Investors are currently presented with a unique proposition, the opportunity to go against the market and buy cheap UK shares. Warren Buffett advises that buying against the consensus and being a contrarian investor can lead to profitable opportunities.

The world’s most successful investor believes that the best time to buy is when others are fearful, selling when others are greedy. In turn, this emphasises the importance of independent thinking and not blindly following the crowd in the world of investing.

Targeting undervalued stocks

When the market is down and investors are pessimistic, targeting undervalued stocks requires a diligent and calculated approach. While it may be tempting to purchase stocks are that trading at a considerable discount over one or two years, it’s important to recognise that some stocks are cheap for a reason.

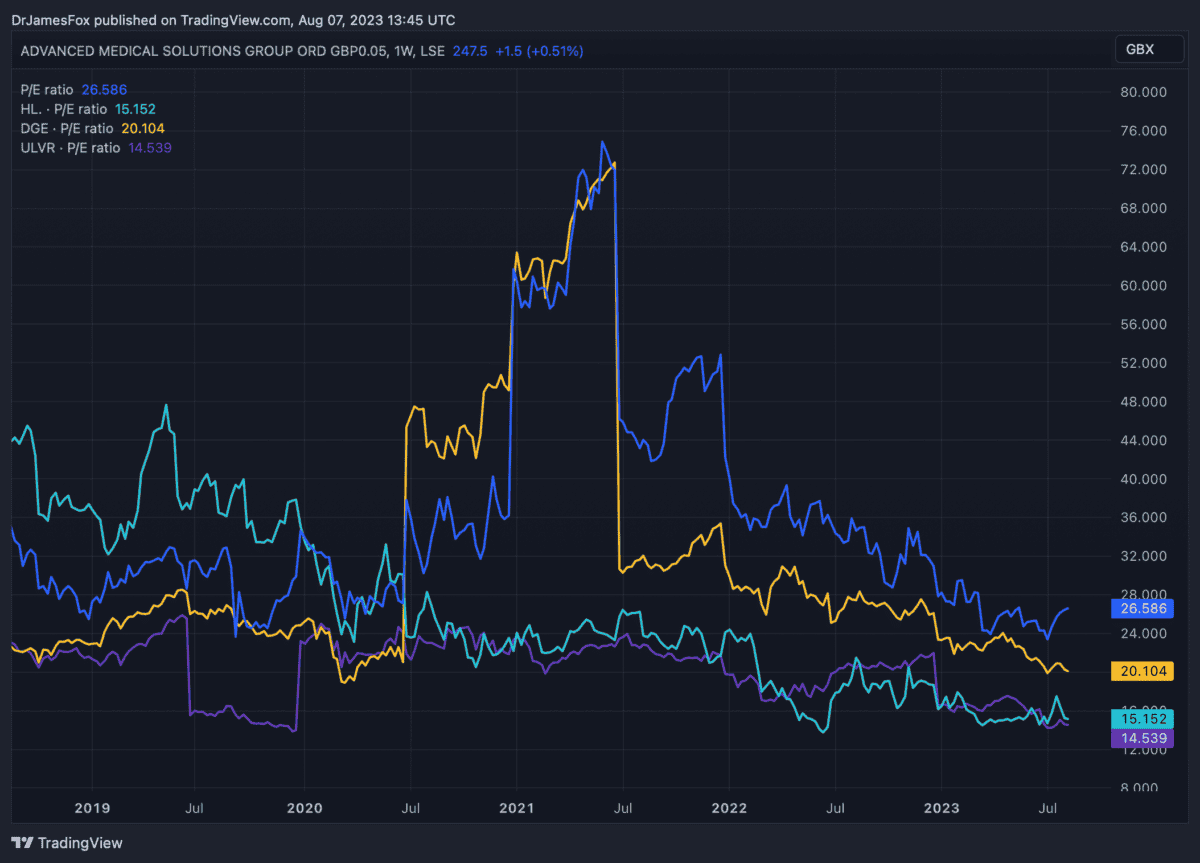

This means we need to conduct thorough research and analysis to identify stocks with strong fundamentals, solid financials, and sustainable business models. This may include using formulas such as the price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and price-to-sales (P/S) ratio. In turn, this can help us find companies that trade with low valuations compared to their historical averages and peers.

Meanwhile, Buffett tells us to focus on companies that have a competitive advantage in their respective industries. He also looks for companies with low debt, steady cash flow, and a robust market position. These factors can indicate a company’s resilience.

