Passive incomes can originate from a range of sources, such as buy-to-let rentals. However, my personal preference lies in investing in stocks and shares. In my view, this approach is not only simpler but also represents a more efficient utilisation of my time.

However, it’s not solely a matter of time efficiency, it also tends to be more financially rewarding. The yields attainable in the stock market at present, particularly in the UK, are likely to surpass any potential returns I could secure in the real estate market.

So is it easier to create a sizeable passive income from stocks today than it has ever been?

UK stocks: an opportunity

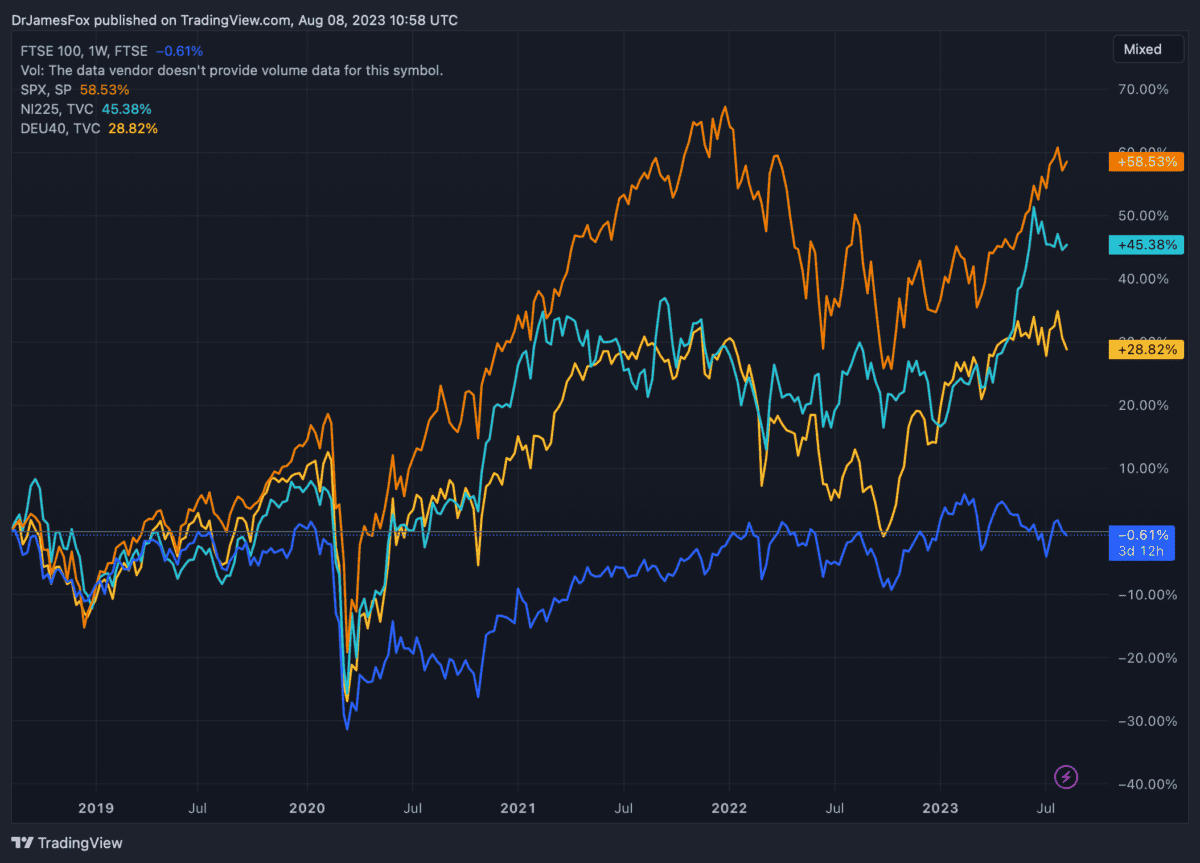

Presently, UK stocks are experiencing a state of depression. Over the span of five years, the FTSE 100 has stagnated, and it stands as the weakest performer among all major indices.

The below chart shows just how far behind the FTSE 100 has fallen. Meanwhile, it’s worth noting that the FTSE 250 is down 8.8% over five years.

The index’s depressed condition compared to global counterparts can be attributed to several factors, including Brexit, and what I personally perceive as an exaggerated sense of pessimism surrounding the UK economy.

It’s important to note that Britain’s economy isn’t lagging its European counterparts, and it’s worth emphasising that a significant 70% of FTSE 100 revenues are generated beyond the UK borders.

