Since making explosive gains in February, Rolls-Royce (LSE:RR) shares have found themselves range bound. While day-traders may be able to take advantage of this, it’s not positive for wider investor sentiment.

Buying such a stock

Range-bound stocks can offer opportunities for short-term trading or value investing. And as a value investor, this makes Rolls-Royce an interesting proposition. The share price is bouncing between support and resistance levels (the lower and upper end of the range), around 145p-155p.

While this isn’t always the case, range-bound stocks can be undervalued because of short-selling and, over time, falling investor sentiment. Moreover, buying at the lower end of the range can present even more of an opportunity. This is because the support levels provides something of a buffer — certainly not one that’s guaranteed — as recent history shows us the support level is the lowest the stock goes before pushing upwards.

Undervalued?

It’s very hard to tell whether Rolls-Royce is undervalued. That’s partly because of the transition the business has been through in recent years. Having taken on more debt during the pandemic, it had to sell units to pay off a government-backed loan.

This means it can be challenging to put together a discounted cash flow model. Why? Because we don’t have visibility on future cash flows. Moreover, it currently trades with a price-to-earnings ratio of 79 — but, this isn’t overly reflective of the state of the business.

Rolls expects to generate underlying operating profits of £0.8bn-£1bn and free cash flow of £0.6bn-£0.8bn this year. However, this isn’t the same as profit. Once again, we’re yet to really see where the business stands in this post-Covid world.

Prospects

An investment thesis for the engineering giant can be built around the prospects of the industries in which it operates. Civil aviation is the largest segment. Here, Rolls sells engines to airlines and aircraft manufacturers. It also provides aftermarket services such as maintenance, repair, and overhaul to ensure optimal engine performance.

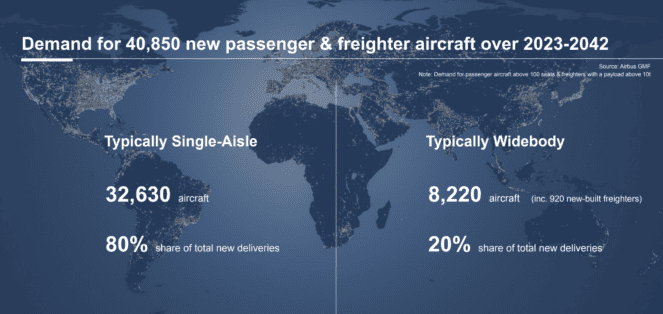

Airbus, a partner and user of its engines, expects the global commercial aviation sector will need more than 40,000 new passenger/freighter aircraft deliveries over the next 20 years. This sounds great for Rolls, but most of this demand will be for narrow-body aircraft.

Rolls engines are typically used on wide-body jets. And although there’s significant demand here, there’s clearly more in the single-aisle space. This is why Rolls is looking to move into the segment with the UltraFan engine, which is suitable for both aircraft types.

These long-term prospects complement improving data in the near term. It’s forecast that 4.35bn people will travel this year, up from a previous estimate of 4.2bn. Rolls-Royce engine flying hours were up to 83% of 2019 levels for Q1, and this figure is expected to grow as the year continues.

Holding or buying

I already have a significant position in Rolls, and the stock has been good to me. The shares have fallen to the lower end of their range over the last week. And I’m increasingly willing to add to my holding. The long-term prospects for its largest revenue-generating sector are very attractive.

That’s not to say there aren’t better or more obvious value picks on the market. I’m torn between Rolls and several stocks that appear meaningfully undervalued.