the profits the bank makes on its lending activities.

Not only does the company face a steady flow of heavy loan impairments as the cost-of-living crisis endures. A gloomy outlook for the British economy for the next few years at least suggests a prolonged period of weak revenues growth.

Finally, Lloyds — like Barclays, NatWest and other industry heavyweights — faces mounting competition from challenger banks that threaten future income. All things considered, I’d rather find other FTSE 100 value stocks to buy.