Investment trusts offer a fantastic way to gain exposure to all sorts of technology themes through a single investment.

One revolutionary technology that has exploded into the public consciousness in 2023 is artificial intelligence (AI). This follows the staggering success of generative AI bot ChatGPT, which was released in November.

Here, I’m going to look at three investment trusts that are heavily invested in AI.

Scottish Mortgage

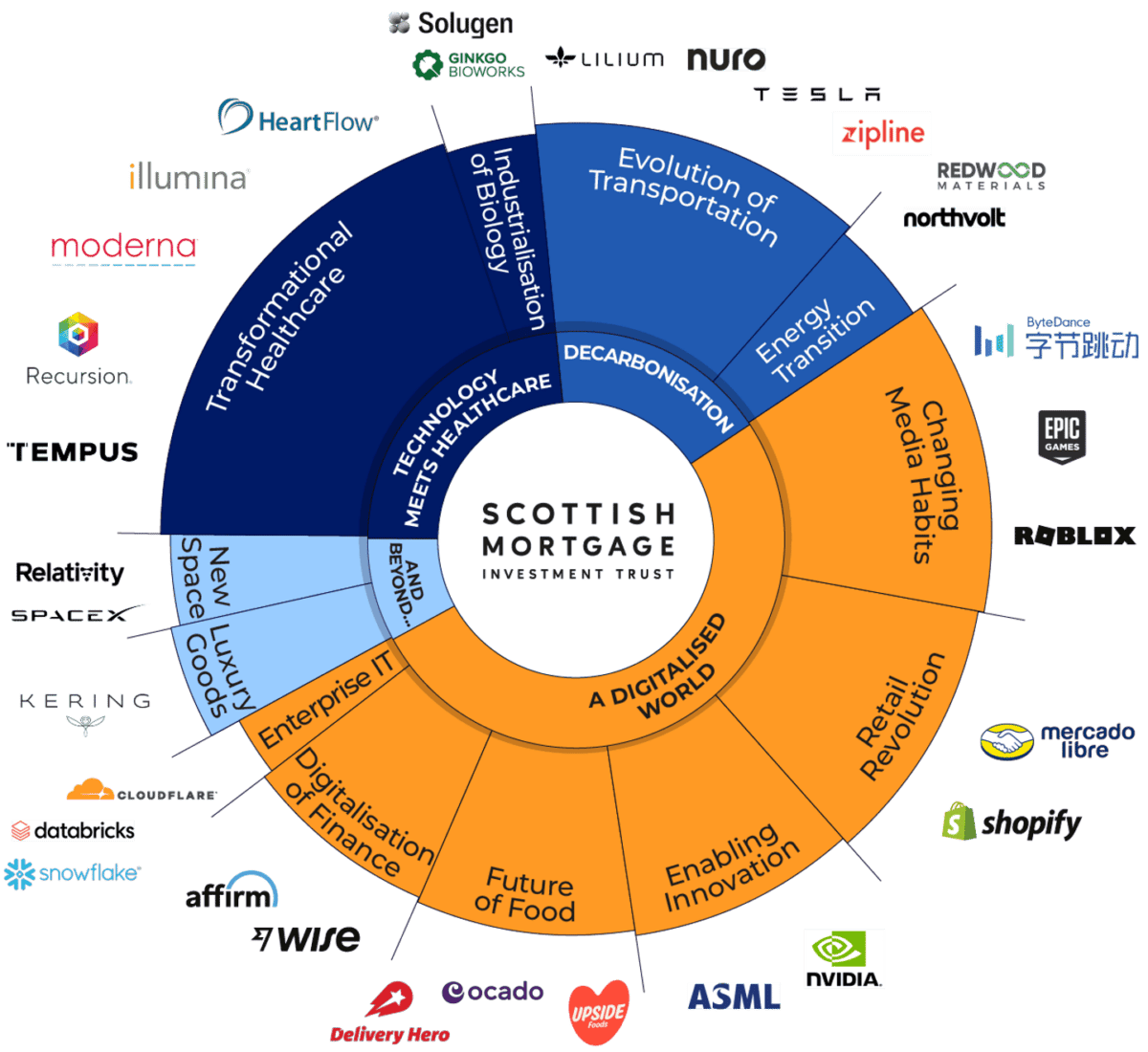

With a market cap of £9.9bn, Scottish Mortgage Investment Trust (LSE: SMT) is the largest such trust in the UK.

