Electric vehicle (EV) maker Tesla’s (NASDA:TSLA) share price has rebounded strongly after a troubled 2022. In fact it’s up 102% in the year to date as investors have piled back in.

Elon Musk’s company is by far the most Googled S&P 500 share in the UK over the past year, according to CMC Markets. The carmaker’s name and ticker are typed into the search engine 260,180 times a month, on average.

I’m considering adding some Tesla shares today. Though I’m concerned a bubble has now formed around the stock following recent share price strength.

So what should I do?

Premium valuation

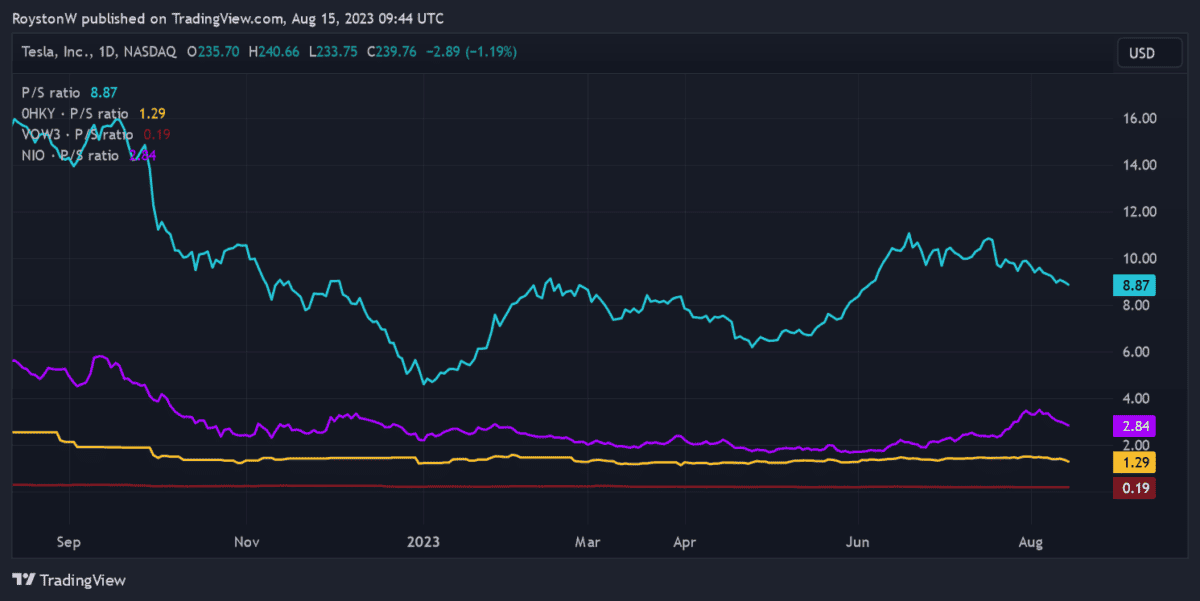

At $239.80 per share, the firm now trades on a forward price-to-earnings (P/E) ratio of around 70 times. It also looks mighty expensive on a price-to-sales (P/S) basis, especially compared to its peers.

As the chart below shows, Tesla trades on a P/S ratio of around 8.9 times. This sails above corresponding readings of 2.84 and 1.29 times for EV industry rivals NIO and BYD. Volkswagen, meanwhile — which is the third-largest EV company by sales — trades on a tiny ratio of 0.19.

I need to find a reason then why Tesla stock commands such a juicy premium versus the competition. If I can see some clear competitive advantages I may still be tempted to take the plunge.

Brand power

Incredible brand power is the chief reason why the carmaker remains in high demand with investors. According to consultancy Brand Finance, it’s currently the world’s most valuable automative brand with a value of $66.2bn.

This is thanks in part to the Tesla’s obvious green credentials. Companies that can help soothe the climate emergency are highly popular with the public.

It’s also because of the firm’s strong track record of innovation. More recently, the carbuilder’s huge investment in artificial intelligence (AI) — a huge money spinner in its own right — has also grabbed the public’s imagination. Tesla hopes to produce its first totally self-driving vehicle this year.

The company also benefits from its obvious association with tech-pioneer Musk.

Time to buy Tesla?

So will I buy Tesla stock for my own shares portfolio right now? The answer is no.

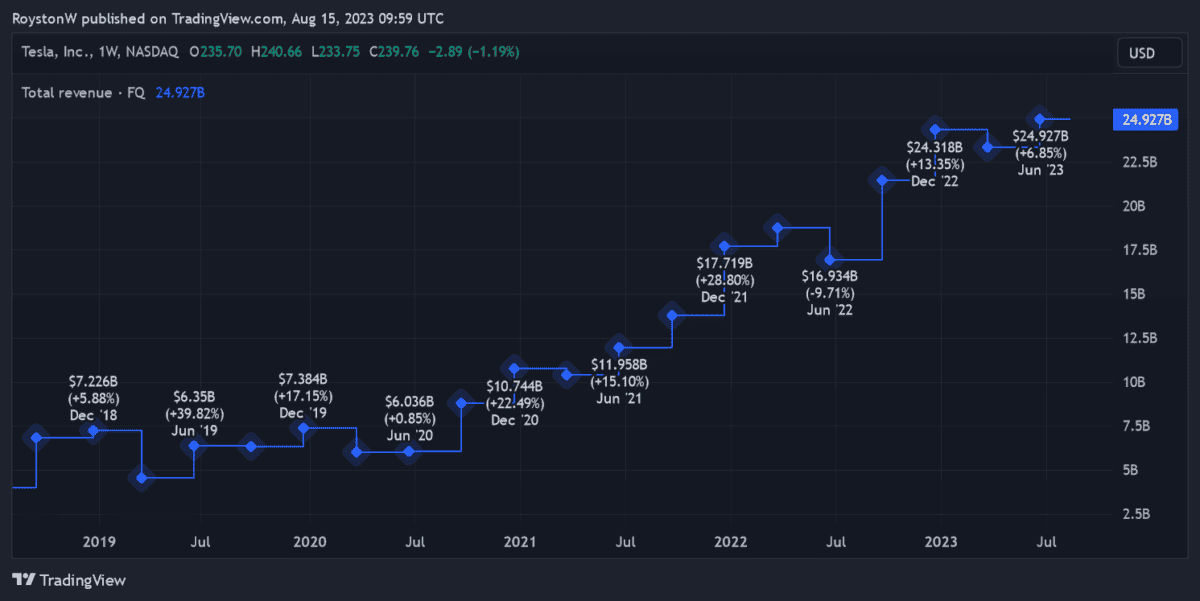

The carmaker’s revenues have risen at an impressive rate during the past five years, as the chart above shows. They could continue going to the moon too, as the EV charging infrastructure improves and worries over the climate emergency increase.

But Musk’s motor company will have a fight on its hands to continue dominating the market. Impressive sales numbers from industry rivals including BYD and Rivian Automotive show that competition in the EV space is ramping up. China’s BYD sold 1.3m cars in the first half, up more than 90% year on year.

Increasing competition also means that Tesla is having to cut prices to tempt drivers to buy its cars. Indeed, the business announced overnight further price reductions for its Model Y and Model 3 vehicles in China, putting extra pressure on its margins.

As a potential investor, I’m also concerned about ongoing production issues at the firm, as well delays in rolling out new models like its Roadster.

I don’t believe Tesla shares merit the huge premium they currently command. So I’d rather buy other US and UK shares today.