Rolls-Royce (LSE:RR.) shares have been a huge success story in what has proved to be a muted year for FTSE 100 stocks. The UK’s premier index is down almost 3% since the beginning of January, but the Rolls-Royce share price has more than doubled.

That’s an impressive return. The company recently upgraded its full-year profit forecast, which suggests more growth could be on the cards. However, today the shares are over five times as expensive as their five-year low in October 2020. Back then, they traded for under 39p.

So, would an investment in the aerospace and defence business still make sense at today’s price, above £2 a share? Here’s my take.

A rebounding stock

Buoyed by improved trading conditions for its civil aerospace division, Rolls-Royce delivered underlying profit of £673m in H1 2023 and lifted full-year profit guidance to £1.2bn-£1.4bn. Compare that to the £125m profit in H1 2022 and it’s clear the company has made enormous progress in 12 months.

The civil aerospace arm generates revenue by maintaining and servicing engines for leading airlines. Encouragingly, the division’s 12.4% margin is the highest it’s been for at least 15 years.

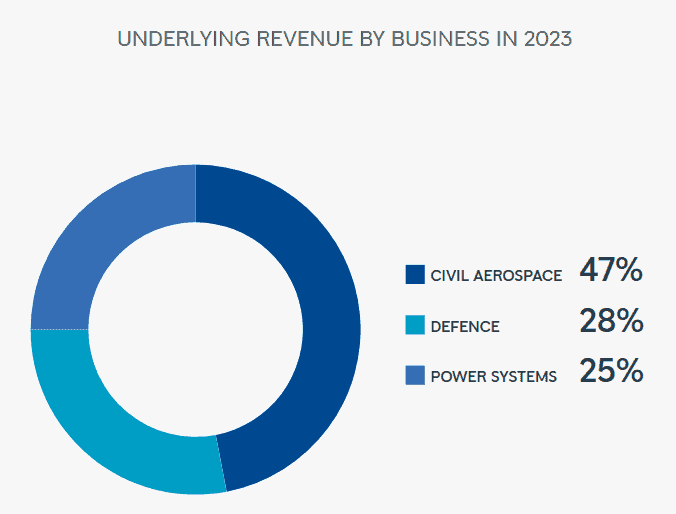

A significant factor behind the better performance was a 36% year-on-year rise in large engine flying hours, reaching 83% of pre-pandemic levels. A healthy travel market is essential for Rolls-Royce to thrive, considering it derived nearly half its revenue from civil aerospace operations in H1.

Business has been good for Rolls-Royce’s defence unit too. The division delivered a 33% operating profit hike to £261m and margins also improved. What’s more, the order intake is up 87% to £2.7bn, which points to strong future revenues.

The company’s power systems division hasn’t enjoyed the same success — but its performance wasn’t disastrous either. Operating profit effectively flatlined and margins shrank slightly. A 14% slump in the order intake to £1.9bn is disappointing, but glowing results elsewhere made up for this fly in the ointment.

Risks remain

So, do these stellar financials mean investors can expect further growth in Rolls-Royce shares?

It’s certainly a realistic possibility, but there are still challenges facing the business. Although the major credit rating agencies all have a positive outlook, the firm’s rating remains below investment grade.

| Agency | Rolls-Royce credit rating |

|---|---|

| Moody’s | Ba3 |

| Fitch | BB- |

| S&P | BB |

CEO Tufan Erginbilgic has highlighted improving the credit rating as a key priority. In addition, although net debt fell from £3.2bn to £2.8bn, significant progress still needs to be made on this front.

Plus, there’s a risk that Rolls-Royce has benefitted considerably from post-pandemic recovery trends in its core markets. Accordingly, it could be difficult for the company to maintain such a strong trajectory as trading conditions normalise. This might result in a more pedestrian future for the Rolls-Royce share price.

Should investors buy?

Rolls-Royce’s business was devastated by Covid, but the turnaround under Erginbilgic’s leadership has been admirable. The company’s in stronger shape today and the growth outlook is promising.

However, investors should note the share price has risen considerably over the past year. I’m not convinced future returns will be as impressive.

Nonetheless, I already own Rolls-Royce shares. I’ll continue to hold them for the long term despite the temptation to take profits today.