Today’s market opportunity

The prevailing market sentiment is currently marred by a wave of extreme investor pessimism, driven by widespread concerns over high inflation and uncertainties surrounding the future of the UK economy. These factors have combined to create an atmosphere of hesitancy and caution among investors, leading to increased volatility and unpredictability in the financial markets.

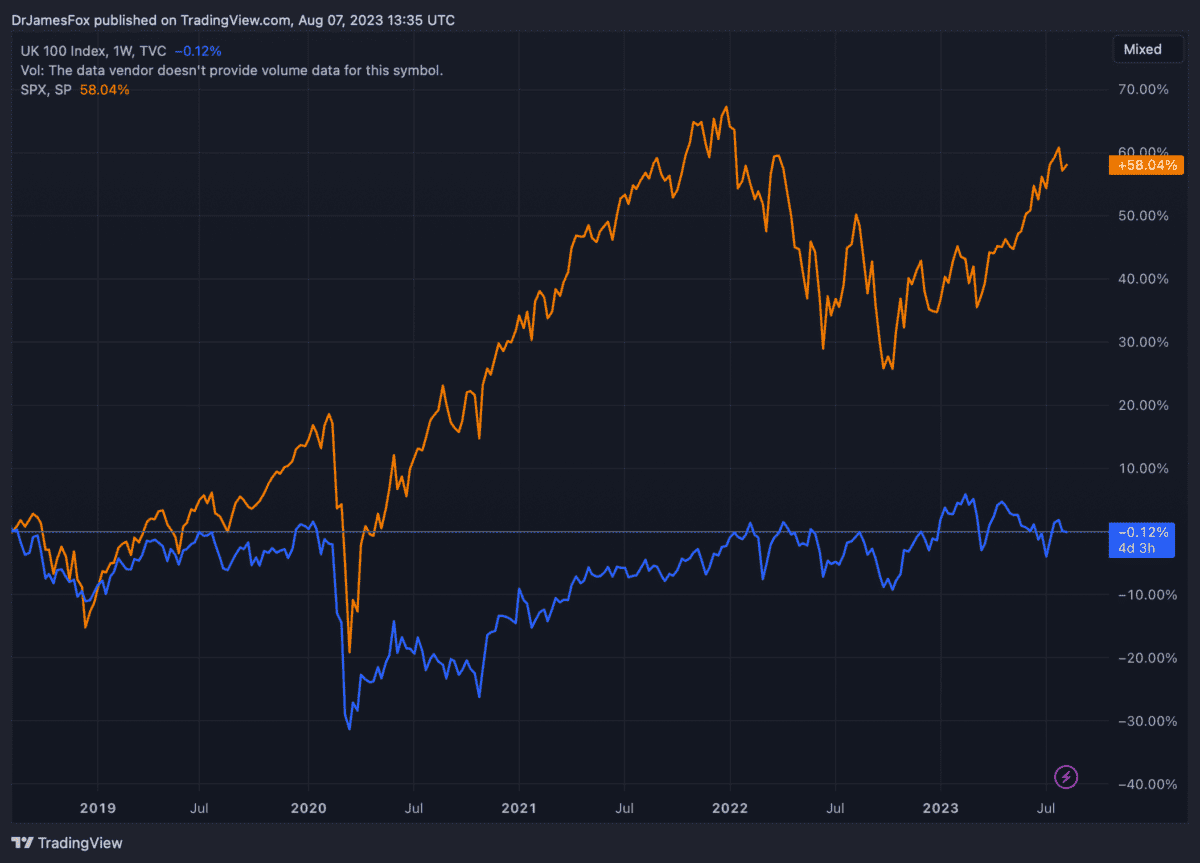

The following chart shows the percentage change of the FTSE 100 relative to the FTSE 250 over five years. As we can see, the FTSE actually contracted by 0.12% over the period.

Nevertheless, I believe the prevailing fears in the market are overstated. As such, with earnings remaining fair stable across the board, a notable trend emerges. One in which we can see numerous companies are now trading at highly attractive valuations.

Investors who are willing to look beyond the pessimism may be presented with a unique buying opportunity. And it may be one that could supercharge a portfolio’s growth in the coming years.

With regards to valuations, the below chart shows the P/E ratios of some of my top UK-listed stocks over the past five years. As we can see, the direction of all these stocks — Hargreaves Lansdown, Diageo, Advanced Medical Solutions, and Unilever — is downwards.

In the dynamic world of investing, it’s important to recognise that low valuations alone do not provide an absolute guarantee of undervaluation, but they serve as compelling indicators of potential value opportunities. Savvy and astute investors who carefully analyse the market landscape can leverage these indications to their advantage.