The unforecast rise of RC365 (LSE:RCGH) shares is one of the investment stories of the year to date. A stock, with a market cap below £10m, surged more than 800% at it peak. Despite its rise, most investors still haven’t heard of this Asia-focused company that provides payment gateway solutions, and IT support and security services.

So, do investors still have the chance to make money with RC365, or has the opportunity passed?

Stock surges

In June, the shares of RC365 experienced a significant surge. The exact cause behind this uptrend remains somewhat uncertain.

However, the company had recently announced certain noteworthy developments, including a memorandum of understanding with the Hong Kong-listed Hatcher Group. This partnership is centred around delivering solutions in the field of artificial intelligence (AI).

The firm also announced deals with with APEC Business Services and acquired Mr Meal Production Limited. This has been followed by deals to feature its brand on Mastercard credit cards intended for residents of Hong Kong and Malaysia.

Additionally, attention was drawn to a potentially sponsored article titled “Missed Nvidia? This London-based AI stock has the potential to achieve a remarkable surge of over 1,000%.”

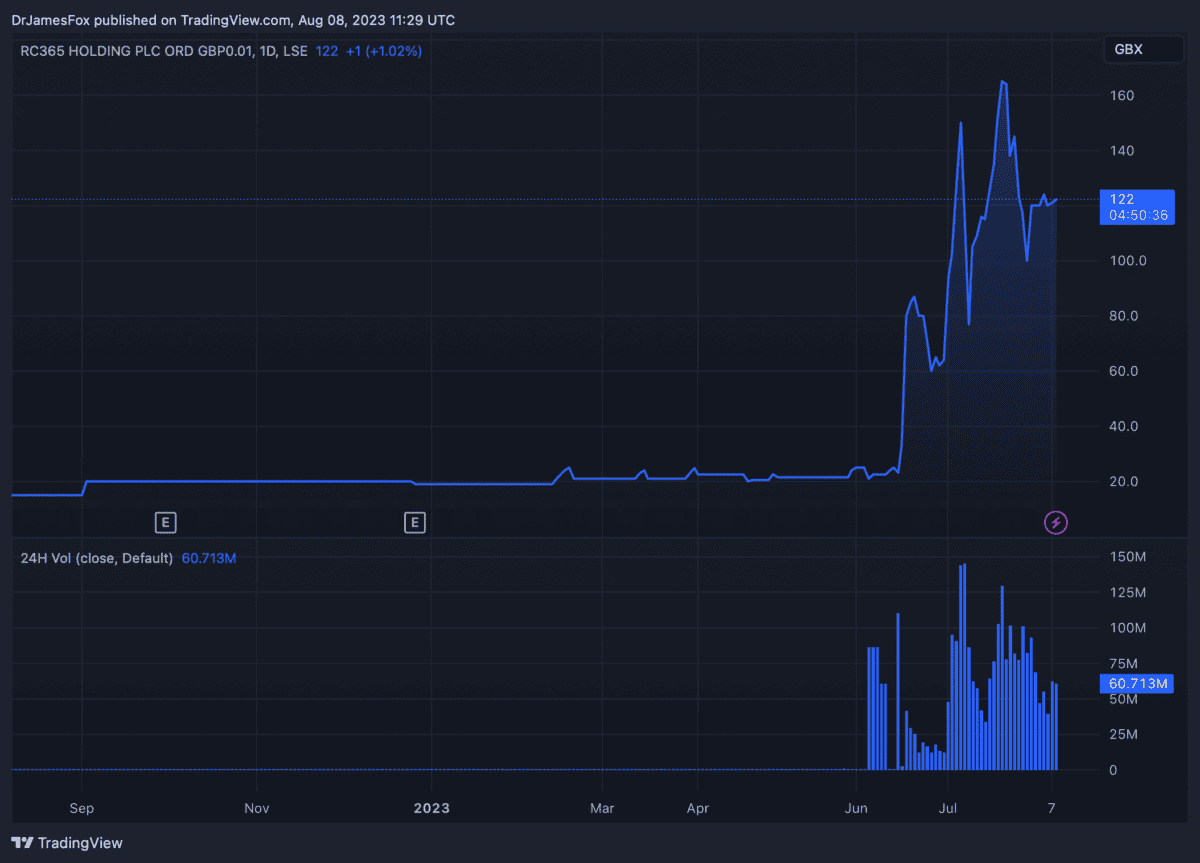

The above chart shows the increase in share trading volume coupled with the soaring share price from June this year. As is highlighted, the stock had made few movements since its listing on 22 September 2021.

Cheap or expensive?