Its portfolio is packed with AI pioneers such as Tesla, chip designer Nvidia, and chip equipment supplier ASML. Indeed, around a third of the portfolio is directly linked to companies involved with AI.

The big attraction here is that the shares are trading at a huge 19% discount to the net asset value (NAV) of the trust. Therefore, this could prove to be a cheap way of gaining exposure to the AI stocks in the portfolio.

One risk worth bearing in mind is that this FTSE 100 stock has around 28% of assets invested in private companies. These can be tricky to value, which explains why investors are currently uncertain of the true underlying valuation.

However, some of its unlisted companies may go public over the next couple of years, relieving some pressure.

One is digital payments processor Stripe, which was recently valued at $94bn. Its billing and checkout solutions power ChatGPT Plus, the premium subscription version of the generative AI chatbot.

Scottish Mortgage is a core long-term holding in my own portfolio.

Polar Capital Technology

Polar Capital Technology Trust (LSE: PCT) is also extremely well positioned for the AI revolution.

Ben Rogoff, manager of the FTSE 250 business since 2006, is extremely bullish on the technology, saying: “We believe AI may prove one of the most transformational technologies of our careers and we share the market’s excitement around its adoption and potential impact.”

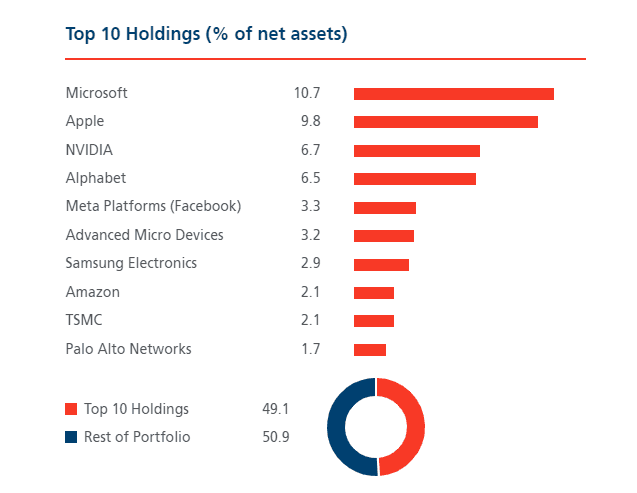

However, Polar Capital is much more conservative than Scottish Mortgage in stock selection. Around 92% of the portfolio is in large companies with market caps over $10bn.

Naturally, this means profitable behemoths like Microsoft, Apple and Alphabet dominate the top of the portfolio.

Above though, we can see that nearly half of these holdings are semiconductor stocks. Obviously, AI depends on chips, but there’s a risk the industry’s recent slowdown could drag on longer than expected.

That said, the trust is already trading at a 13.3% discount to NAV. So the share price today could prove to be a bargain.

Allianz Technology

Lastly, I’d highlight fellow FTSE 250 member Allianz Technology Trust.

It’s also heavily exposed to AI, with large positions in Nvidia and Microsoft. But unlike Polar Capital, it has smaller companies such as HubSpot and MongoDB in its top 10 holdings.

Mike Seidenberg, the lead portfolio manager, believes that cybersecurity will benefit massively from AI. As such, it holds top cybersecurity stocks like Palo Alto and CrowdStrike, as well as identity software firm Okta.

The discount to NAV here is 12.3%, which seems attractive, though there’s always a risk that gap could widen.

I already hold Scottish Mortgage shares, but if I didn’t already have significant exposure to AI, I’d happily invest in either Polar Capital or Allianz Technology.