After a blistering start to the year, the Rolls-Royce (LSE:RR) share price has stalled. At 155p per share, it’s made no real progress since early March as worries over the global economy have risen.

This ramping up of investor caution is understandable. Stock markets are forward-looking, after all. And earnings forecasts here could be severely downgraded should consumer spending on travel fall.

Yet some would argue that this is already baked into the FTSE 100 engineer’s price. Today it trades on a forward price-to-earnings growth (PEG) ratio of 0.2. A reading below one indicates that a stock is undervalued.

So should I buy Rolls-Royce shares for my portfolio today?

Good signs

The International Air Transport Association (IATA) certainly doesn’t see a storm on the horizon for the world’s airlines. This is critical for Rolls as it relies on strong demand at its engine servicing division to drive profits.

This month, the IATA actually upgraded its industry profit forecasts for 2023. It predicted that 4.35bn people will travel this year, up from a previous forecast of 4.2bn. Guidance was helped by Covid-19 lockdowns in China being lifted earlier than expected.

Strengthening industry conditions bode well for Rolls over the longer term as well. Airlines have been ramping up investment in their fleets in 2023 in a positive sign for new engine orders and future servicing demand.

Indian airline IndiGo’s record-setting order for 500 Airbus A320 aircraft last week underlines the health and confidence flowing through the industry. This followed Air India’s then-record order of 470 planes from Airbus and US rival Boeing two months earlier.

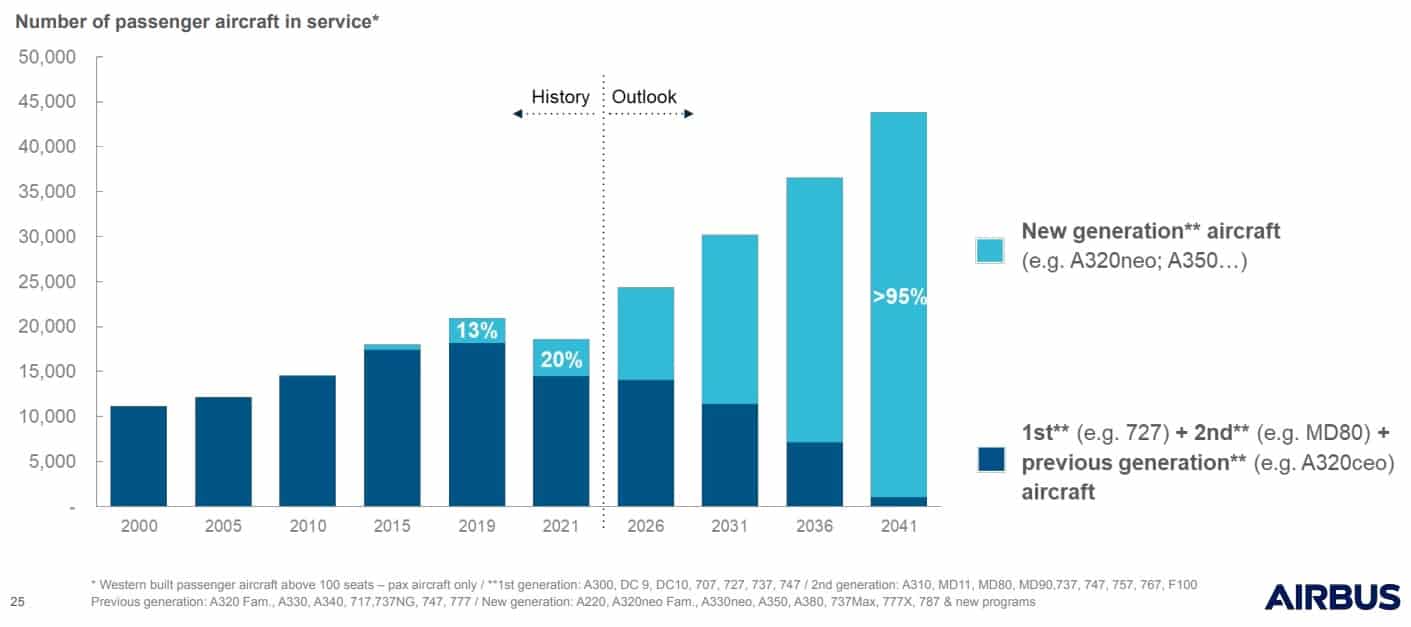

New aircraft orders look set to increase steadily over the long term, in fact. Soaring traveller numbers from emerging markets mean the global fleet will likely swell in the coming decades, as the chart below shows.

However..

But I’m still not prepared to buy Rolls-Royce shares today. This is because of the company’s large net debt pile which, although falling, still stood at an eye-popping £3.3bn as of March.

A spree of disposals has helped the business repair its stretched balance sheet. But with asset sales now over — and the travel industry in danger of a fresh downturn — the FTSE firm could struggle to keep getting net debts down.

This is especially worrisome as interest rates rise and the cost of servicing its financial obligations soars. It certainly casts a shadow over City forecasts that Rolls will begin paying a dividend again from 2024.

A FTSE stock I’d avoid

There are other significant obstacles that Rolls-Royce must overcome.

Severe supply chain problems across the aerospace industry could hamper its expected profits recovery. The company’s transformation plan to cut costs and improve efficiency also has a long way to go. Fresh setbacks here could reignite investor worries over cash burn and pull the share price lower.

Demand for Rolls’ shares could also decline as the practice of ethical investing gains momentum. The firm’s exposure to defence and aviation markets makes it high risk when it comes to ESG.

As I have shown, the engineer’s share price looks cheap on paper. But on balance there are still plenty of other FTSE 100 value stocks I’d rather buy right now.