Technology stocks, many of which are listed on the NYSE, have experienced a resurgence in 2023. That’s been partially driven by improving investor sentiment, but also the artificial intelligence (AI) boom.

Shares in MENA-focused social media firm Yalla (NYSE:YALA) have made significant gains this year, but still look incredibly cheap by several metrics. Let’s take a closer look.

Recent outperformance

Yalla’s shares once commanded a high of $40 before the Covid era tech bubble burst. However, at present, the stock’s value stands at $5.20, notably below its IPO price of $7.50 back in September 2020.

Despite its profitability and consistent steady growth, Yalla, which operates a voice-centric social platform and a portfolio of mobile games, seems to have faded from investors’ radar. Remarkably, even in the face of stable financial performance, the stock has struggled to gather momentum. Interestingly, even a very strong Q2 showing failed to trigger a surge in the share price.

Notably, in Q2, the company reported a substantial year-on-year net income increase of 32.4% and a 34.8% quarter-on-quarter rise to $33.8m. This was fuelled by incremental revenue growth and a reduction in costs.

Development programme

Investors might have harboured apprehensions regarding Yalla’s strategic venture into new markets, particularly the mid-to-hard-core gaming segment. This strategic diversification naturally implies a commitment to research and development investments to establish a foothold in this domain.

Surprisingly, these expectations have not significantly impacted profitability up to this point. Notably, Yalla demonstrated adept cost management, as evidenced by a noteworthy 14.8% reduction in technology and product development expenses during the second quarter of 2023, resulting in an expenditure of $6.6m.

Valuation

On a TTM basis, we can see that Yalla trades at 10.15 times earnings. Not only does that make it one of the cheapest technology stocks, but it’s also cheaper than the majority of the index. It even trades below several cyclical stocks, including banks.

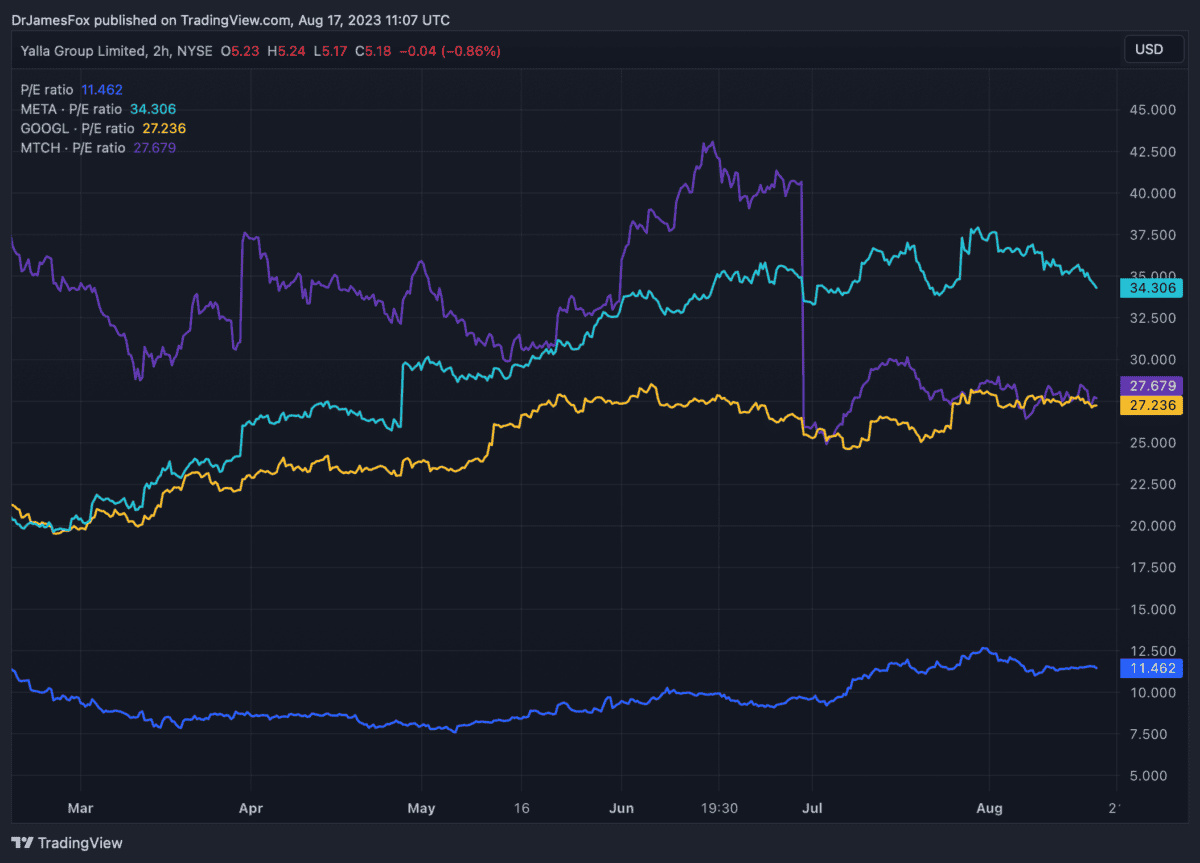

In the following chart, we can also see that Yalla trades at phenomenal discount versus social media giant, Meta, technology leader, Alphabet, and dating app owner Match Group. These comparisons are made on P/E basis for the last full year.

