Rolls-Royce (LSE:RR) shares have been stuck in a trading range (145p-155p) since it’s positive performance update in February. Currently, the engineering giant’s share price is stuck towards the bottom end of the range, at 148p.

So what does this mean for investors. Well, it’s certainly something that traders will be looking to take advantage of — the stock now has a well-defined trading range with support and resistance points. However, it’s something long-run investors can benefit from too, assuming we have a positive outlook on the stock.

Range-bound stocks

When a company’s stock is range-bound, it means its share price is consistently trading within a specific range. In other words, the stock’s price oscillates between a defined upper and lower price level, until an eventual breakthrough.

Investors often refer to these price levels as support (lower boundary) and resistance (upper boundary). The support level represents a price at which buying pressure is expected to prevent the stock from declining further, while the resistance level represents a price at which selling pressure is expected to limit the stock’s upward movement.

For investors, understanding that a stock is range-bound and what the support and resistance levels are can provide insights into potential trading opportunities and risk management strategies.

An opportunity

Of course, a range-bound stock is only good for day traders unless investors believe the company will breakout above the range rather than below it. As such, valuation is key.

At this current movement, it’s hard to distinguish whether Rolls represents good value. That’s because we’re looking at a very different company than the one that entered the pandemic. Rolls sold business units in an effort to pay off government-backed debt taken on in 2020.

It currently trades with a price-to-earnings ratio of 79, and using analysts’ forecasts, we can assume a price-to-earnings outlook of around 29. The latter figure remains around twice the FTSE 100 average. Where investors may see greater value is in the medium-to-long run. It’s hard to forecast earnings, but the omens are positive.

Aircraft demand swells

Population growth, an expanding middle class, economic development, and increasing urbanisation are expected to drive the demand for aircraft over the next two decades.

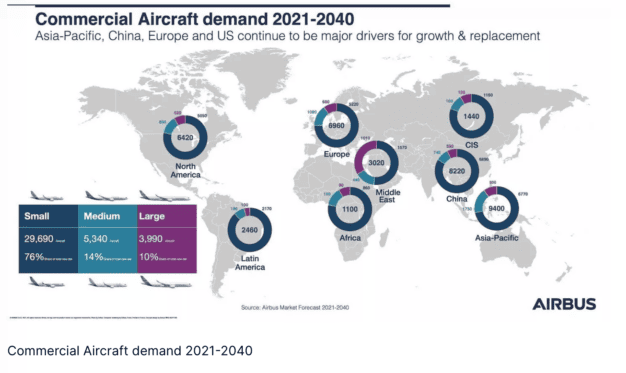

As we can see, the forecast demand is largely for single aisle jets and plenty of this demand stems from China and fast-developing economies in South-East Asia.

While this is positive for Rolls — its largest business unit produces and services aircraft engines — the company will need to successfully shift towards the single aisle market to fully take advantage of the demand trend.

Central to this will be the UltraFan engine, originally designed for wide-body or twin-aisle aircraft rather than single-aisle planes. The manufacturer’s German unit, Project HEAVEN, is exploring scaling the engine down to a size suitable for a single-aisle jet. In turn, this would allow Rolls to benefit more readily from the trends in aircraft engine demand.

My investment hypothesis for this stock is based on long-term demand within the civil aviation market, and the current positioning of the share price towards the lower end of its range. While I hold Rolls-Royce shares, I’m wary that there could be more obvious value picks available.