After falling for months, NIO (NYSE: NIO) shares have mounted a strong recovery lately. In fact, they’ve shot up by around 40% since the end of May.

Why are investors suddenly keen on the Chinese electric vehicle (EV) company? And is the stock worth buying at $10? Let’s take a look.

A change of tack

Tesla kicked off an EV price war last year when it started lowering vehicle prices. This has since forced around 40 brands operating in the Chinese EV market to follow suit.

In April, though, NIO founder and chief executive William Li said: “For us, we will certainly not join the price war”.

However, last month, the automaker announced that it too would finally be cutting prices. It would reduce them by 6% to 9% (around $4,100) on all models from 12 June.

Investors took to this news, assuming that the discounts will stoke demand.

Further pragmatism

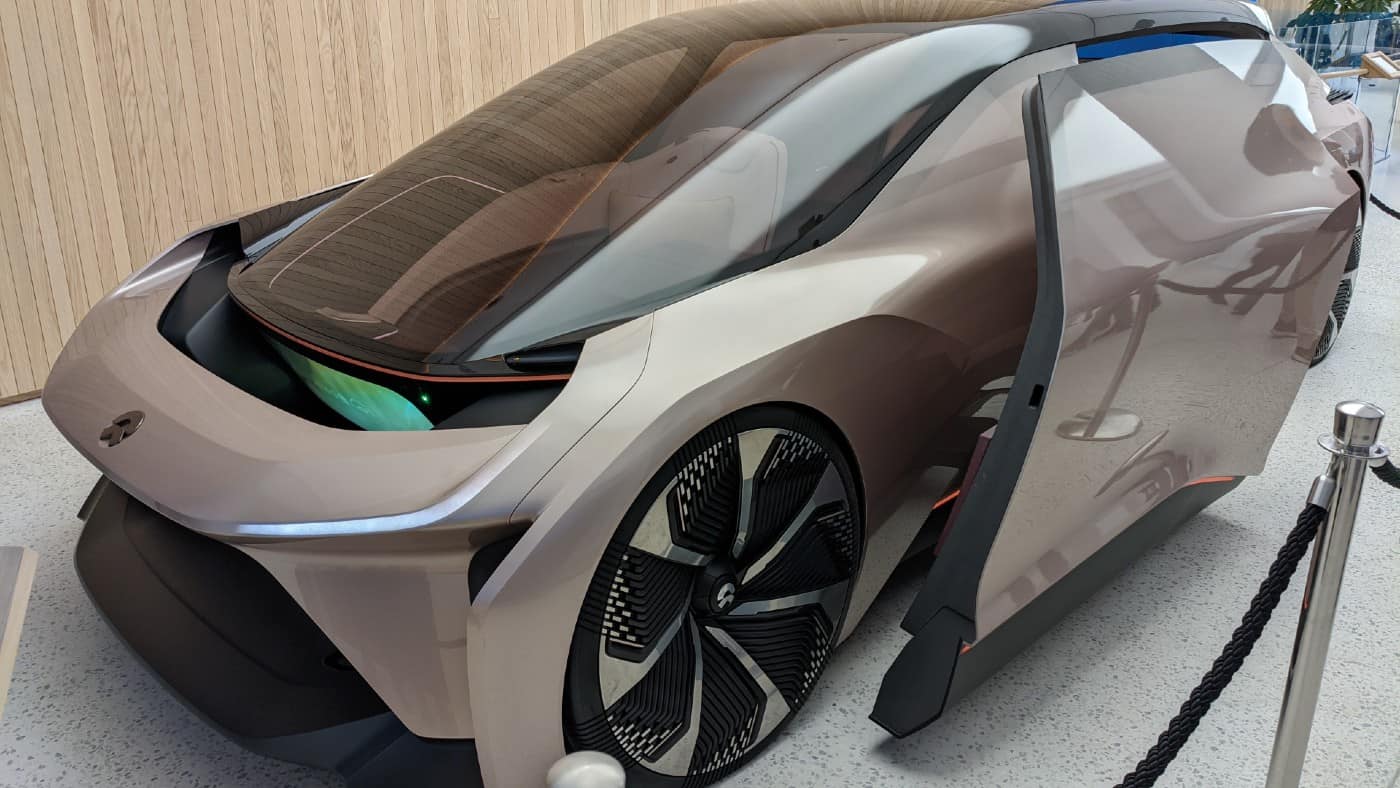

NIO is known for its advanced innovative technology. It has made battery swapping a key selling point, enabling customers to purchase vehicles at a lower price if they sign up for its battery-as-a-service offering. It has built nearly 1,500 swapping stations to date and intends to operate 5,000 by 2030.

However, in another pragmatic move, the company will end its free battery-swapping services for new buyers.

Separately, it also announced it would start charging drivers 380 yuan (or around $52) a month to use its latest driver-assistance system. This software assists with things like parking and highway lane changes.

These changes seem necessary. The firm’s gross margin was just 1.5% in the first quarter of 2023, down from 14.6% in the first quarter of 2022. Price cuts are hardly going to improve things here, so it needs additional ways of bringing in money.

A welcome cash injection

In Q1, NIO delivered 31,041 vehicles. This was a 20.5% increase from the same period last year, though it did represent a 22.5% decline from the fourth quarter of 2022. The good news though is that it has released a handful of new models this year, which should fuel further growth.

That said, it still posted a massive $690m quarterly net loss. This left it with $5.5bn in cash and equivalents, as of 31 March, down from $8.4bn a year earlier.

So investors cheered an update from the firm on 20 June announcing a strategic $1.1bn investment from an Abu Dhabi government fund. This cash is intended to help fund NIO’s international growth.

Buying the stock today

NIO is a hard stock to value. It has no earnings, so most traditional valuation metrics are useless. On a price-to-sales (P/S) multiple, however, the stock looks quite attractive today. It has a P/S of 2.4, which is the lowest that metric has been since 2019.

Whether that proves to be good value in future is anyone’s guess at this point. NIO’s market cap of $17.6bn could prove to be unreasonably small if the firm starts generating big profits. Alternatively, it might look ridiculously inflated if losses keep piling up.

At $10 then, the stock is a bit of a lottery ticket and only suitable investors with a high risk tolerance.

For me, personally, I won’t be buying the shares, as I’m currently focused on scooping up cheap high-yielding UK stocks.