RC365 continues to grapple with financial losses, a fact evident in its annual accounts for the fiscal year ending on 31 March. Losses amounted to HKD5.4m (£530k), up from HKD3.9m in the previous year.

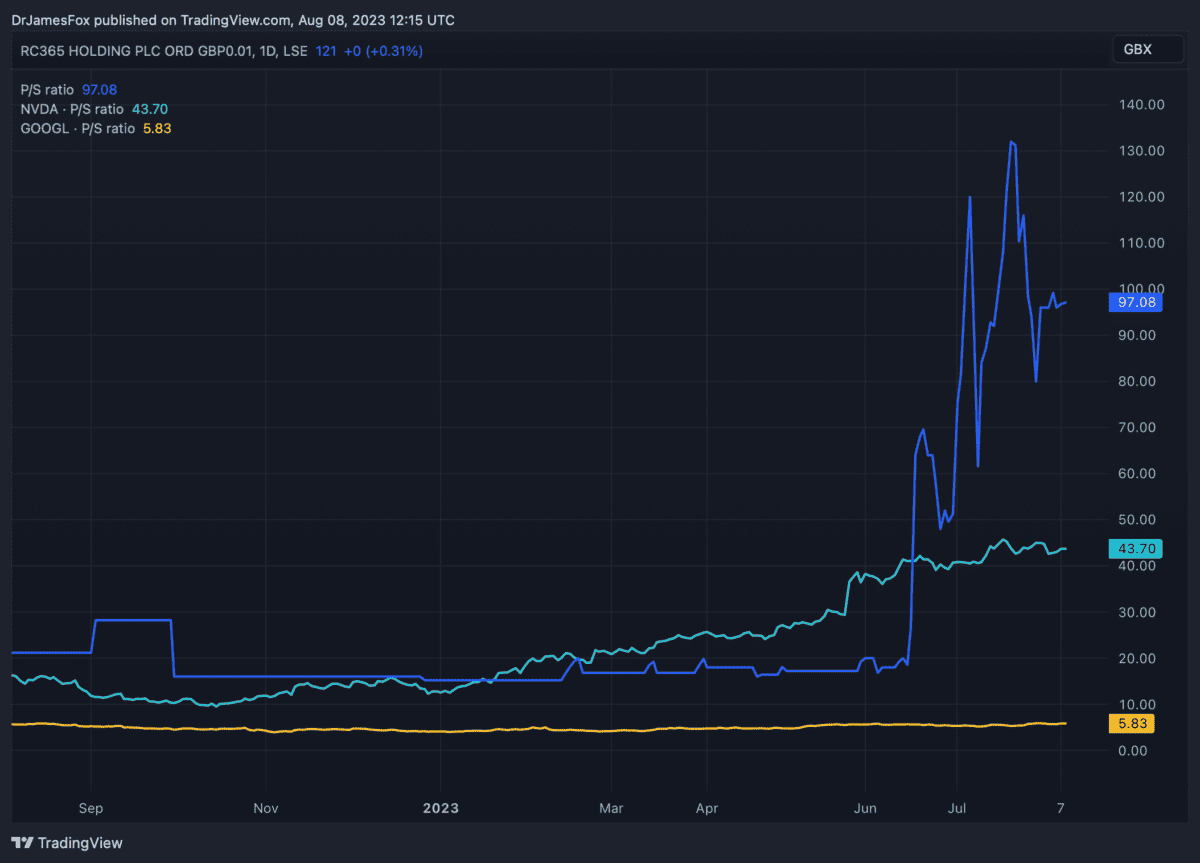

As such, any price-to-earnings ratio would be negative — the ratio doesn’t work well with negatives. But, of course, many growth stocks aren’t profit-making. So, how does RC365 compare on a price-to-sales (P/S) ratio?

Well, the company’s P/S ratio stands at approximately 97 times. A P/S ratio around 10 is considered on the expensive side. Here’s how RC365 compares with AI leader Nvidia — which generally looks very expensive after its 2023 surge — and tech giant Alphabet.

The chart unmistakably illustrates that RC365 is significantly more costly than some of the most highly esteemed tech stocks globally, which is undeniably a worrisome indication. Moreover, there exists limited tangible evidence that the recent deals and MoUs entered into by RC365 will be capable of generating a substantial upsurge in revenues in the foreseeable future.

A hard pass!

Convincing evidence supporting RC365’s current stock market valuation is notably scarce. This prompts a prudent approach for investors considering potential growth prospects within the company.

Additionally, it’s important to emphasise that CEO Chi Kit Law commands a significant ownership stake of 69.75% of issued shares. This gives Law the capability to exert considerable influence over share price movements, which could potentially impact public shareholders to their disadvantage.