The art of predicting stock market movements can be highly challenging and, indeed, stock market forecasts are not always reliable.

However, the Economy Forecast Agency (EFA) has demonstrated surprising accuracy so far this year. Its forecasts have been largely on target, providing valuable insights for investors navigating through these uncertain times.

As investors, our focus goes beyond short-term predictions. We are constantly looking ahead, at least six months or more, attempting to forecast the trajectory of market forces.

Should you invest £1,000 in Barclays right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Barclays made the list?

We anticipate how economic indicators, geopolitical events, corporate earnings and other factors will interact and influence market dynamics and is crucial for making informed investment decisions.

The EFA forecast

The forecast provided by the EFA for the FTSE 100‘s performance to July 2024 paints an intriguing picture for investors and market observers. With its projection of the FTSE 100 finishing that month at 9,061 points, along with an upper limit of 9,605 and a lower limit of 8,517, it’s clear the body anticipates some notable market movement in the coming year.

What stands out is the significant upside potential indicated by the forecast’s upper limit. A potential 26% increase from the FTSE 100’s current position indicates that we’re expecting a substantial market rally, if it materialises.

This kind of growth could be seen as an opportunity for investors seeking to capitalise on the market’s potential positive momentum. In such an event, even an index-tracking fund would allow investors to reap significant returns.

The global underperformer

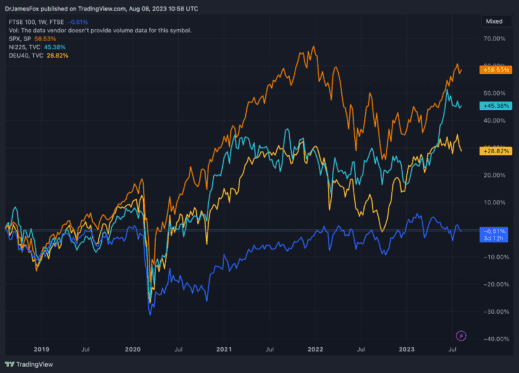

The charts presented below shed light on two significant aspects. Firstly, they illustrate that the FTSE 100 has exhibited a lack of growth over five years.

Secondly, these visual representations also underscore the stark reality that the UK’s blue-chip index stands as the weakest performer on a global scale.

Proceed with caution

While a potential 26% upside is indeed appealing, investors should exercise caution. Prudent investors will naturally take into account any downsides that may occur.

Equally, it’s important to approach these forecasts with a level of caution and critical analysis. Markets are influenced by a myriad of factors. These include economic indicators, geopolitical events, technological advancements and global trends.

As such, while the market forecast suggests a promising outlook, there’s always an inherent uncertainty. Investors should keep their ears to the ground and stay informed concerning economic data, corporate earnings reports and geopolitical developments.

Readying the portfolio

Certainly, if we are to place confidence in the forecast, it would be prudent to strategically align our investment portfolios. A practical approach to achieve this involves investing in an index-tracking fund, such as the Legal & General UK 100 Index Trust. This fund is designed to mirror the performance of the FTSE 100 index.

Personally, I anticipate a favourable trajectory in the FTSE 100’s movement. A contributing factor to this expectation is the current subdued state of the index. The prevailing negativity surrounding UK equities is probably overstated.

Consequently, I am sticking to my investment strategy with a focus on UK assets as we approach 2024. This approach is rooted in the belief that the market sentiment could experience a positive shift, providing potential opportunities within the UK market landscape.