Shorted shares are stocks that are borrowed and then sold by investors who believe that the price of a stock will go down. Heavily-shorted companies present big risks, but they can also generate massive gains if they do well. So, do some of the UK’s most shorted shares have a place in my portfolio?

1. Ocado

Ocado (LSE:OCDO) has been one of the most volatile stocks on the London Stock Exchange, having traded on either side of 10% over the past week. However, this is not a surprise as Ocado is the most-shorted UK share with a short interest of 6.2%.

The online grocer saw its share price jump by 50% in June after news of a potential takeover from Amazon surfaced. As such, short-sellers bought Ocado shares en masse in order to avoid heavy losses, hence the massive jump. But whether Ocado shares warrant a buy is an entirely different question.

Ocado has been making losses on end since 2017 and its route to profitability doesn’t look to be coming any time soon. With Amazon set to deny its interest in acquiring Ocado, according to latest reports, there are certainly better UK shares out there to invest in.

2. ASOS

ASOS (LSE:ASC) was one of the most-shorted stocks in June. Fast forward a month later and its fortunes seem to have turned around. The online fashion retailer started June with a short interest of approximately 5%, and has seen the figure fall to 1.2% today after the stock rose over 20%.

The reason for this is the FTSE 250 stalwart’s most recent results. Having seen declining profits since early 2021, the company reported an underlying operating profit of £20m in its Q3 trading update. What’s more, the board even guided for a profit of £40m to £60m in the second half of its financial year.

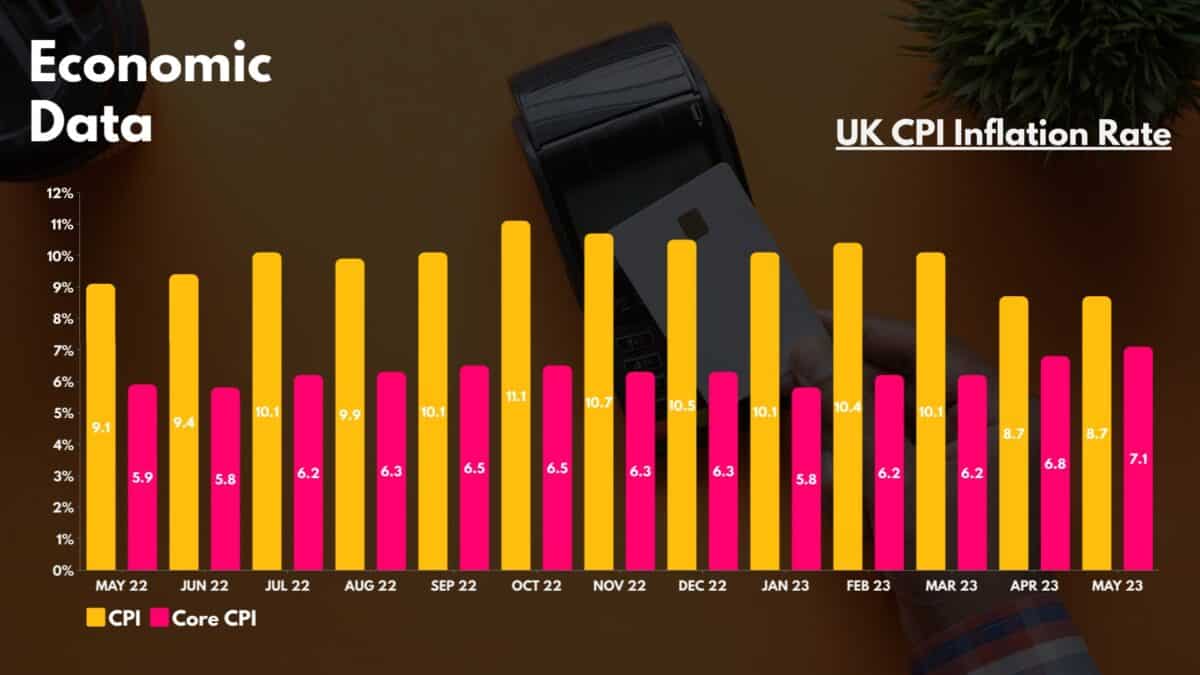

Consequently, ASOS is now the 59th most-shorted stock, which is a remarkable feat. Nonetheless, there’s still some way to go before the ASOS share price can fully recover from its current slump. And it will require the help of inflation falling further before there’s meaningful progress on its top and bottom lines.

Even so, given the recent upbeat figures from NEXT and Primark owner Associated British Foods, the near term looks bright for apparel. If ASOS can capitalise on this and continue improving its cost base, its shares look like a tremendous bargain with a price-to-sales ratio of 0.1 — and is a stock I’m considering.

3. Moonpig

Moonpig (LSE:MOON) has moonshot itself to the top of most-shorted UK shares. The greeting card firm reported a healthy uptick in revenue in its latest FY23 results. Despite that, traders remain pessimistic, choosing to focus on the 7% decline in adjusted profit before tax instead.

Be that as it may, this could actually benefit Moonpig. If the group manages to outperform its guidance and grows revenue by more than 8% while maintaining its EBITDA, short-sellers could end up buying Moonpig shares in bulk to avoid losses, subsequently boosting the Moonpig share price.

The business is now head and shoulders above its competition in the online greeting card space. Thus, the stock could end up being one of the better heavily-shorted UK shares to buy. And with a reasonable forward price-to-earnings ratio of 14.5, Moonpig stock is one I’m considering.