Aviva (LSE:AV) shares have dropped 6% this week, trading at 380p. This is only a few pence away from the 52-week lows of 366p from last October. Given that Aviva shares are only modestly down 6% over the past year, this recent slump could provide a good opportunity for investors to pick up the stock on the cheap. Here’s what the charts say.

Encouraging signs for income investors

With a current dividend yield of 8.18%, Aviva has one of the highest yields in the FTSE 100. The share price fall has helped to boost this slightly in the recent months. Yet I feel the yield can remain elevated thanks to the trend higher in the dividend per share paid.

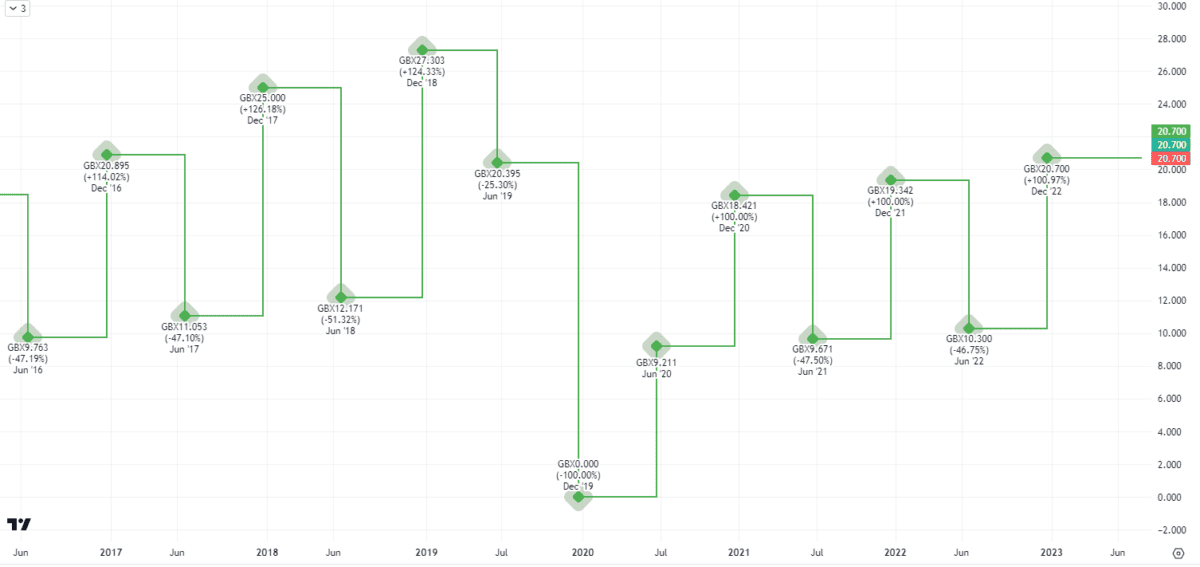

The below chart shows that before the pandemic, the December dividend was up at 25p and 27p (in 2018 and 2019, respectively). The business usually pays out two dividends a year, with the final one being the larger of the two.

The pandemic saw this collapse as the business aimed to preserve cash flow. Since then, the payments have picked back up. Yet they aren’t back at the same levels as before the pandemic.

On this basis, I’d expect the business to try and raise both the interim and the final dividend in coming years. This would bode well for investors that buy the stock now.

