I’m struggling to see much value in US growth stocks at the moment, with many rocketing due to excitement around artificial intelligence (AI). So I’ve instead been looking at UK dividend shares to buy in August. Here are three that I’m either planning to add to or start a position in.

10% yield

First up, I’m heading eastwards for dividends with Henderson Far East Income (LSE: HFEL). As the name suggests, this investment trust focuses on income stocks from across the Asia-Pacific region.

The headline attraction here is the 10% dividend yield, which is fully covered by income. This mouth-watering yield has trended upwards over the last five years as the share price has dropped by around 33%.

Should you invest £1,000 in Henderson Far East Income Limited right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Henderson Far East Income Limited made the list?

The portfolio managers do tend to lean towards a value approach. This means the fund doesn’t have much in the way of technology stocks at the moment, which is unfortunate as many of these have risen on the back of market enthusiasm for AI.

If growth-oriented stocks continue to outperform this year, then the share price may struggle. However, I think the overall trust should offer defensive qualities if market conditions weaken.

Top holdings include Bank of Communications, one of the largest banks in mainland China, and Taiwan Semiconductor Manufacturing.

To my mind, Asia offers superior long-term earnings growth potential. And this trust gives my portfolio exposure to this rapidly-growing region, while diversifying my income in the process.

FTSE 250 winner

Commonly known as SAINTS, the Scottish American Investment Company (LSE: SAIN) is one of the oldest investment trusts in the UK. In fact, it’s been around for 150 years old, having been set up in 1873 for Victorian private investors.

Now, the yield is far less impressive on the surface at 2.62%. But this FTSE 250 trust, run by Baillie Gifford since 2004, hasn’t cut its dividend in 80 years. Therefore, I’m hoping for sustainable long-term dividend growth here.

Plus, there’s also the prospect for capital appreciation, as the share price has risen 110% in the last decade.

Since 2004, on a total return basis (income and capital growth), its shareholders have seen their initial investment grow by 4.6 times. This compares to the average higher-yielding UK income fund at just 2.8 times.

The trust’s objective is to grow the dividend at a faster rate than inflation. Last year, the dividend was hiked 9% in line with this policy. But with inflation remaining stubbornly high, this could become more difficult to achieve.

However, one thing I like is that beyond its staple of global stocks, the trust also invests in bonds, property and other asset types. This diversifies its income streams.

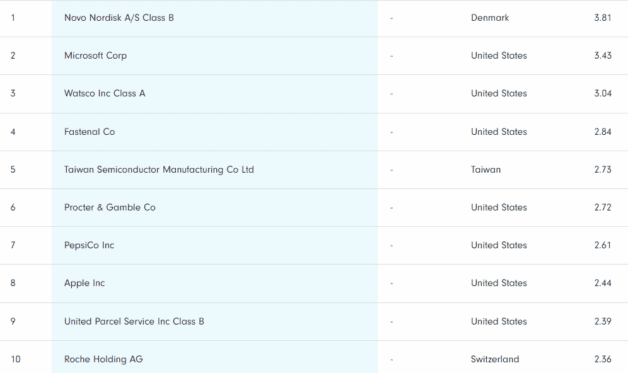

Portfolio top 10 holdings

FTSE 100 struggler

Finally, I’m looking to add Persimmon to my portfolio for the first time. The stock is not far from a 10-year low after rising mortgage rates and inflation impacted the housebuilder’s earnings.

The general outlook for the UK property market remains bleak.

Yet I can’t help feeling interest rate hikes will ease off and the housing market will recover in time.

Plus, Persimmon is a very well-run business, has no debt, and is trading on a price-to-book ratio of around one.

Meanwhile, there’s a 5.5% dividend yield on offer while I wait for a potential turnaround.