I’ve seen some articles recently that put across the potential for a stock market crash coming before the end of the year. Part of the reasoning is linked to a global economic slowdown. Further, the potential bubble in artificial intelligence (AI) stocks could deflate in coming months with the high valuations. When assessing these arguments, here’s what I can glean from the charts.

Checking out volatility

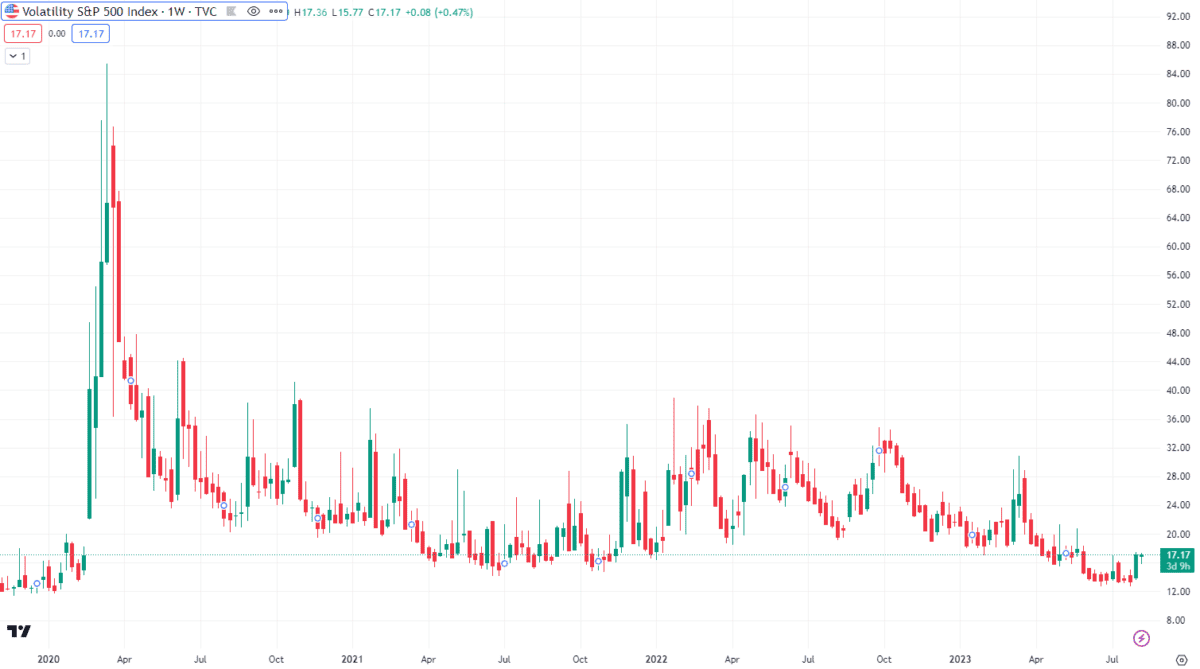

To begin with, let’s consider the volatility index for the S&P 500 (known as the VIX). At any point, the VIX gives a projection of the expected volatility on the stock market for the next month.

This gives investors a feel for how worried they should be about the chances of a large move. Granted, volatility could mean a move higher — it doesn’t necessarily mean a crash!

Passive income stocks: our picks

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

As can be seen, the sharp spike on the far left was related to the Covid-19 pandemic, which did cause a stock market crash. Yet look at where the index is trading now. It’s close to the lowest levels since the start of 2020. To me, this doesn’t indicate that anyone is expecting a large move in coming weeks.