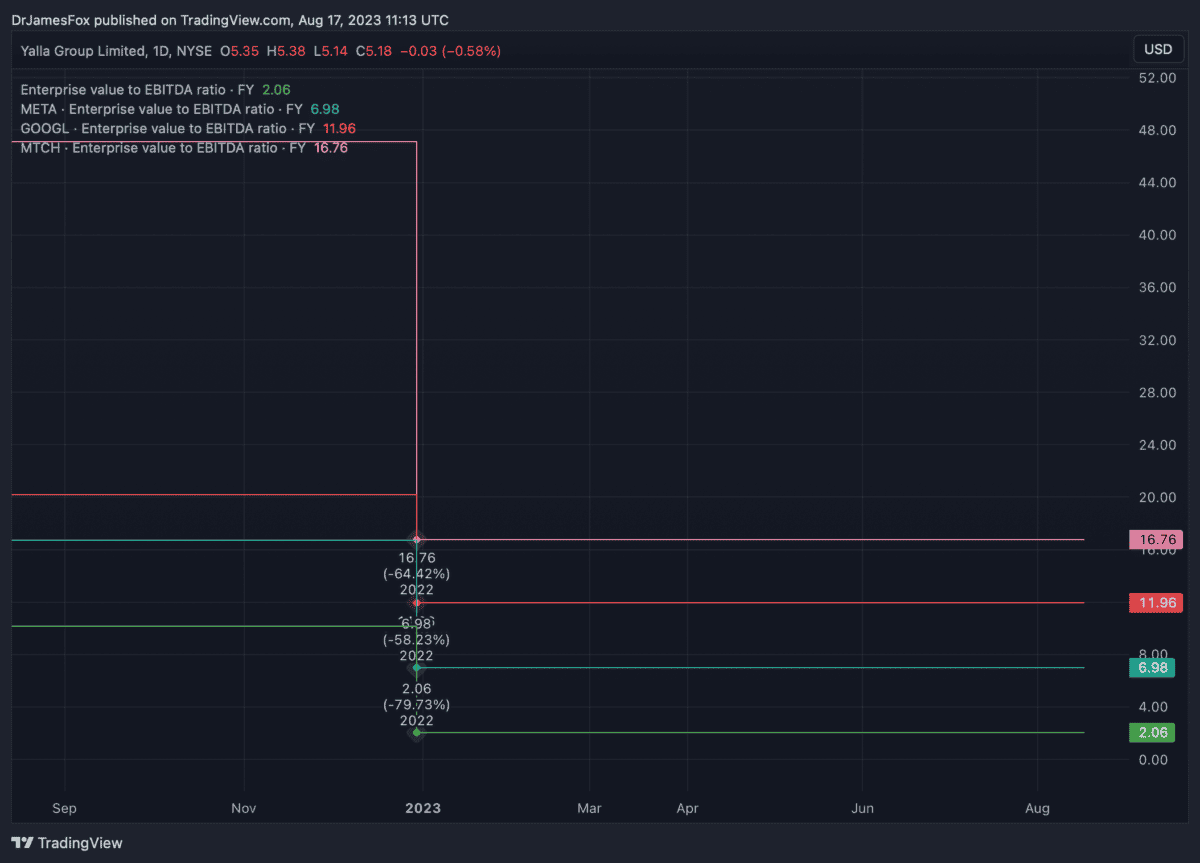

Nonetheless, the disparity becomes even more conspicuous when we look at the EV-to-EBITDA ratio. This discrepancy primarily stems from Yalla’s substantial cash reserves, which significantly augment its valuation dynamics.

Impressively, by the close of the second quarter, the company boasted an impressive $510.5m in cash holdings, marking an increase from the $471.4m reported at the end of Q1. This robust financial position translates into Yalla’s remarkable EV-to-EBITDA ratio, hovering slightly above two.

Yalla’s valuation suggest it offers little growth opportunities, but that’s not true. And it’s movement into the mid-to-hard-core gaming segment could soon deliver stronger financial gains following the release of Merge Kingdoms.

While no stock is without its imperfections, it’s worth noting that Yalla shares might benefit from more well-defined revenue growth. However, the remarkable value proposition it presents, coupled with intriguing growth potential, makes it a compelling consideration for investors.

There may also come a time when investors expect a dividend.