Fevertree (LSE: FEVR) shares have experienced a 59% fall over the last five years. Zooming out further though, the stock has been a great success story since listing in November 2014. It’s up 676% (excluding dividends) in less than a decade.

But after the more recent share price setback, is now an opportune time to invest in the maker of premium drink mixers or should it be avoided? Let’s take a look.

Feeling the squeeze

Fevertree was founded in 2004 with a simple premise: if only a quarter of a G&T is gin, why not make the tonic the highest quality possible?

Passive income stocks: our picks

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

Today, its ingredients are sourced from all over the world and the London-based firm is still growing in multiple international markets.

Arguably the most important of these is the US, which is the second-largest spirits market in the world after China. Here, year-on-year revenue grew 23% in 2022.

So why have the shares taken a hit in recent times?

Well, the firm’s current struggles originate with the supply chain disruptions and ensuing inflation brought on by the pandemic. These issues started to squeeze margins back in 2020.

Then Russia invaded Ukraine and the resulting energy inflation fed through to soaring shipping costs and skyrocketing glass prices. And unlike most of its rivals, the glass it uses for its bottles is a huge cost.

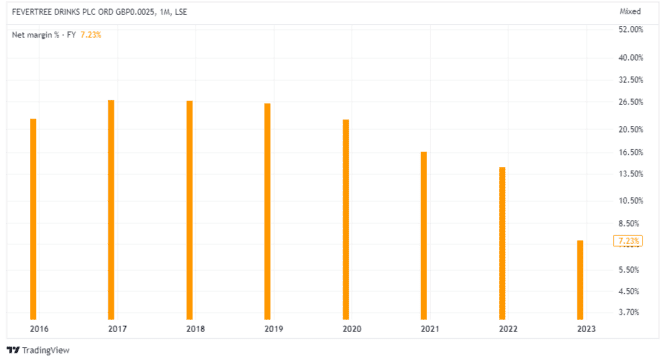

Below, we can see the affect these intense inflationary pressures have had on its profit margin over the last few years.

Glass half full

Nevertheless, the company has recently broadened its portfolio to include a new range of cocktail mixers, as well as launching products in the adult soft drinks space. These adjacent market opportunities could turn out to be quite substantial over time.

Meanwhile, management is guiding for 13%-18% revenue growth for this year, with EBITDA between £36m and £42m.

Next year, the company is hoping there’s an easing in energy-related costs associated with glass manufacturing. If so, this could drive margin improvement and boost profits.

Are the shares worth buying?

Fevertree has a strong brand and asset-light business model (manufacturing is largely outsourced). And it’s very well diversified geographically, with the US, Europe and the rest of the world now accounting for nearly 70% of its business.

Plus, it has continued to generate cash despite major inflationary headwinds. Combine all this with a share price that’s down more than 50% over the last five years, and I see the company as a prime acquisition target.

As for the acquirer, my natural assumption would by a global beverage firm. Coca-Cola, perhaps? Or Diageo? It wouldn’t surprise me if either swooped in.

That said, I don’t tend to factor in acquisition potential when I invest. And the stock is still far from cheap, currently trading on a price-to-earnings (P/E) ratio of 61. That fizzy valuation doesn’t make me want to reach for my investment app and press the buy button.

But I’m a big fan of the company and its products. And I’d imagine the recent sunshine we’ve been enjoying in the UK hasn’t harmed sales in its most mature market.

So the stock will remain on my watchlist for now, and I’ll revisit the investment case at a later date.