The last 18 months have marked one of the steepest interest rate hiking cycles in history. During that timeframe, the Bank of England (BoE) has raised the base rate by 475 basis points. As the probability of a hard landing scenario increases, so too does that of a stock market crash.

Sticky inflation

Driving the shock 50 basis point interest rate hike earlier this week was the news that inflation is not coming down as fast as economists had been expecting.

In my opinion, inflation is becoming embedded in the economy and will prove to be anything other than transitory in the coming years.

Yes, inflation is a lot higher here in the UK than the US and other G7 economies. But what really matters is not the absolute rate at which prices are rising but that in most western countries it is significantly above central banks’ 2% target.

This point is crucial. Today, investors are betting on one thing: that we’re going to see another 10 years of strong growth and low costs of capital, similar to what we witnessed in the 2010s.

I take a different view. I see this decade being characterised by low or negative growth with higher-than-average cost of capital. If this turns out to be the case, I find it difficult to believe that stock markets won’t suffer.

This time it’s different

Both the Federal Reserve and the BoE are increasingly running out of options. Despite the severity of rate hikes, financial conditions remain way too loose.

Nominal interest rates have risen dramatically. However, on an inflation-adjusted (real) basis, rates have moved much more slowly. And it’s the real rate that matters much more to the economy at large. In the UK, with inflation sitting at 8.7%, monetary policy isn’t particularly tight.

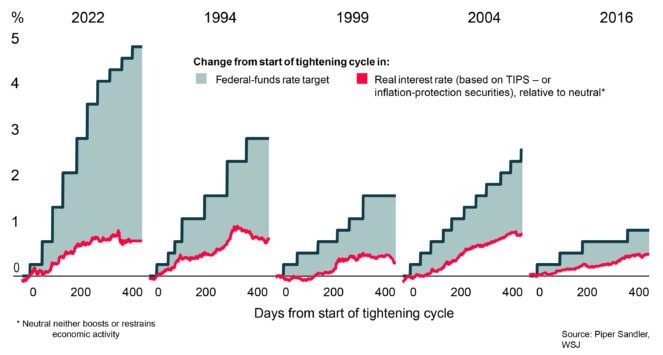

The following chart compares today’s interest rate hiking cycle with others in recent history. Such a chart, to me, partially helps to explain why the S&P 500, and particularly mega-cap tech, have rallied year to date.

Opportunities

I might be bearish on overall equity markets, but that doesn’t mean there aren’t opportunities out there.

One sector I remain bullish on is energy. If the US economy does start slowing and the Fed cuts rates, I would expect to see a reacceleration in inflationary trends. In such an environment, oil will return above $100.

Capital investment on the part of major oil companies has been low, despite oil prices being above historical average. BP and Shell are my picks in this sector.

On top of this, the global economy continues to decarbonise. Trillions of dollars of investment are going to pour into this push in the decades ahead. The need for base metals such as copper, nickel, and lead are set to explode.

However, as with energy, years of under-investment in the mining sector means that demand is likely to outstrip supply. Glencore and Anglo American shares look cheap relative to their long-term prospects.

Finally, there is gold. In my opinion, it still remains the ultimate inflationary hedge. In the coming decade, I expect the traditional 60:40 stock and bond portfolio to evolve, and gold to play an increasingly important role.