Rolls-Royce (LSE:RR) shares have well and truly broken out of range. It’s not only great for Rolls-Royce shareholders. Personally, I see it as a glimmer of hope for all those other depressed UK stocks stuck in holding patterns.

So, with Rolls now trading at £2.08, does the stock still represent good value? Let’s take a closer look.

Momentum

Rolls-Royce shares are clearly riding a wave of momentum, having surged by an impressive 146% over the past year. The most recent surge in its value can be attributed to an encouraging earnings preview and subsequent update in late July and early August.

In the six months leading to June 30, Rolls-Royce accomplished a remarkable 31% surge in underlying revenues, tallying up to £6.95bn.

The FTSE 100 company’s underlying operating profits experienced an impressive increase, more than quintupling to £673m. Moreover, Rolls-Royce managed to transition from a cash flow deficit of -£68m during the same period last year to a positive cash flow of £356m.

This transformative performance has propelled the stock out of its previous range-bound state, resulting in a remarkable 41% gain within just a month.

Valuation

The shares are currently trading at a multiple of 108 times earnings. While this valuation might appear notably steep, it might not accurately mirror the company’s true worth.

This is due to the fact that the stock is presently in a phase of recovery, and the projected performance over the upcoming two years significantly diverges from the patterns observed in the previous three years.

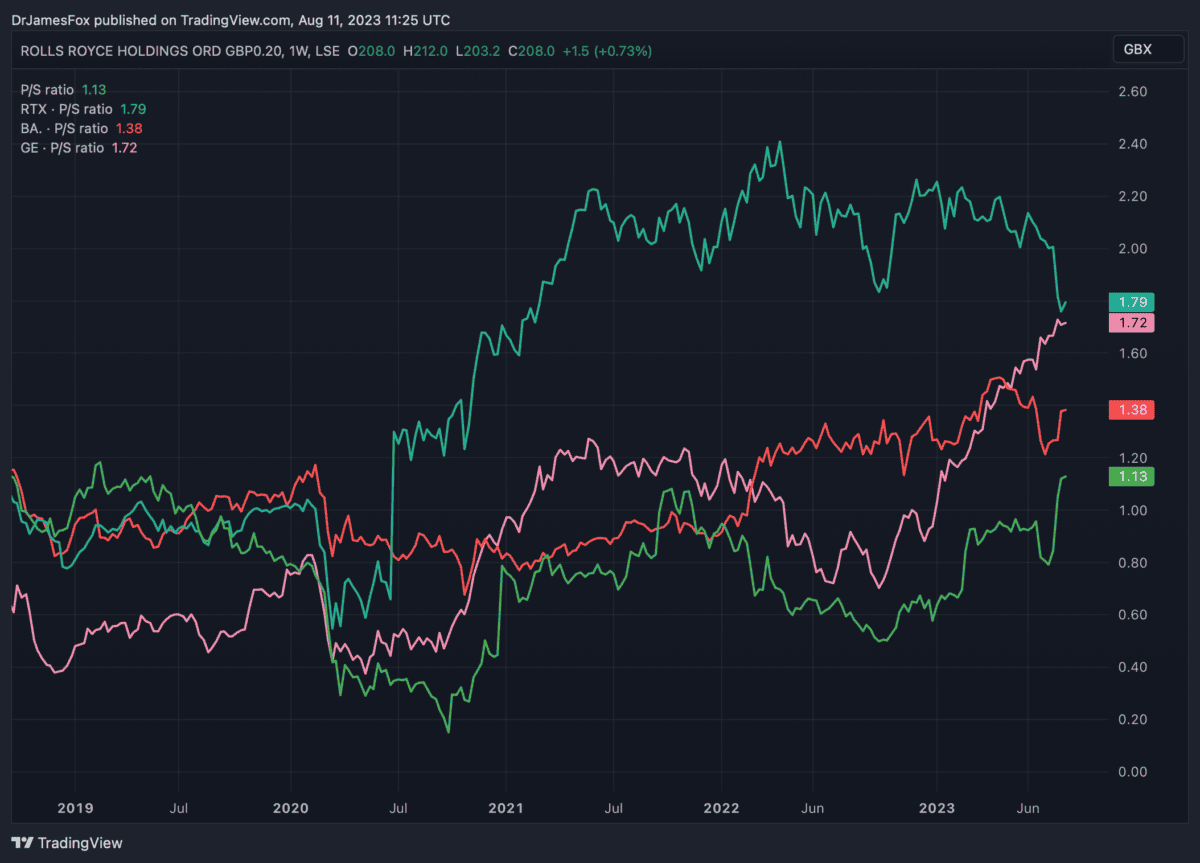

As such, the price-to-sales ratio is a more efficient metric for comparison. Rolls current trades at 1.13 times sales, which, despite the rally, makes it cheaper than its peers, including General Electric, Raytheon, and defence giant BAE Systems.

