Warren Buffett is widely regarded as the greatest stock market investor of all time. So it’s worth listening to his investing advice.

Here, I’m going to highlight what I regard as Buffett’s most powerful quote of all time. I think this tip could help investors generate significantly higher returns over the long term (and save them a lot of pain).

Buffett’s top tip

Buffett has come out with some legendary quotes over the years.

For example: “The first rule of an investment is don’t lose money. And the second rule of an investment is don’t forget the first rule.”

Here, he’s talking about the importance of minimising big losses to become a successful investor.

Another great quote is: “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

Here, he’s suggesting that it’s worth paying a higher valuation for a really great company.

However, if I had to pinpoint his most powerful quote, I’d go with this gem:

Your goal as an investor should be simply to purchase, at a rational price, a part interest in an easily understood business whose earnings are virtually certain to be materially higher, five, 10, and 20 years from now.

The reason I love this tip is that it really nails what investing’s all about – buying shares in companies likely to get much bigger in the years ahead (at a reasonable valuation). And then holding for the long term.

All too often, investors pursue strategies that deliver sub-optimal results. For example, they buy cheap stocks (that are cheap for a reason) and end up losing money when these get even cheaper.

Or they buy stocks at 52-week lows (that are trending down) and lose money when they keep falling.

If investors were to go back to basics and stick to investing in high-quality companies that look set to grow their earnings significantly in the years ahead, they could improve their returns dramatically.

Investing for growth

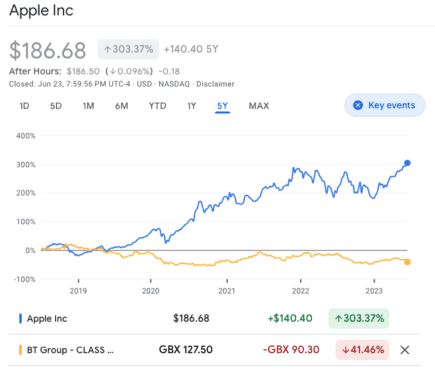

For example, instead of investing in BT, which has looked cheap for years but generally been a really poor investment due to a lack of earnings growth, they might have invested in Apple (Buffett’s largest holding), which has seen its earnings explode as the world becomes more digitalised.

Over the last five years, Apple shares have risen about 300% versus a loss of around 40% for BT.

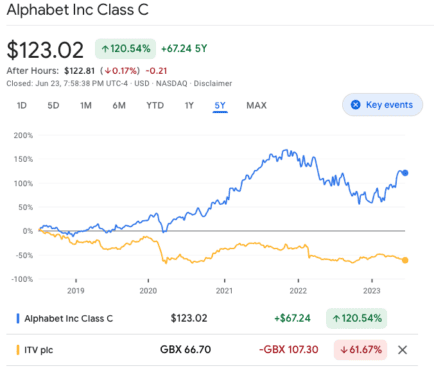

Or instead of investing in ITV, which has struggled to generate earnings growth as viewing habits change, they might have invested in Google and YouTube owner Alphabet, which has done really well as advertising has gone digital.

Over the last five years, Alphabet shares have risen about 120% versus a decline of around 60% for ITV.

How to find Buffett-style stocks

Of course, identifying businesses whose earnings are “virtually certain” to be materially higher, five, 10, and 20 years from now is not always easy.

And there are always some companies that appear to have a lot of earnings growth potential but don’t deliver.

However, by doing some research, with the help of websites like The Motley Fool, it’s possible to identify high-quality growth companies.

And by taking a diversified approach to investing, the chances are they will do well in the long run.