In the world of telecom shares, the Airtel Africa (LSE:AAF) share price and Vodafone (LSE:VOD) price continue to provide fascinating contrasts for the thoughtful investor. The question is: which offers better value?

Continents apart

Airtel Africa offers telecoms and mobile money services across 14 African nations, primarily in East, Central, and West Africa. It’s controlled by the Indian telecoms behemoth, Bharti Airtel.

On the other hand, Vodafone’s roots lie in the heart of Europe, operating mobile and fixed networks in 17 countries, and holding stakes in an additional five.

Should you invest £1,000 in Hargreaves Lansdown right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Hargreaves Lansdown made the list?

Vodafone, while dabbling in mobile money services within a few African nations, remains a primarily Euro-centric business.

In FY23, Vodafone’s revenue from Europe and the UK towered at £40.7m, leaving its £3.8m earnings from ‘Other Markets’ in the dust.

That means Vodafone does not have the same explosive growth story as Airtel Africa.

The numbers tell the story

In July 2023, Vodafone’s service revenue recorded 3.7% organic growth, with improvements across Europe driven by the UK. Overall revenue, however, dropped to $12bn, albeit exceeding market expectations.

Airtel Africa reported a dip in its pre-tax profit for fiscal 2023 due to higher forex losses, brought on by the dollar’s meteoric rise in 2022. Yet revenue climbed to $5.3bn, albeit slightly below market expectations.

Diving deeper into the financials

In a head-to-head showdown, Vodafone seems to thrash Airtel Africa with a lower price-to-earnings (P/E) and price-to-sales (P/S) ratios at 2 and 0.5 respectively, suggesting better value. Airtel stands at 7.5 and 0.9, respectively.

Vodafone’s hefty dividend yield of 10.2% looms over Airtel’s 3.8%. Vodafone also registers a slightly higher return on equity of 20.3% and a lower debt-to-equity ratio of 1.1, against Airtel’s 19.7% RoE and a debt to equity ratio of 1.2.

| Metric | Airtel Africa | Vodafone |

| Dividend Yield (%) | 3.8 | 10.2 |

| Market Cap (£bn) | 4.1 | 20.5 |

| Price-to-Earnings (P/E) Ratio | 7.5 | 2 |

| Price-to-Sales (P/S) Ratio | 0.9 | 0.5 |

| Return on Equity (RoE) (%) | 19.7 | 20.3 |

| Debt to Equity Ratio | 1.2 | 1.1 |

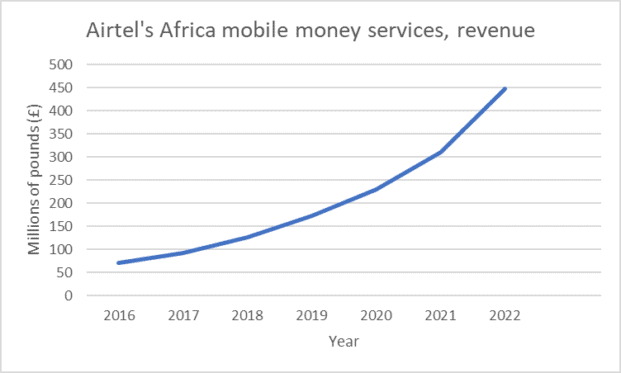

Nonetheless, Airtel’s growth in its mobile money services segment is breathtaking. It’s been on an upward trajectory, from £71.4m in 2016 to a remarkable £448.7m in 2022.

Data source: TradingView

Who you gonna call?

The choice between Airtel Africa and Vodafone becomes a trade-off between growth and dividends.

In essence, Vodafone offers a more stable, income-focused investment, while Airtel Africa could be a potentially rewarding growth bet for investors who can stomach the risk.

While Vodafone might be the preferred choice for those seeking immediate dividend gratification, Airtel Africa’s long-term growth prospects and focus on untapped African markets make it a tempting prospect for those with a more adventurous investing spirit.

I don’t currently have any individual stocks that give my portfolio direct exposure to Africa. The continent’s population is growing three times faster than the global average. UN projections say that by 2070, the region will become the most populous place globally, surpassing Asia.

This compelling growth story has me hooked, and I’d happily add Airtel Africa to my portfolio today if I had the spare cash.