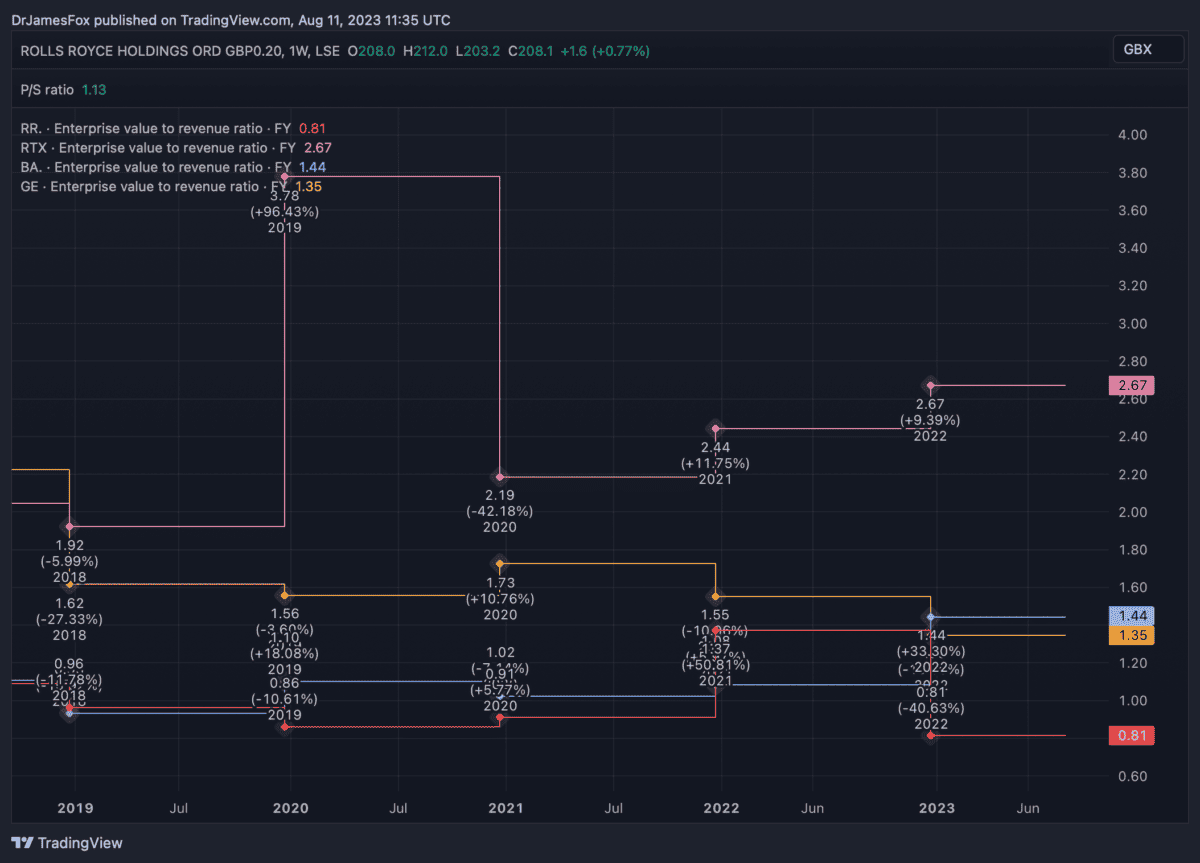

Despite the presence of a substantial amount of debt on Rolls-Royce’s balance sheet, its valuation doesn’t seem to be on the higher side when considering the enterprise value-to-sales ratio. This implies that, relative to the value of its sales and the broader financial context, the company’s valuation might still be reasonable.

Fortunes

The outlook centres on a rising appetite for air travel. Factors such as population expansion, a growing middle class, economic progress, and urbanisation are projected to fuel aircraft demand in the coming decades.

This bodes well for Rolls, particularly as the civil aviation industry represents more than half of the company’s revenues. Nonetheless, to fully capitalise on this surge in demand, the business must effectively pivot towards the single aisle aircraft market.

Certainly, there are valid concerns about the weight of debt and the potential repercussions of another economic upheaval. However, these concerns seem to have been factored into the current valuation. Even at £2.08p, several metrics suggest the stock is undervalued in comparison to its peer companies.