JP Morgan analyst David Perry recently changed his long-held bearish rating on Rolls-Royce (LSE: RR) stock. He upgraded it to a ‘hold’ and set a price target of £2.35.

In isolation, this news isn’t all that important. After all, analysts are constantly rating stocks as part of their job. But as Bloomberg reported on 7 August, it was highly symbolic, as it means Rolls-Royce shares are now free of all ‘sell’ ratings from major brokers for the first time since 2006.

This means that not one analyst covering the FTSE 100 stock is recommending to clients that they stay away from or sell it.

Surely that must be good, right? Here’s what the charts say.

A look at the targets

Analyst recommendations and price targets aren’t always reliable indicators. They are constantly changing and can be way off the mark. But when there is a consensus that a stock is a ‘strong sell’, for example, then that would certainly give me pause for thought as an investor.

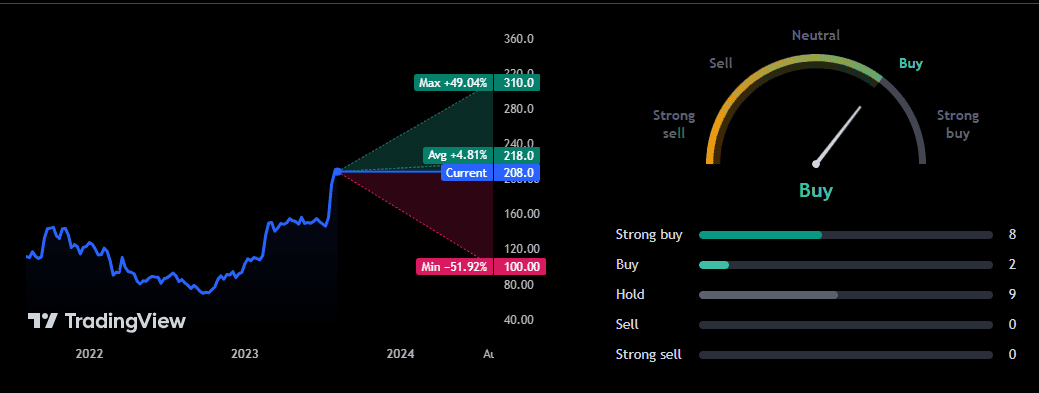

As the chart below shows, the average analyst price target for Rolls-Royce stock is slightly higher (4.8%) than the current share price of 208p. Some analysts have their target set as high as 310p, which if met, would represent a gain of 49% for buying in today.

Data from TradingView

It’s noticeable that of the 19 analysts covering the stock, nearly half (8) rate it as the equivalent of a ‘strong buy’. That is clearly very bullish.

So, seen from an analyst rating standpoint, Rolls-Royce stock looks like a buy. But it should be noted that the higher the share price goes, the more likely it is that some analysts start worrying about valuation.