Looking at options

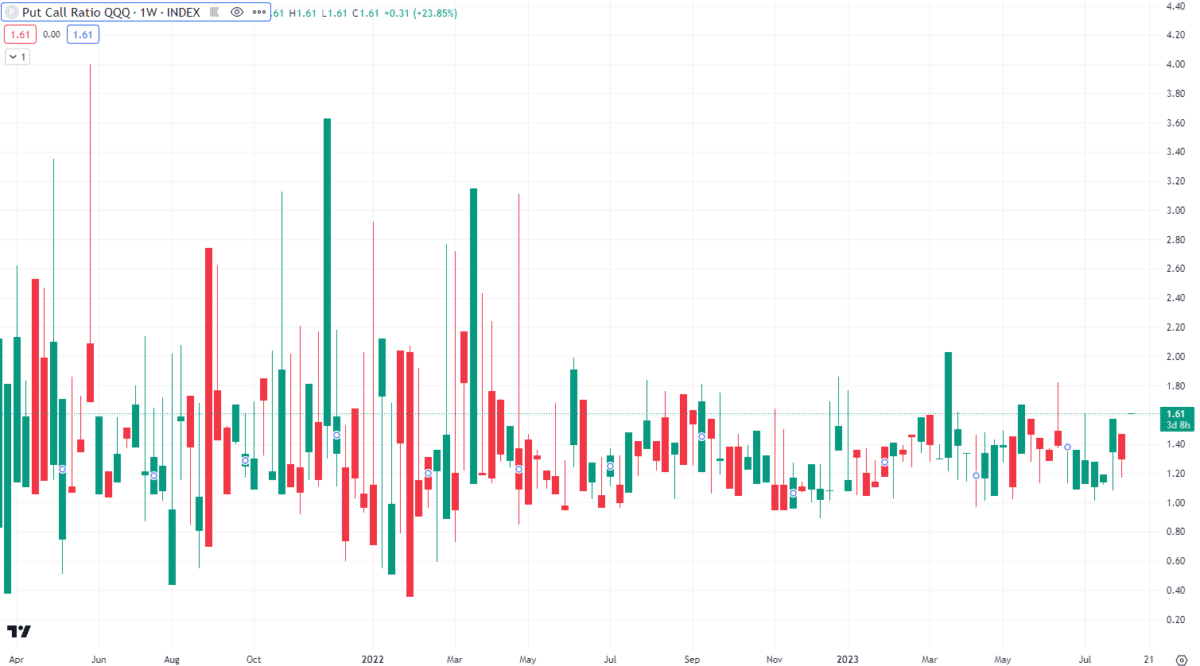

Another chart that’s useful is the put-to-call ratio for the tech heavy NASDAQ 100. A put option is a financial derivative bought if an investor thinks the market will fall. A call option is bought if an investor thinks the market will rise. These are bought by paying an upfront premium. In many ways, it’s like buying a form of insurance.

If the ratio is above one, it shows that more puts than calls are being bought. This indicates that investors are trying to hedge and protect themselves against a possible crash. The ratio is currently 1.61, so this does indicate negative sentiment. However, the ratio has been considerably higher, even just at the start of this year. Therefore, this doesn’t convince me that tech stocks are flashing red.

Noting areas of support

Before we can reach a stage where we have a full-on crash, it’s important to note some key levels of support in the market.

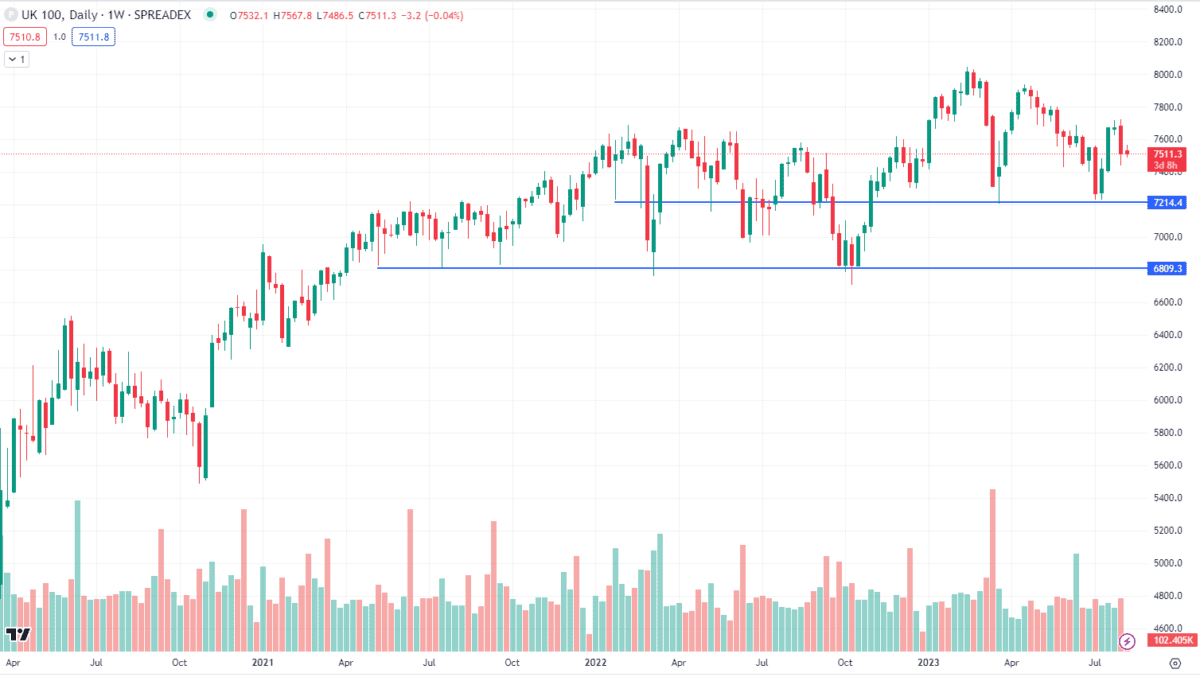

For example, below shows the FTSE 100. Over the past couple of years, buyers have often bought any dip around 7,200 points or 6,800 points.

Now this isn’t to say that the price hasn’t (and won’t) fall below there. But it’s clear that long-term value buyers in the UK have been happy to invest at those times. This has meant that the index as a whole has rallied back from those support areas.

Therefore, I won’t start getting overly concerned until the market drops below 6,800 points. Even if this does happen, I’ll use it as an opportunity to buy stocks within the FTSE 100 that will likely be undervalued.