Large parts of the world are literally on fire right now due to extreme heat. The climate emergency is intensifying and this will have implications for all UK shares, from the largest FTSE 100 share to the smallest penny stock.

UK share investors need to take action to protect their wealth from this ‘new normal’. Many listed businesses face an uncertain future as our lifestyles change in response to the climate emergency.

Okay, the issue of company profits clearly pales into insignificance when experts talk about things like mass extinctions. But long-term wealth building remains an important topic too, and investors need to remain active to build capital for retirement.

Passive income stocks: our picks

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

Here are three shares I’m considering buying as the world’s weather patterns steadily change.

Foresight Solar Fund

A hotter climate will boost power generation from solar sources and, by consequence, the profits that renewable energy companies will make. Foresight Solar Fund Limited (LSE:FSFL) is one such share on my radar today.

Fresh data from energy think tank Ember shows this phenomenon in action. It indicates that solar power generation in Europe hit 129.2 terawatt hours in the first half of 2023. This was up 11% year on year and represented new record highs. With the heatwave tipped to carry on into August at least the dial should continue to rise.

I like Foresight Solar Fund because of its wide geographic wingspan. It owns assets in the UK, Spain, and Australia. Because of this, group earnings are less reliant on favourable weather conditions in one or two places, thus reducing risk for investors.

Keeping up solar panels and related infrastructure isn’t cheap. But I’m still convinced the business could deliver solid long-term returns as renewable energy demand booms.

Antofagasta

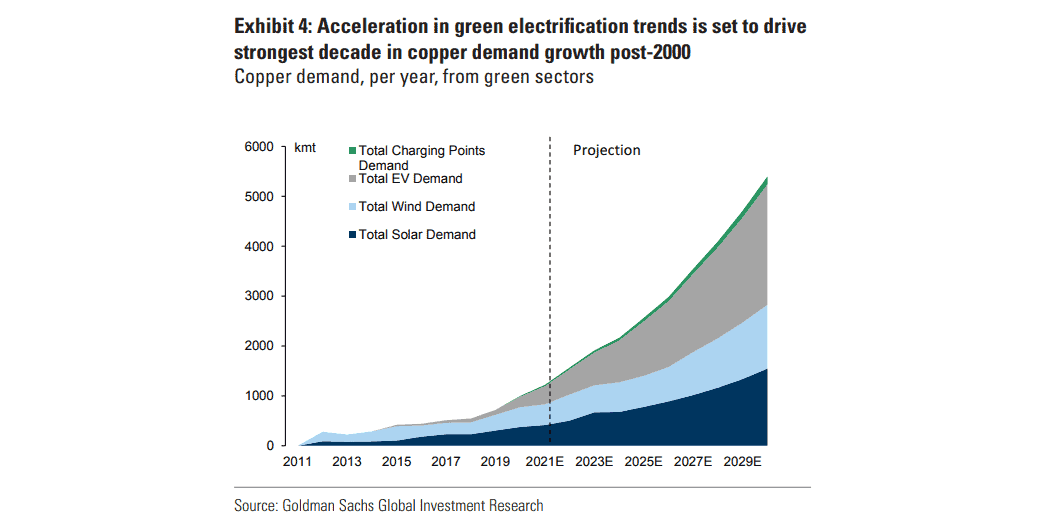

Rising investment in carbon-cutting technologies also means copper consumption is set to soar. The red metal’s unique qualities make it a critical material for the growth of the renewable energy and electric vehicle sectors, as the chart below shows.

Investing in a copper miner therefore could be a good idea. FTSE 100-quoted Antofagasta (LSE:ANTO) is one such share I’m considering buying today. It’s one of the world’s top 10 biggest producers of the commodity, and owns a large portfolio of working mines and exploration assets in Chile.

Be aware that Antofagasta isn’t immune to the problems of climate change itself, though. Indeed, drought conditions severely impacted production at the firm’s Los Pelambres mine in 2022. But on balance I think the earnings outlook here is extremely bright.

Anglo American

Mega miner Anglo American (LSE:AAL) is another safe-haven share I might buy for the climate emergency. Like Antofagasta, it provides a range of metals that make the energy transition possible. These include copper, nickel, manganese, and platinum group metals.

But its ownership of the Woodsmith project is what sets it apart from other mining stocks. The asset — which the company hopes to get up and running by 2027 — is the world’s largest-known source of polyhalite, a critical material in fertilisers.

Increasingly severe droughts, combined with a steady decline in farmable land, all mean crop yields need to rise significantly. Commodities like polyhalite will play an essential role in feeding our growing global population. I’d buy Anglo American shares even though trouble getting Woodsmith online could hamper earnings.