I’ve bought two FTSE 100 shares in my ISA in recent weeks. Both are new stocks for my portfolio, as I’ve never owned either before. Here’s what they are and why I’ve invested in them.

Global bank

Winston Churchill famously said: “Never let a good crisis go to waste.”

So for the last few weeks I’ve been looking for ways to take advantage of the sell-off in bank stocks that started in March. I thought a generic bank exchange-traded fund (ETF) might do the job, but there are many stocks in these ETFs that I don’t really want exposure to.

In the end, I settled upon FTSE 100 constituent Standard Chartered (LSE: STAN). The share price is down 21.5% in the last 10 weeks.

This is an emerging markets-focused bank, with significant operations across Africa and Asia. That appeals to me more than domestically-oriented UK banks where the growth prospects appear more sedate.

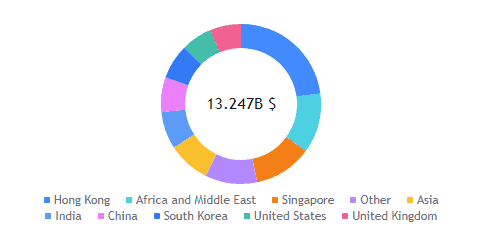

Below, I can see how well diversified its business is. Nearly 23% of its revenue is derived from Hong Kong, while 12.1% is from Africa and the Middle East, and 8.5% from elsewhere in Asia. India makes up 7.5%.

The banking sector is growing strongly in all these geographies and is expected to do so for many years.

That said, these potentially high-growth regions do come with additional risk. Higher US interest rates and surging global inflation could push developing nations towards defaulting on their sovereign debt. That could hit StanChart’s profits in these economies.

However, the UK-listed banking group announced plans to exit seven African countries last year. It will focus its efforts on high-growth economies such as Egypt and Saudi Arabia, which are more developed and profitable.

The shares are trading on a forward price-to-earnings (P/E) ratio of just 6.2 times. And there’s a prospective 5% dividend yield covered five times by expected earnings.

I think the stock represents all-round good value for me.

Taking to the skies

The second ‘new’ stock I’ve bought is Rolls-Royce (LSE: RR). It has had an amazing run, surging 83% over the last year.

However, over a five-year period, the share price is still down 50%.

In a recent trading update, the engine maker said it performed as well as expected in the first part of the year. It’s improving its cash generation, cutting debt and expenses, while investing for future growth.

Flying hours are on track to reach as high as 90% of pre-pandemic levels this year. I think that figure will reach 100% over the next couple of years as international travel fully recovers.

Plus, Australia’s new submarines built as part of the AUKUS programme will be powered by Rolls-Royce nuclear reactors. I’d expect more such deals for its Defence division given the ongoing geopolitical tensions.

New CEO Tufan Erginbilgic said that “positive results are expected to build as the year goes on“.

Net debt at £3.3bn remains a worry, as it will continue to drag on profitability. There’s plenty of work to be done here, but I’m optimistic on Rolls’ future.

After surging for months, the share price has taken a breather over the last few weeks. I’ll be looking to build out the position I’ve started throughout the rest of 2023.