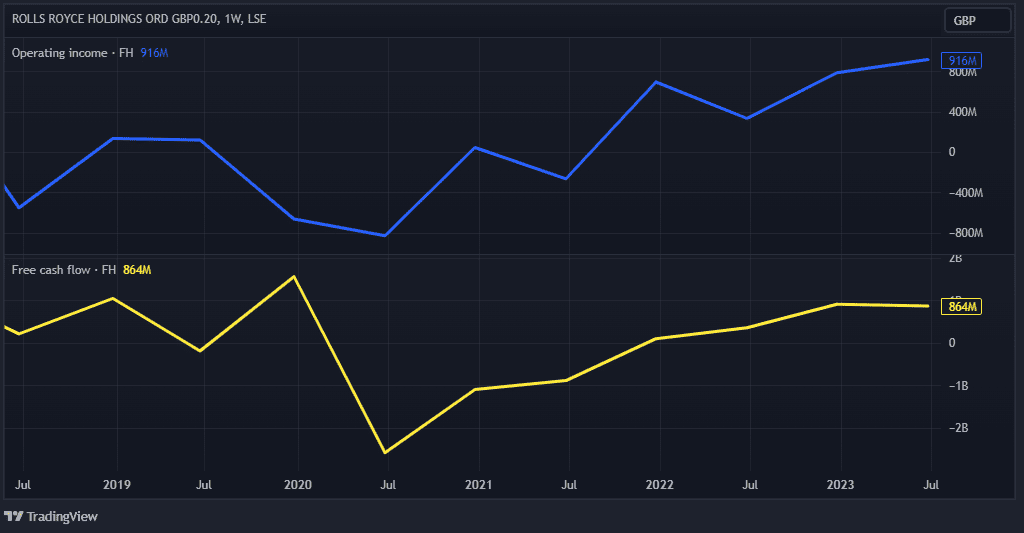

Increasing profitability

One major issue that analyst David Perry had with Rolls-Royce was that it wasn’t charging enough for selling and servicing its engines. This was one of the first things new chief executive Tufan Erginbilgic addressed upon taking up his role. He increased the prices in the civil aerospace division by 12%.

In the company’s latest H1 results, we can see the early benefits of this and various cost-saving measures. Between January and June, Rolls made an underlying operating profit of £673m, up from £125m in the same period last year.

Full-year profits have been upgraded as a result and the firm’s profitability is trending higher.

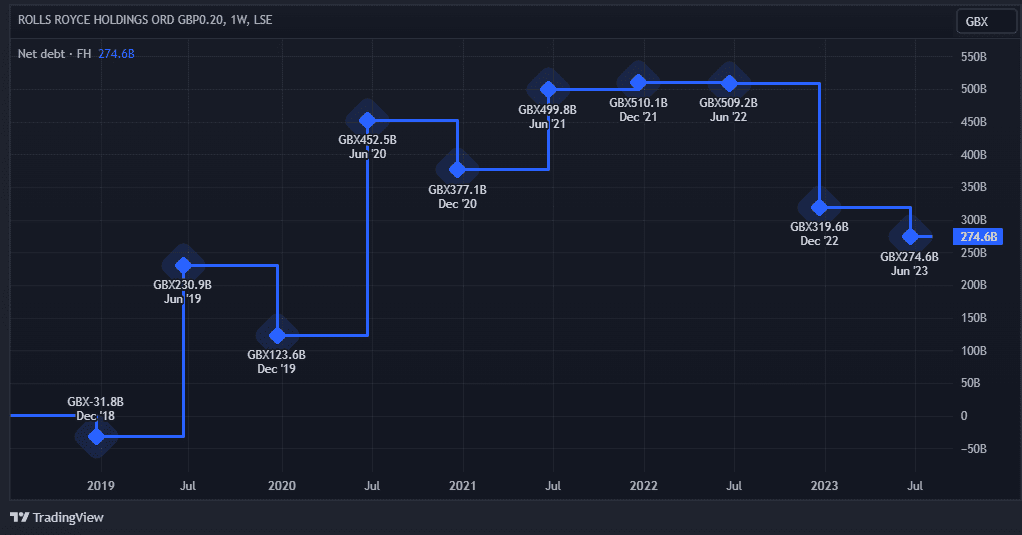

Progress being made on debt

Crucially, the company’s net debt has been reduced from £5.2bn in 2021 to £2.8bn at the end of June. This is obviously very encouraging.

However, this reduction has largely been down to disposals. The company’s ability to sell off more assets now seems to be limited. And Erginbilgic recently warned that much of the early turnaround is now complete. The rate of improvements, he said, would slow from this point.

Therefore, there’s a risk that investor sentiment could sour if the company starts delivering steady rather than spectacular progress.

I’m holding

Despite its rise, Rolls-Royce stock still appears cheap. Based on anticipated earnings, it currently has a forward-looking price-to-earnings growth (PEG) ratio of just 0.2.

Therefore, I don’t think it’s too late to buy the shares at £2. And I’m holding on to the ones I picked up in March. I bought with a minimum five-year holding period in mind, and that hasn’t changed.