Financial services companies in the UK face heightened uncertainty as the domestic economy struggles. Passive income stock Aviva’s (LSE:AV.) share price has dropped 14% since the start of 2023 as investors have worried about falling product demand.

I view recent weakness as the perfect opportunity to pick up its shares on the cheap. Here are four reasons why I’d buy the life insurance giant today.

1. Great all-round value

The good news for value investors is that the FTSE 100 firm now looks like an unbelievable bargain. Based on this year’s projected profits, it trades on a price-to-earnings (P/E) ratio of 9.3 times.

Aviva shares also carry an 8.7% forward dividend yield at current prices of 385p. This is more than double the corresponding average of 3.7% for FTSE-listed stocks.

2. Robust dividend forecasts

It’s important to remember that dividend yields are based solely on projections. There’s no guarantee that the shareholder payouts analysts are predicting (or companies are targeting) will come to pass.

Indeed, as rising interest rates and weak growth damage profits across UK PLC, there are many stocks I believe will deliver lower-than-forecast dividends in 2023. But I’m confident Aviva shares will meet its £915m dividend target in 2023. This equates to around 33.4p a share.

This is thanks to Aviva’s ability to generate enormous amounts of cash. The company’s Solvency Capital II ratio stood at 212% as of the end of December. This provides the base to return lots of cash to its shareholders through share buybacks and large dividends.

3. A history of FTSE-beating returns

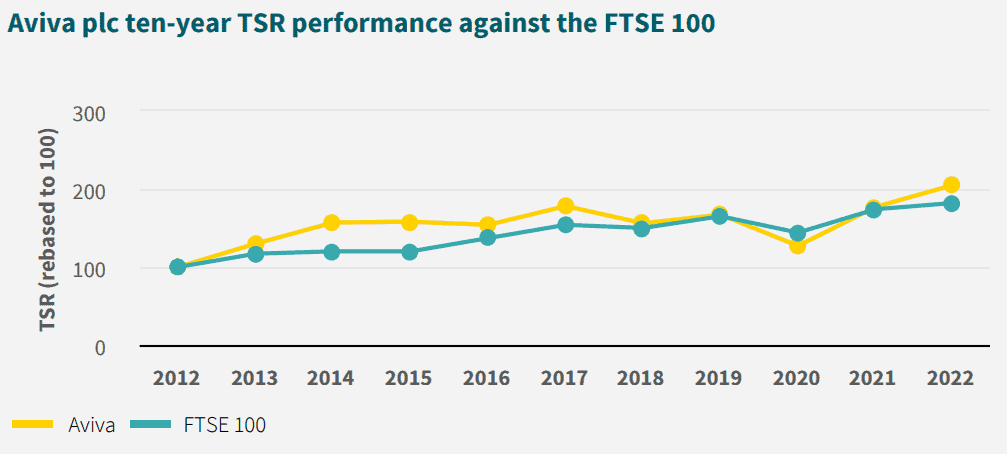

Past performance is no reliable indicator of the future. But as the chart above shows, the financial services giant knows how to generate strong returns to its investors.

Aviva’s share price has risen 19% over the past 10 years and has had a great track record of returning surplus cash to shareholders over that time. Therefore the business has consistently beaten the average total shareholder return for FTSE 100 shares over the period.

4. A safe pair of hands

Under chief executive Amanda Blanc, I’m confident Aviva can make the most of this colossal market opportunity.

The company has undertaken heavy streamlining since she became CEO in 2020. An ambitious £750m cost-cutting drive and large asset sales have boosted the balance sheet, giving it the financial ammunition to pursue growth opportunities.

The divestment of non-core units also allows the company to better focus on core UK, Irish and Scandinavian markets.

I’m also encouraged by the digital revolution that’s taking place under Blanc’s watch. As technology steadily takes over, it gives Aviva additional opportunities to cross-sell products, retain existing customers and reduce costs.

Demand for its protection, wealth and retirement products could dip in the near term. But over the long haul, I expect the firm to perform strongly and deliver more brilliant shareholder returns.