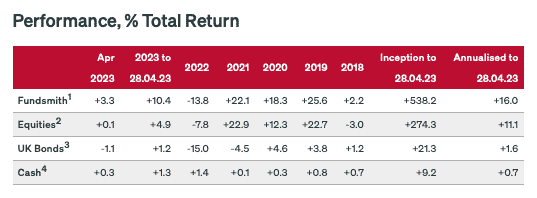

Fundsmith Equity has performed well in 2023, so far. For the first four months of the year, it generated a return of 10.4%, making its army of investors across Britain considerably wealthier.

Here, I’m going to discuss why I’ve invested in Fundsmith. I’ll also highlight some of the key risks to be aware of.

What is Fundsmith?

Fundsmith is one of the UK’s most popular investment funds. Run by portfolio manager Terry Smith, it was launched in late 2010. So it has been around for over 12 years now.

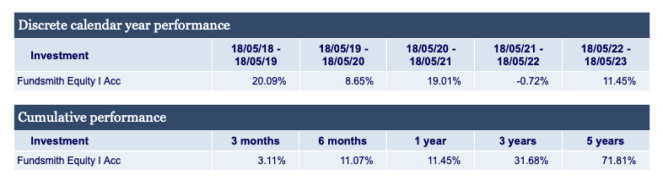

Since its inception, the fund has performed very well, delivering returns of about 16% a year (to the end of April). As a result, it has helped a lot of British investors grow their wealth substantially.

What it invests in

Fundsmith is a global equity fund. This means it’s able to invest in stocks listed internationally (such as in the US or Europe), and not just UK-listed companies.

The focus however, is on investing in ‘high-quality’ businesses. By this, I mean companies that:

- Have strong competitive advantages and are resilient to change

- Are very profitable

- Are financially sound

- Have long-term growth potential

Some examples of companies the fund is invested in currently include technology giant Microsoft, luxury goods powerhouse LVMH, and diabetes treatment specialist Novo Nordisk.

Overall though, Smith has a pretty simple investment strategy. His motto is “buy good companies, don’t overpay, and do nothing“. In other words, he’s looking to invest in top businesses and hold them for the long term.

Why I’ve invested

There are a number of reasons I’ve invested in it.

For starters, I really like Smith’s investment strategy. It’s very similar to Warren Buffett’s approach to investing. And look at the success Buffett has had in the stock market over the years. Today, he’s worth over $100bn.

Second, I like the fact that it’s a global fund. The UK has some brilliant companies. But let’s face it – many of the world’s most dominant players are listed overseas.

Third, I like the fact that it gives me exposure to powerful long-term trends. Smith likes to invest in companies that have plenty of growth potential. And there’s a thematic element to his approach. For example, Novo Nordisk is a play on the global diabetes crisis. Similarly, LVMH is a play on rising wealth across Asia.

Of course, there’s also the fund’s track record. Put simply, its performance over the long term has been outstanding.

Finally, minimum investments are low (through investment platforms like Hargreaves Lansdown).

Overall, I see Fundsmith as one of the best investments in the UK.

What are the risks?

There are risks here. As with any stock market-based investment, it’s possible to lose money with Fundsmith. Last year, for example, the fund lost approximately 14% for investors.

Meanwhile, it can perform quite differently to the stock market as a whole. Fundsmith is a ‘concentrated’ fund, meaning that it holds far less stocks than the average fund or stock market index. As a result, its performance can be better or worse than the broader market.

Given the risks, I don’t see Fundsmith as a ‘one-stop shop’ when it comes to investing. I own plenty of other funds and individual stocks for diversification.