Defence stocks have soared in value since Russia’s invasion of Ukraine in February 2022. The BAE Systems (LSE:BA.) share price, for instance, has risen 76% since the beginning of last year. Over the same period, the FTSE 100 index has dropped 2%.

Still, at a current price of 967p, could BAE Systems shares be considered cheap?

P/E ratio

A good starting point is to look at the UK company’s price-to-earnings (P/E) ratio. At 15.6 times for 2023, this sits above the forward average of 14 times for FTSE 100 shares.

There are good reasons for this heavier rating, in my opinion. Firstly, a bright outlook for defence markets has improved even further since the breakout of the Ukraine conflict. Ongoing tension over Chinese foreign policy is another reason why arms spending is tipped for strong and sustained growth.

BAE Systems’ non-cyclical operations has also boosted its valuation. Unlike most UK shares, its revenues aren’t closely correlated to the state of the wider economy. In the current macroeconomic climate investors are prepared to pay a premium for this quality.

However, the company’s shares don’t look expensive compared to the industry average. In fact, it looks cheaper than many of the defence sector’s heavyweights, based on this year’s predicted earnings.

RTX Corporation (until recently known as Raytheon Technologies) and Lockheed Martin trade on P/E ratios of 17 times and 16.4 times respectively. Northrop Grumman carries an even higher earnings multiple of 18.8 times for this year. And French defence firm Thales trades on a P/E ratio of 16.2 times.

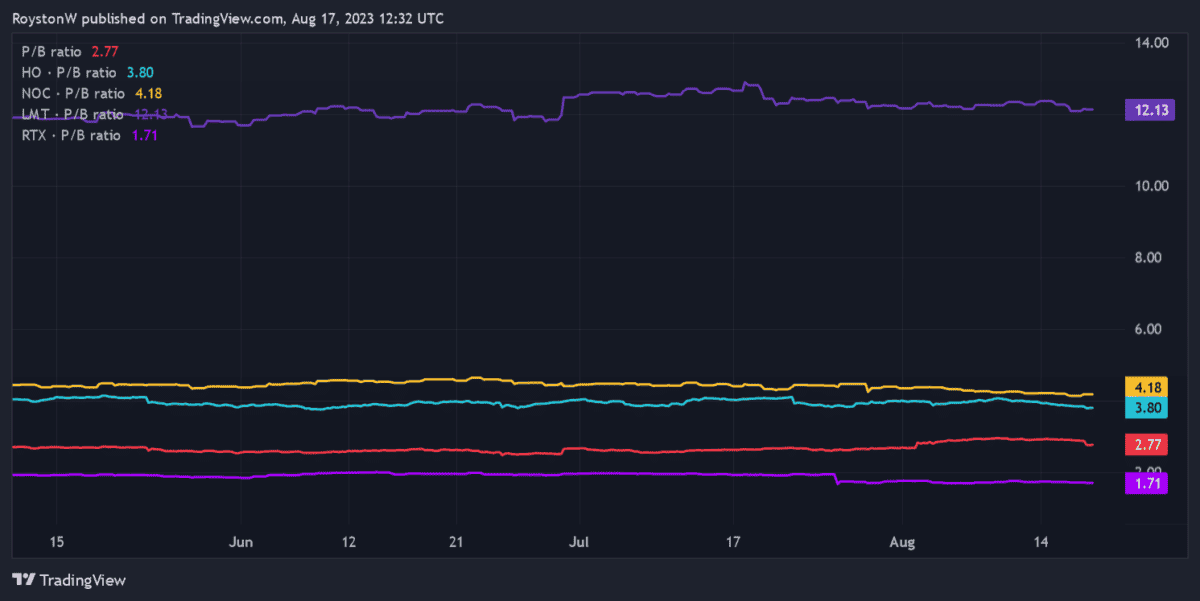

P/B ratio

Another useful exercise is to compare BAE Systems’ price-to-book (P/B) value compared with the broader industry. This provides an indication of the company’s value based on its tangible assets.

The lower the reading, the better. And as the above chart shows, the UK company’s P/B ratio is more attractive than most of its peers.

It’s lower than those of (in ascending order) Thales, Northrop Grumman and Lockheed Martin. In fact, the latter’s multiple is more than four times higher than that of BAE Systems.

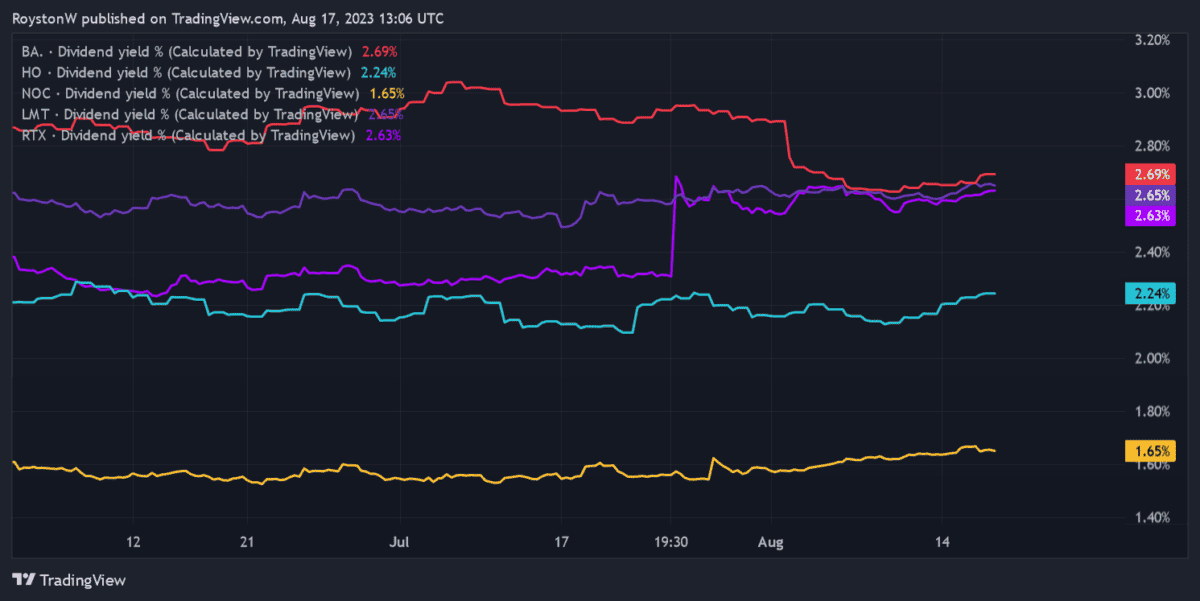

Dividend yield

Lastly, it’s worth comparing the dividend yields the FTSE 100 share offers versus those rivals. As the below chart shows, it sits at the top of tree, alongside RTX and Lockheed Martin.

It’s important to remember that these figures are based on broker forecasts. However, strong dividend cover of 2 times and a robust balance sheet means BAE Systems looks in great shape to meet current payout estimates.

Should I buy BAE Systems shares?

I think the discount the company trades at to the broader industry makes it a top buy today.

As I say, the defence market looks primed for strong growth. And thanks to its close relationships with the UK and US, profits at BAE Systems appear on course to soar. Latest financials showed its order backlog rose to a record £66.2bn as of June.

This is a FTSE 100 share I’d buy to hold in my portfolio for the next decade if I had some spare cash.