Real estate investment trusts (or REITs) can be a great way to make long-term passive income.

These property stocks are obliged to pay at least 90% annual rental profits out in the form of dividends. So there is a lot less flexibility for their boards to exercise discretion and limit shareholder payments.

This isn’t the only advantage. Like all real estate businesses, they tie their tenants down on long term contracts. This provides excellent earnings stability that, in turn, means dividends often beat the UK average during economic downturns.

Should you invest £1,000 in British American Tobacco right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if British American Tobacco made the list?

Finally, property shares such as REITs can effectively pass on inflationary pressures by hiking rents. This gives profits (and by extension) dividend forecasts extra protection.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

A top REIT I’m looking to buy

I already own a few of real estate investment trusts right now.

Healthcare facility operator Primary Healthcare Properties and care home provider Target Healthcare REIT both sit proudly in my portfolio. I also own shares in warehouses and distribution hub specialist Tritax Big Box REIT today.

But I’m searching for other top REITs to buy to boost my passive income now and in the future. Here is one I’m aiming to buy I have extra cash to invest.

Big Yellow Group

The UK self-storage market has been growing rapidly in recent decades. However, it still has plenty of scope to expand to catch up with the US and European neighbours France and The Netherlands.

This is why I’d buy shares in Big Yellow Group (LSE:BYG). According to property services business Cushman & Wakefield, Britons took out an extra 2m square feet of self-storage space in 2022 in which to store their stuff. Not even the mounting pressure on consumers’ wallets could stop the market growing.

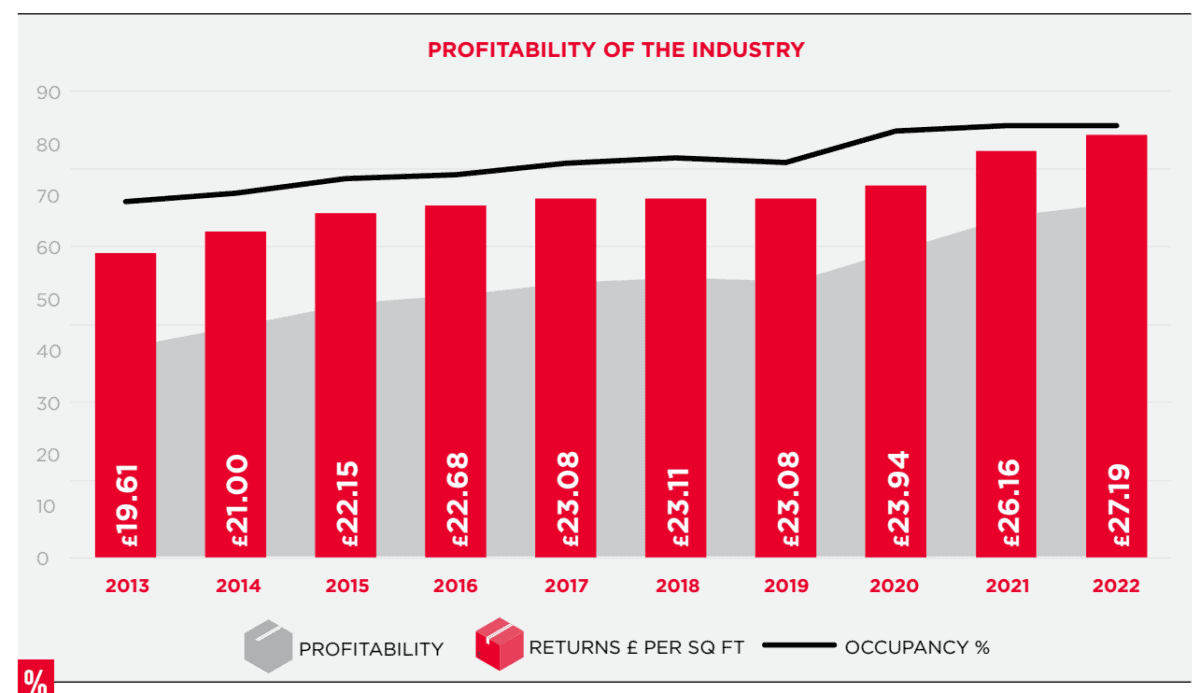

Soaring renter numbers and shrinking new property sizes are driving demand for extra space across the UK. So is rising consumerism and a growing hoarding culture. This is why rental returns continue to climb for self-storage operators. They rose 4% year on year in 2022 to £27.19 per square foot, Cushman & Wakefield said.

Big Yellow is the UK’s biggest operator in this industry by total space. It owns 6.3m square metres spread across 108 stores. And it’s expanding rapidly to capitalise on this booming market (which is now worth just shy of £1bn).

It acquired domestic rival Armadillo back in 2021. And it has a packed pipeline of 11 new developments that will add an extra 900,000 square feet to its portfolio.

Okay, the business isn’t totally immune to near-term pressures as the economy struggles. Average occupancy levels dipped 3% in the 12 months to March, to 83.7%, as consumer felt the pinch.

Yet I’d still buy Big Yellow shares today on expectations of market-beating returns over the long term. Today its forward dividend yield sits at a juicy 4.1%.