Many investors will be aware that Lloyds (LSE:LLOY) shares look cheap compared to its peers. But, of course, this reflects the bank’s relative exposure to perceived risk and its efficiency at generating income from assets.

However, when we delve deeper, do Lloyds shares still look undervalued? Let’s explore.

Risk exposure

Lloyds, and peer Barclays, haven’t been overly popular with investors since the financial crisis. However, these cyclical institutions currently trade at a discount even versus their historical average valuations. On several metrics, Barclays is actually cheaper than Lloyds.

Should you invest £1,000 in Lloyds Banking Group right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Lloyds Banking Group made the list?

However, focusing on Lloyds, we can observe that it trades at a considerable discount to the index and most of its peers. It has a price-to-earnings (P/E) ratio of 5.3 and a forward P/E of 5.9. This put it at a considerable discount versus HSBC at 6.6 times, Standard Chartered at 10 times, and Bank of America at 8.8 times.

The primary reasoning for this is Lloyds’s exposure to defaults in this rising interest rate environment. The thing is, higher interest rates are good for banks until they’re not. And with the BoE rate potentially hitting 6%, there are serious concerns about loan defaults.

This impacts Lloyds more than other banks due to its funding mechanics and interest rate sensitive operations. After all, Lloyds doesn’t have an investment arm. As such, if we do see a slew of customer defaults across the loan market, Lloyds will likely be hardest hit.

Still mispriced

Despite this, Lloyds still looks mispriced at 42p. One metric that tells us this is the price-to-book (P/B) ratio. This is used to assess a company’s valuation by comparing its market price per share to its book value per share, which represents the net assets of the company.

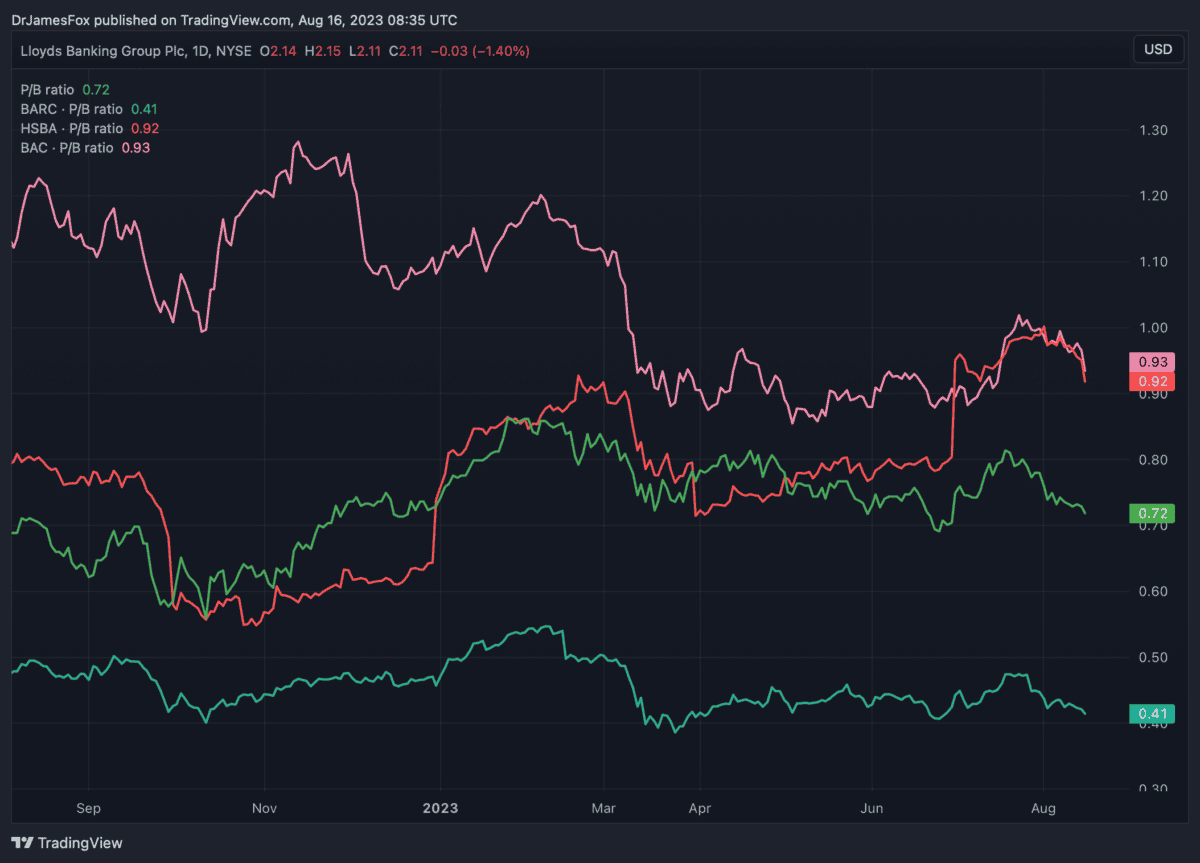

In the below chart, we can see that Lloyds trades at 0.73 times the value of its net assets. This, therefore, reflects a discount of 27%. Only Barclays, which is very heavily discounted, trades at a greater discount.