Let’s talk about dividends

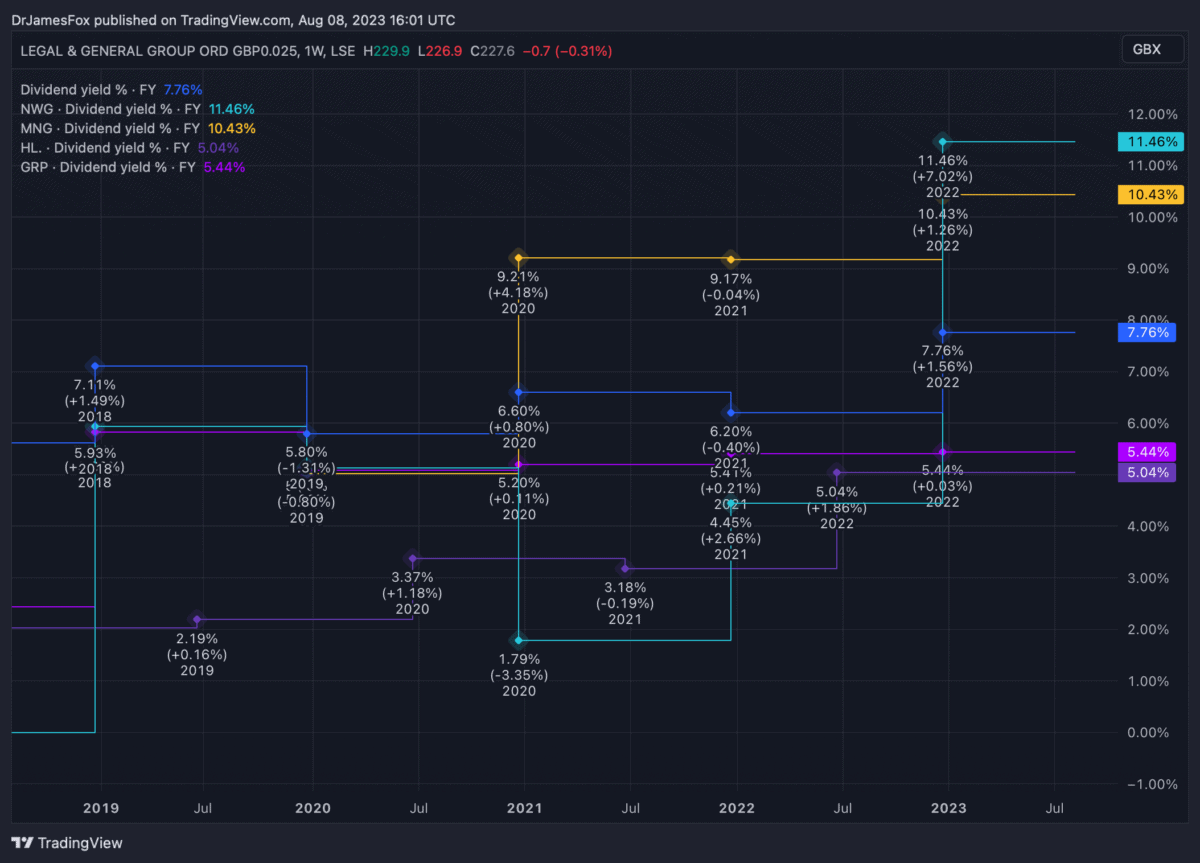

When share prices undergo a decline, the corresponding increase in dividend yields can present a favourable scenario for passive income-focused investors.

Despite the FTSE 100 experiencing a five-year standstill, earnings within UK stocks have displayed notable resilience. This underscores that prevailing investor sentiment is among the primary concerns.

Consequently, dividend payouts have often risen, even as share prices have either declined or maintained their stability. This situation makes dividend yields particularly enticing at present. A striking illustration of this is that around 60 companies on the FTSE 350 have yields in excess of 6%.

The chart below shows the yields of five leading dividend stocks from five different sectors. Here, we can see the yields for Legal & General, NatWest Group (including a special dividend for 2022), M&G, Hargreaves Lansdown, and Greencoat UK Wind have grown over five years.

Leveraging yields

Certainly, individuals holding cash have the option to invest in a well-rounded portfolio of dividend stocks, effectively transforming a lump sum into an annual income stream.

Ideally, this approach should be executed via a Stocks & Shares ISA, allowing the investor to capitalise on the benefits of tax-free dividends and potential share price appreciation.

Moreover, high dividend yields and low share prices could also complement a discerning investor looking to harness the power of compound returns.

Nonetheless, it’s essential to recognise that stock values can still experience a decline, and dividend payouts are susceptible to reductions at any point. Thus, thorough research remains a prudent step in the process.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.