Investing within a Stocks and Shares ISA is one of the best ways to build wealth in the UK. Sadly though, not all investors have success with their ISAs. That’s because they make investing mistakes that bring down their returns dramatically.

Here, I’m going to highlight three very common mistakes ISA investors make. Avoid these, and building long-term wealth becomes a lot easier.

Lack of diversification

Quite often, investors only own a handful of stocks. This really isn’t enough – if one or two of these stocks underperforms, they will drag the whole portfolio down.

To be fully diversified and minimise stock-specific risk, as portfolio really needs to hold at least 20 different stocks. This way, a couple of bad picks won’t have a huge impact on overall performance.

It’s worth noting here that there are plenty of ways to diversify easily today. For example, adding funds or investment trusts to a portfolio gains instant access to a broad range of shares.

Home bias

Now, a good portfolio will be diversified by asset class and within asset class. It will also be diversified geographically.

This last bit is where a lot of investors trip up. Quite often, investors experience what’s known as ‘home bias’ and invest predominantly in shares listed in their home country. This can limit their long-term returns.

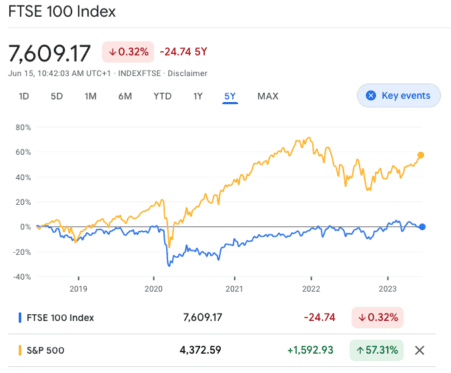

Just look at the recent performance of the UK’s FTSE 100 index versus the US’s S&P 500.

For the five-year period to the end of May, the Footsie produced a return of just 3.2% a year (including dividends) while the S&P 500 returned approximately 11% per year.

This means UK investors could have potentially improved their returns significantly by allocating some capital to US shares.

Why has the US market performed so much better than the UK market? It’s mainly because the US is home to tech giants such as Apple, Microsoft, and Alphabet – which are growing rapidly as the world becomes more digitalised.

Portfolio construction

Finally, a third mistake ISA investors make is not ‘right-sizing’ their portfolio positions. This means weighting a stock or security relative to its risk/reward profile.

Quite often, retail investors have huge positions in risky stocks (e.g. 50% of their portfolio in Tesla). This isn’t sensible from a risk-management perspective.

But neither is weighting stocks equally. Because with an equally-weighted portfolio, higher-risk stocks have the same weightings as lower-risk stocks.

Generally speaking, the best approach, when it comes to building a portfolio, is to give the most weight to solid, blue-chip stocks that have attractive risk/reward profiles and less weight to more speculative shares that could potentially blow up.

This is what professional fund managers tend to do. They often also cap position sizes at 5% to ensure that no single stock is a massive part of their portfolio.

By right-sizing their stock positions, risk can be reduced dramatically.

Generating strong returns

By focusing on these three areas of portfolio management, ISA investors can significantly reduce their overall risk levels. By doing this, they can give themselves a much better chance of generating strong long-term returns.