At the close of 2022, this UK penny stock in the healthcare space was riding high.

Polarean (LSE:POLX) had received the green light for its novel lung-visualisation technology from the US Food and Drug Administration (FDA) on 28 December.

The FTSE AIM-traded company seemed to have a bright new year ahead of it.

Indeed, a hospital in Ohio opened its wallet and gave Polarean its first product order in April.

So, why has the stock tumbled in 2023? And is its 48% price crash a flashing ‘buy’ signal for my portfolio?

Breath-taking technology

Polarean has produced what it hopes will be the next generation of lung-imaging technology. Unlike CT scans, no ionising radiation is involved, which is a bonus for patient safety.

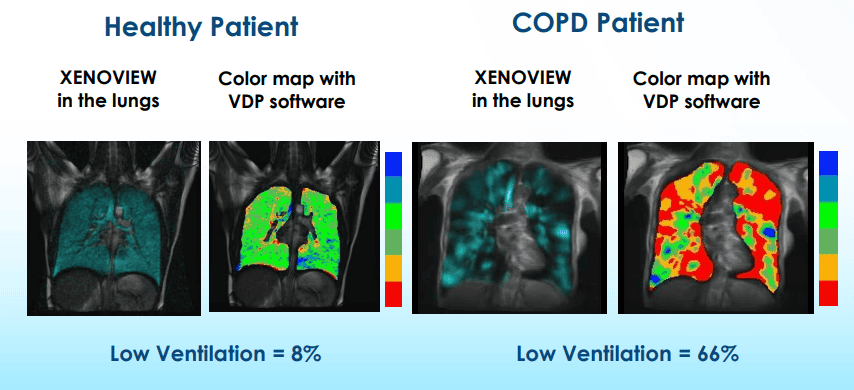

Its patented hyperpolarized xenon-129 gas helps capture what the company calls a “Xenoview“. Patients inhale the product and hold it for around 10 seconds.

The final product is an MRI picture that provides healthcare workers with a detailed look into the lung’s labyrinthine network of 300m alveoli.

Researchers at prestigious institutions across the US, Canada, the UK, and Germany are currently working to flesh out use cases for the technology. The US National Library of Medicine website lists 94 projects that rely on Polarean’s innovative product.

Polarean’s first order for a gas-blend cylinder for the production of Xenoview came late last month from Cincinnati Children’s Hospital. The Ohioan paediatrics centre is one of the hospitals that has been involved in investigating Xenoview. The hospital bought enough gas for 100 scans.

Take a deep breath

Although Polarean looks like a golden boy in the academic world, capital markets gave the company a mauling in mid-February when it announced it would need to raise more cash to reach its two-year commercial targets.

The share price cratered nearly 20% in a day, and it hasn’t recovered since. Polarean said it was considering funding options ranging from strategic partnerships to equity raises.

Polarean gave shareholders more bad news in March, revealing that $12.4m of its $13.9m cash pile had been deposited at Silicon Valley Bank before it went bust. Fortunately, that scare was short lived, with the company’s deposits emerging unscathed.

Worryingly, Polarean’s investor presentation does not mention the words ‘profit’ or ‘profitability’ once in 21 pages, focusing instead on the technology and the target market.

Is Polarean a buy?

Polarean is currently trading at a price-to-sales (P/S) ratio of 50, which suggests investors are pricing in a lot of growth. The only broker covering the medical imaging device company predicts revenue will grow by 800% in two years.

I like that Polarean has less than £500,000 of debt and cash holdings over £10m.

In addition, institutional investors hold one-third of the company’s stock.

Still, this penny stock is too risky for me.

If the company can’t get to profitability, it might have to blow up its share structure and dilute existing holders to stay alive. For now, I’ll be watching from the sidelines – with bated breath.