Those who ruled out Alphabet (NASDAQ:GOOGL)(NASDAQ:GOOG) stock earlier this year after its Bard hiccup must be left red-faced. Having dropped 15%, the shares are now up 40% this year, and have even beaten Microsoft‘s impressive gains.

An intelligent move?

Alphabet stock is now one of the S&P 500‘s biggest winners this year, and it’s no surprise why. At the company’s I/O conference, where CEO Sundar Pichai unveiled a slew of new and exciting developments on the AI front, which have garnered plenty of enthusiasm.

For one, Bard has been updated with a more sophisticated language model that expands its use case as it rolls out globally. Meanwhile, Google has been busy upgrading its search engine. Search will soon feature AI responses alongside organic search results.

Should you invest £1,000 in Barclays right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Barclays made the list?

More impressively, AI is also being integrated into numerous other products. One is Google Photos, where users can now use AI-powered editing tools such as magic eraser. What’s more, Google Assistant can now book appointments for users via a phone call.

Additionally, Google Maps will now include features such as live view indoors. Moreover, Google Services such as Gmail will be able to compose e-mails on a user’s behalf. And to top it off, the firm announced its new line of Pixel products featuring a foldable touch-screen phone with faster Tensor chips.

Does Microsoft have the cutting Edge?

These developments should lead investors to ask whether Microsoft’s Bing and Edge browser can meaningfully compete and take market share from Google. Unfortunately, the answer for now is no — at least not yet.

The latest data from Similarweb shows that Google volumes have in fact, grown since Bing launched its ChatGPT-powered search engine.

This reinforces the investment case for Alphabet stock, and that the group still has plenty left in the tank. Plus, DeepMind, which holds a treasure chest of AI tools, is yet to be publicly released. With that in mind, I’m confident that Alphabet has got what it takes to give Microsoft a run for its money.

Should I buy Alphabet stock?

So, are Alphabet shares a ‘buy’ on that basis? Well, there are still plenty of factors to consider. On the face of it, one could argue that buying the stock is a no-brainer. After all, its trailing and forward valuation multiples are trading near their five-year lows.

| Metrics | Alphabet | Industry average |

|---|---|---|

| Price-to-earnings (P/E) ratio | 27.0 | 30.9 |

| Forward price-to-earnings (FP/E) ratio | 22.4 | 25.7 |

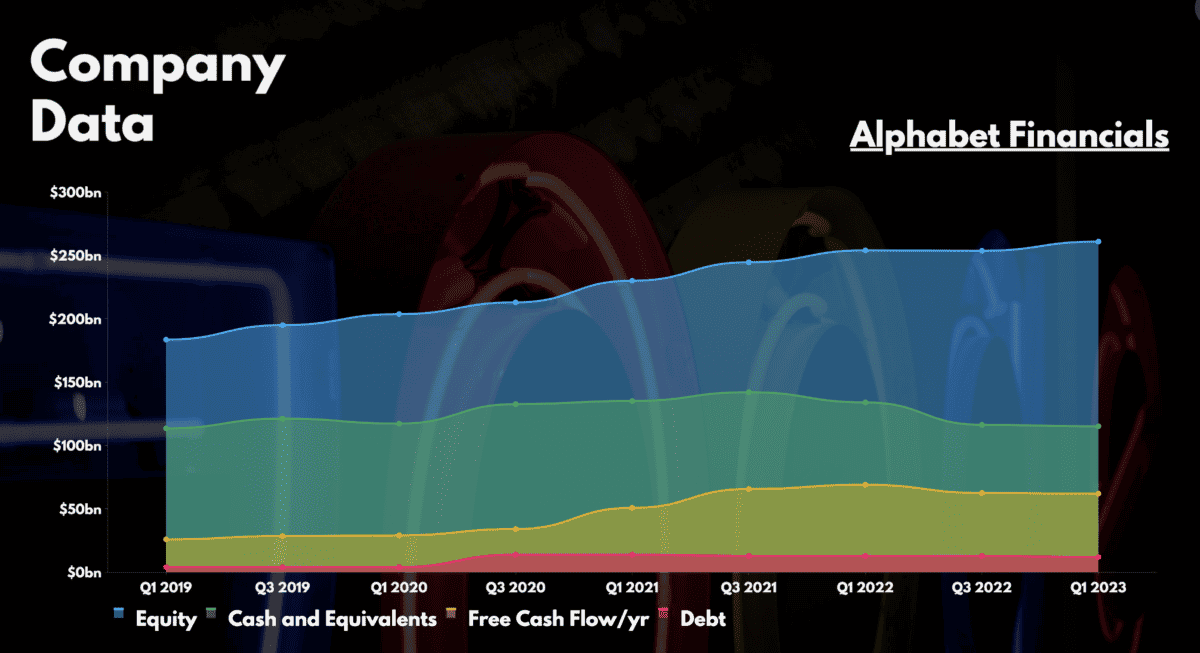

Furthermore, the conglomerate’s balance sheet is one of the most robust in the world. Boasting a debt-to-equity ratio of 4.5%, investors don’t have to worry about high financing costs that could impact potential profits.

Even so, headwinds still persists for Alphabet stock and the industry it operates in. The US is teetering on the edge of a recession, and could end up in one if the Federal Reserve continues to raise rates. This wouldn’t be good for Alphabet as companies tend to reduce advertising spending when cutting costs.

Either way, the long-term outlook still remains favourable for Alphabet, especially with its leading AI offerings. And if NVIDIA‘s AI-driven hype is to be realised, there’s still plenty of potential for Alphabet stock to fulfil given its ‘buy’ ratings and price targets of up to $190.