Largely speaking, the key to successful investing is to buy shares with the intention of holding them for years. I myself own many FTSE 100 shares I plan to hang onto for at least a decade.

I’m a committed disciple of legendary investor Warren Buffett‘s strategy to “only buy something that you’d be perfectly happy to hold if the market shut down for 10 years”.

He knows a thing or two about successful share investing. The ’Sage of Omaha‘ has amassed a personal fortune over $100bn since he started buying shares in the early 1940s.

A top FTSE share I own

Taking a long-term approach protects share owners from market volatility that can decimate wealth. The theory is that quality companies will rebound from periods of weakness to deliver robust eventual returns.

Look, it’s not always possible for an investor to sit on the shares they own. Unforeseen circumstances can arise that mean a shareholder has to liquidate some or all of their holdings.

And of course changes at a company, to an industry, or to the broader economic climate mean that liquidating one’s position prematurely can be essential. Imperial Brands and Cineworld are a couple of UK companies I’ve sold sooner than I expected to.

But on the whole, buying stocks to hold for the long haul has served me well. With this in mind, here is one FTSE index share that I own and plan to never sell.

Metals mammoth

Profits at commodities producers can sink when times get tough. The landscape is especially murky right now as the global economy cools and interest rates keep rising.

Just today key surveys from China — a critical market for raw materials suppliers — showed industrial activity and retail sales slowed unexpectedly in April. These reports are the latest in a string of releases indicating tough conditions in the Asian territory.

Yet despite the threat of near-term turbulence I plan to hold onto my Rio Tinto (LSE:RIO) shares. I expect earnings here to surge through at least the next decade as a new commodities supercycle gets underway.

Growth drivers

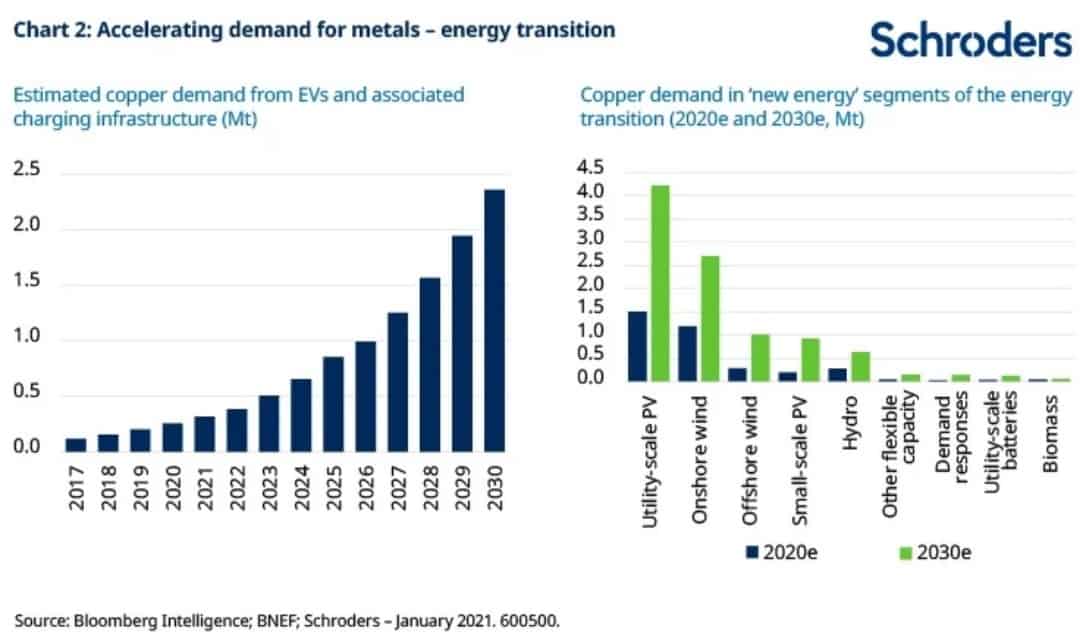

The FTSE 100 miner produces copper, iron ore, aluminium, lithium, scandium, and titanium oxide, among other things. These are all minerals that are due to be sucked up in increasingly mighty quantities on phenomena like rising demand for renewable energy, consumer electronics, and construction products in emerging markets.

The graph above shows the exceptional opportunities Rio Tinto will have as electric vehicle sales take off alone. And as one of the world’s biggest miners, it has the financial might to exploit this opportunity through asset expansions and acquisitions.

Some of the company’s exciting projects include expansion of the Oyu Tolgoi underground copper mine in Mongolia and the Western Range iron ore joint venture in Australia. It also has a string of other exploration and development assets under consideration that could drive future earnings.

I’m happy to accept that Rio Tinto’s profits will be volatile at times according to broader economic conditions. I believe the potential for it to generate market-beating returns over the long haul make it a top stock to own.