Lloyds (LSE: LLOY) shares have been on a bit of a run lately. They’ve risen 7.9% in just two weeks.

However, when I zoom out to consider performance over longer periods of time, things take a turn for the worst for the FTSE 100 stock.

I don’t think there’s any point flogging a dead horse. Most investors are aware that the Lloyds share price has performed dreadfully since the turn of the century.

Passive income stocks: our picks

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

The investment case here seems to lie almost entirely with the dividend and the 6.1% yield on offer.

But is it sustainable? Here’s what the charts are telling me about this income stock.

Rising rates

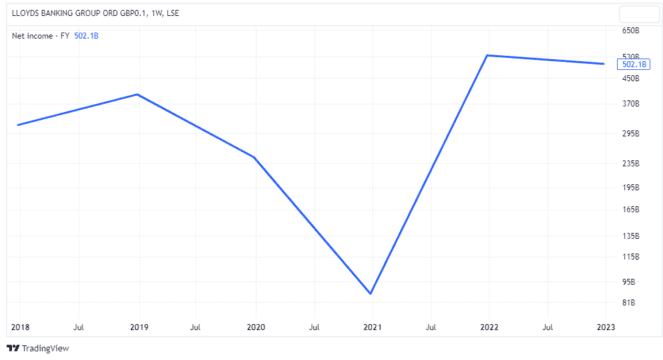

Like most big banks, Lloyds has been a major beneficiary of rising interest rates over the last 12 months. Higher net interest margins — the difference between the interest income earned and the interest paid out — have rapidly boosted profits.

Last year’s net profit was above £5bn.

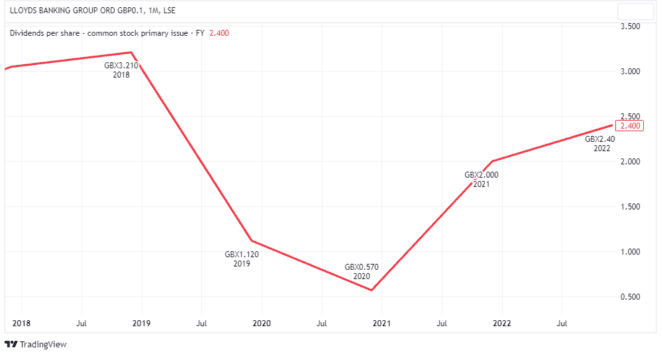

This has coincided with the company increasing the dividend again following its cancellation during the pandemic. However, we can see that the 2.4p per share paid out last year was below the pre-Covid payout of 3.26p.

This suggests there could be plenty of income growth ahead for investors buying the stock today.

Dividend cover

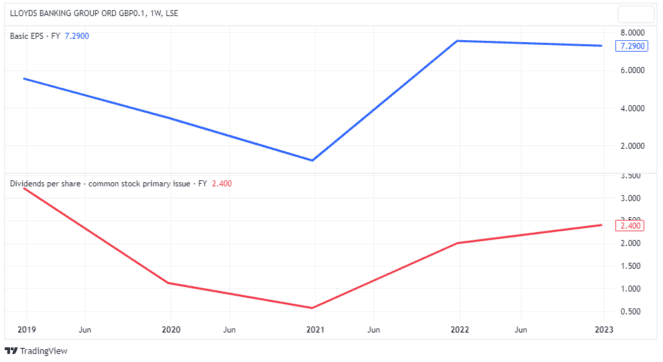

Dividend cover is the most popular method of measuring dividend safety. It’s calculated as annual earnings per share (EPS) divided by the annual dividend per share (DPS). This provides a quick way of assessing how many times the dividend is ‘covered’ by earnings.

Above, we can see the effect of rising earnings coupled with conservative growth of the dividend.

EPS of 7.2p ÷ DPS of 2.4p = 3.

Dividend cover of 3 is very healthy. It suggests that even if earnings decline this year, the bank still has ample scope to continue paying shareholders.

Value trap?

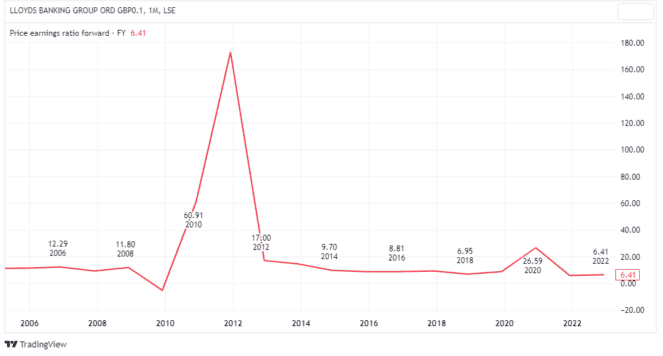

At 46p, the shares trade on a forward price-to-earnings (P/E) ratio of just six times. That’s less than half the FTSE Index average.

Below, we can see how the P/E has drifted down to this lowly valuation over many years.

So, while I think a P/E of 6 is dirt cheap today, this chart shows me that it is entirely possible for that multiple to contract further in future. The stock could prove to be a value trap.

Of course, the valuation could well head higher too. But the bank will have to navigate some choppy economic waters to get to that point.

Multiple headwinds

In Q1, Lloyds reported a 46% jump in pre-tax profit to £2.2bn, up from £1.5bn a year earlier. However, management warned that net interest margins are likely to weaken this year.

Meanwhile, there remains the likelihood of a big rise in loan impairments as companies and individuals struggle with high inflation and soaring interest rates. Then there are cracks appearing in the housing market, to which Lloyds is directly linked as the UK’s largest mortgage lender.

Lloyds is essentially a play on the UK economy, and to me that’s problematic. The UK is facing weak growth, stubbornly high inflation and the prospect of a new government next year.

So, while the income prospects appear solid, there are too many uncertainties right now to justify adding the stock to my ISA, I feel.