Looking attractive with valuation metrics

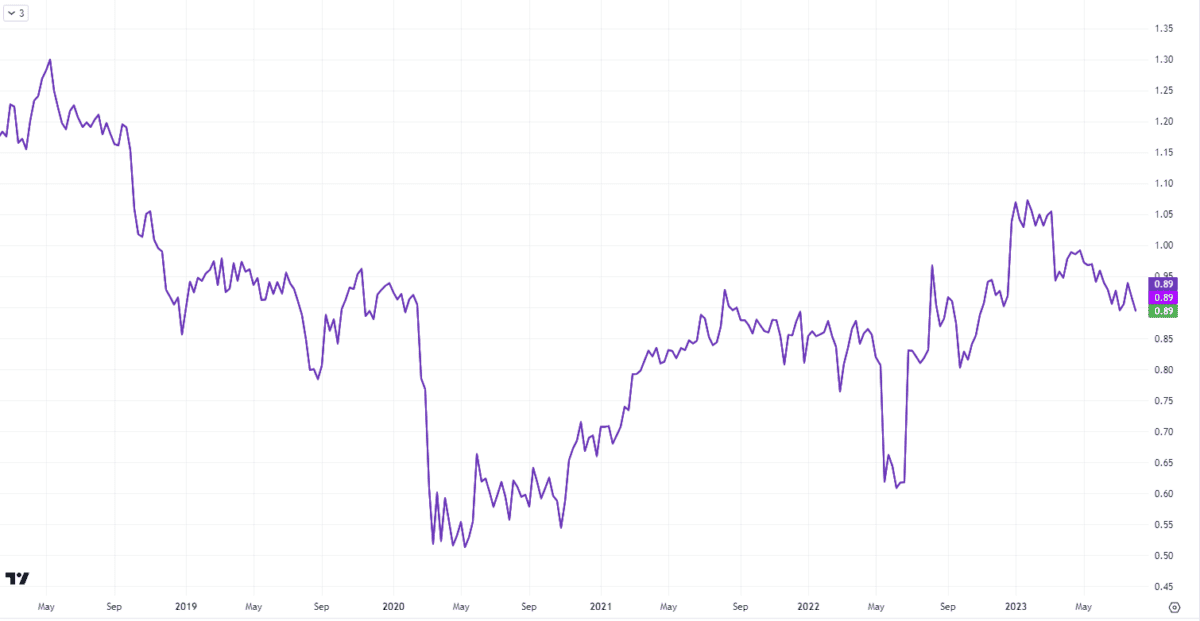

Given that Aviva didn’t turn a profit in the latest results, I can’t use the price-to-earnings ratio on a chart to see if it looks attractive. However, I can use the price-to-book ratio (P/B) instead.

This variation compares the book value (i.e., comparing the assets and liabilities) to the current share price. Anything below one usually means that the stock is becoming undervalued, relative to the core value of the company.

The chart shows a value of 0.89. Even though the P/B ratio has been much lower during the pandemic, it has dropped in recent months. This leads me to conclude that even if the stock isn’t as undervalued as it has been since 2020, it does still offer value to potential investors.

Watch out on profits

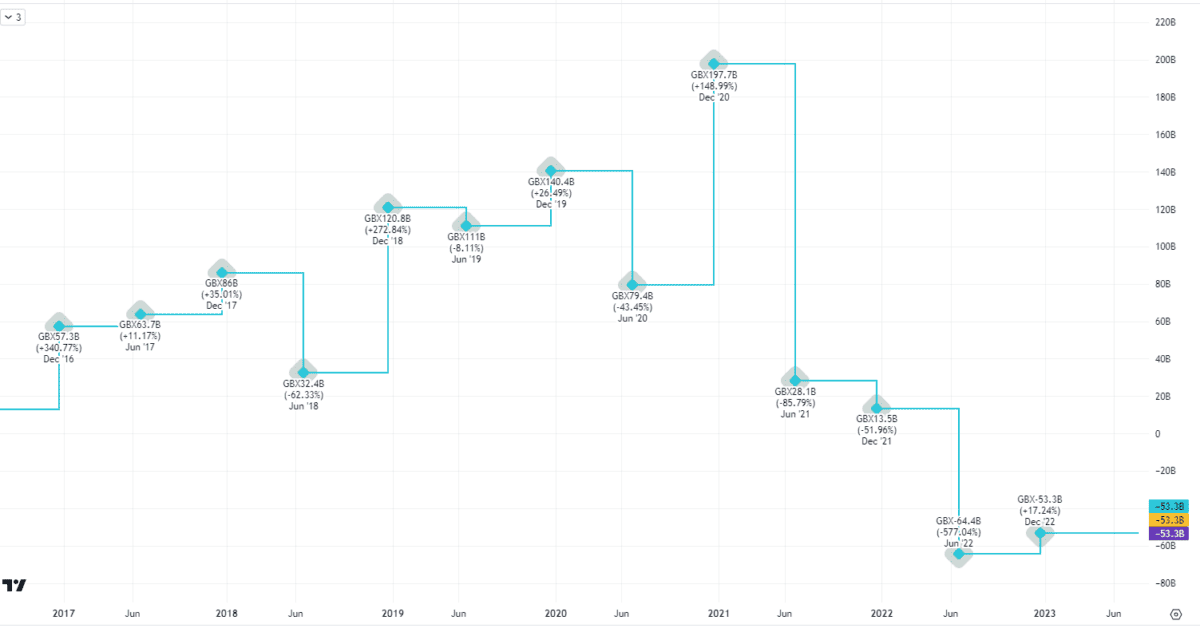

One element as to why the share price has been falling is the drop in profits. The below chart shows the net income over the past few years. There was a large drop due to the negative impact of Covid-19. Yet the company hasn’t really been able to bounce back when looking at this particular profit metric.

This is a concern going forward. If Aviva can’t fix the bottom line (either by lowering costs or increasing revenue) then it will start to drag on other areas. This includes free cash flow and even dividend potential.

I believe that the above charts do indicate that Aviva shares could be a smart buy now, particularly for those focused on income. The risk from falling net income is apparent, but I feel this is already factored in with the stock close to 52-week lows.