If we’re investing for passive income, or use a compound returns strategy for growth, we’re going to be looking for dividend stocks with high yields. Of course, as long as the yield is sustainable, the higher it is, the better it is!

Unique conditions

To call this a once-in-a-lifetime opportunity is clearly a big shout. I appreciate that. But I also think it’s fair to say that these come by very infrequently. Maybe we’re not going to see another opportunity like this for a very long time.

Of course, this isn’t the first time we’ve seen a depressed market with high yields. Just three years ago, share prices tanked when Covid sent us into lockdown and yields spiked. But it felt like an existential threat to our society. The risks were real. This time, it’s different.

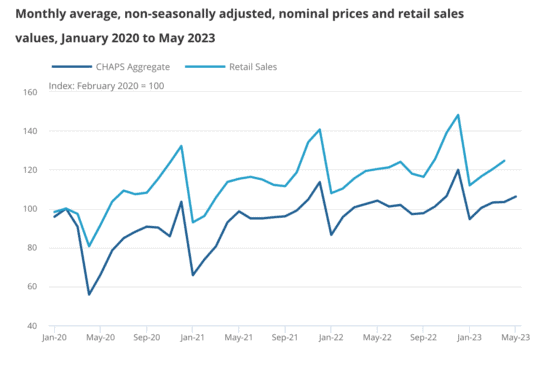

The current macroeconomic environment is less concerning, characterised by stubborn inflation and robust interest-rate-resistant consumer spending. The forecast meltdown hasn’t been forthcoming. And that’s why I think the opportunity is so alluring.

And amid these conditions, company earnings have largely held up. I don’t doubt there’s more pressure coming. But, so far, stocks have largely outperformed expectations.

Locking-in high yields

As we know, share prices and dividend yields are inversely correlated. When share prices go up, dividend yields fall, and vice-versa. So hunting big dividend yields is much easier in beaten-down markets.

First of all, I need to be wary of unsustainable yields. The first place to start is the dividend coverage ratio (DCR) — a financial metric that indicates the number of times a company can pay dividends to its shareholders from its earnings. A DCR above two is considered healthy, but companies with lower DCRs and strong cash flows are fine with me.

Once I’ve established that the yield looks sustainable, then it’s one to add to the shortlist. But, of course, it’s not just about the big yields. I want to be confident that this company will be able to grow, and grow the dividends with it.

Big hitters

There are a host of companies that offer sizeable dividend yields. Far too many to consider in one article. To start, there’s a handful of stocks on the FTSE 100 that offer big dividend yields. But not all of the yields look stable to me.

Some of my favourites include insurance stocks, Aviva, Legal & General, and Phoenix Group — all 7%+ yields. These giants of the financial world boast strong cash flows and this helps to protect the yields. But, historically, they don’t offer much in the way of share price growth.

I also like Barclays despite concerns around the mortgage market. The 4.8% dividend yield was covered 4.25 times in 2022. In fact, EPS for Q1 of this year is greater than the total dividend for last year. In short, I believe the yield is safe and has room to grow.

Looking away from the FTSE 100, there’s Epwin Group — a producer of energy-efficient and low-maintenance building products. The £100m-company currently offers a 6.4% dividend yield. The stock is down 30% over the year, but revenue was up 3% year on year by May.