While defaults are a concern, it’s important to remember that all UK banks recently passed the stress test. Lloyds was, depending on how you look at it, the second-best performer. Under the stress scenario, Lloyds’s CET1 would fall to 11.6%, putting it ahead of all banks bar Nationwide.

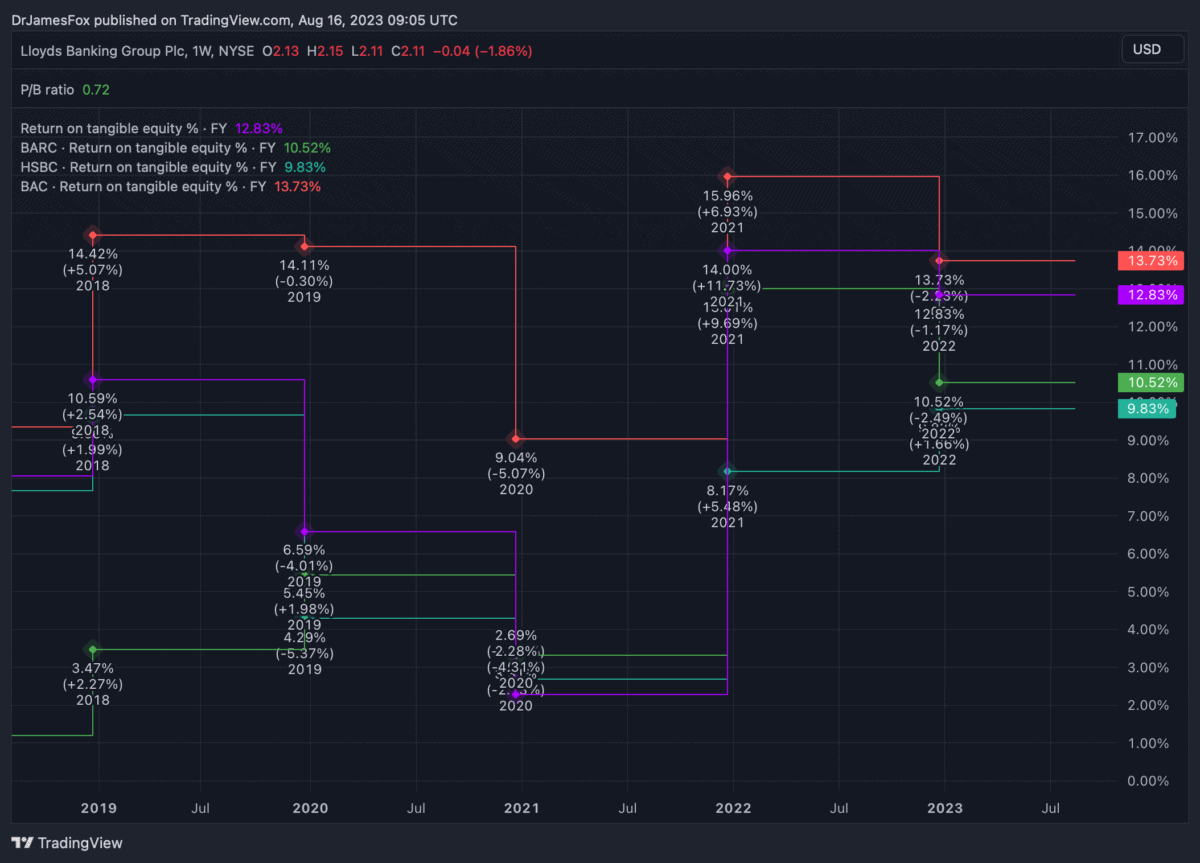

There are, naturally, lots of things to consider. Lloyds has not traditionally been the most efficient at generating returns compared to peers. But in an environment where interest rates fall to around 2%-3%, which they are forecast to do, Lloyds could be a highly efficient business. This RoTE chart, with data until the beginning of 2023, demonstrates this.

Of course, the quicker interest rates fall to the forecast new long-term average, the quicker the Lloyds share price will recover. Investors are certainly risk-off at this moment, and Lloyds carries more risk than its peers. Despite this, I believe it’s a risk worth taking. And I’ve been topping up my portfolio as a result.