I’m searching for the best FTSE 100 value stocks to buy when I have extra cash to invest. Here are a couple on my radar right now.

Standard Chartered

Investing in certain FTSE-listed banks like Lloyds and Barclays could provide underwhelming returns in the years ahead. With the UK economy poised for a sustained period of weak growth, these businesses could struggle to increase profits.

Passive income stocks: our picks

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

As a result I’d rather buy shares in Standard Chartered (LSE:STAN). This blue-chip bank is focused on Asian emerging markets, where rapid population and personal income growth means demand for financial products looks set to soar from current low levels.

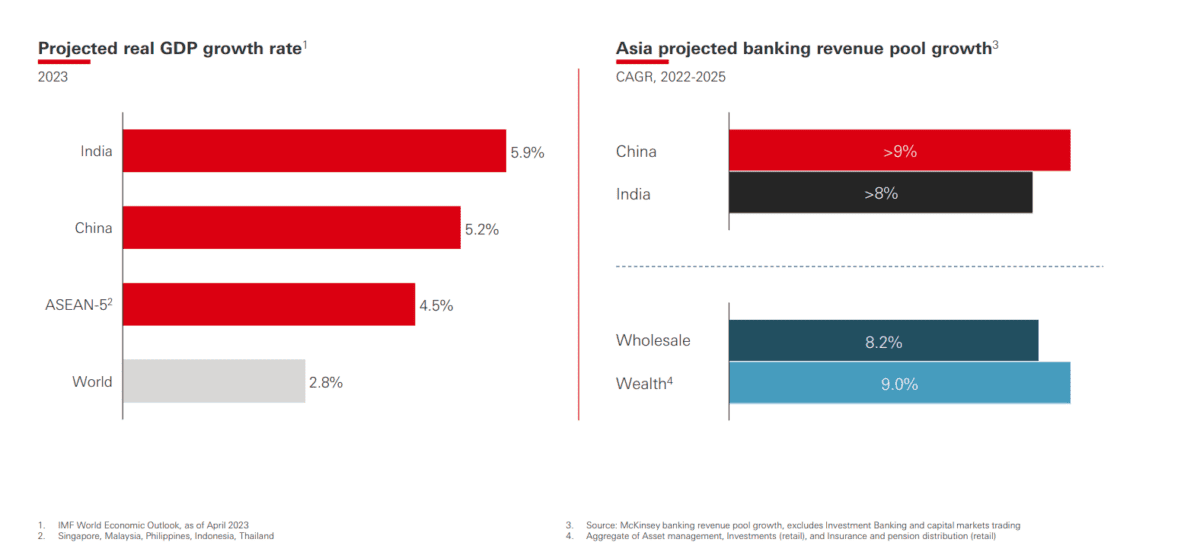

As the chart from HSBC above shows, territories like China and India have terrific growth potential in the coming years. But this is not the only reason I like Standard Chartered. I’m also attracted to its huge presence in Africa where the banking sector is growing strongly.

Market worries over the global banking sector have sent the company’s share price plummeting of late. This leaves the company trading on a forward price-to-earnings (P/E) ratio of just 4.2 times.

At these sort of prices, I think Standard Chartered shares are a bargain. Contagion in the banking sector is something investors need to keep a close eye on. But right now I think the potential benefits of owning this FTSE 100 share outweigh the risks.

International Consolidated Airlines Group

Even as interest rates rise and economic data remains mixed, confidence across the airline sector remains high. A raft of significant plane orders in 2023 — including Ryanair’s purchase of up to 300 Boeing 737 jets announced last week — underlines the cheery outlook for the industry.

Yet despite a slew of positive updates from airlines like International Consolidated Airlines Group (LSE:IAG), I remain reluctant to invest. Not even this particular company’s low P/E ratio of 7 times is whetting my appetite.

That’s because the British Airways owner carries mountainous amounts of debt. Net debt, while down almost by 19% year on year in the first quarter, still stood at an uncomfortable €8.4bn then.

A slowdown in the airline industry could obviously scupper IAG’s ability to keep paying this down. Comments from Heathrow Airport last week that “passenger growth may be levelling off” reveals a potential disaster coming the company’s way.

I’m also concerned about what a fresh surge in fuel prices and a steady rise in labour-related costs could do to the firm’s balance sheet. And if debts remain at elevated levels, the company’s ability to fund future growth and to pay decent dividends will come under serious pressure.

I like IAG’s robust position in the lucrative transatlantic market. I’m also a fan of its plan to boost its budget airline exposure, as its total takeover of Air Europa in February shows. Yet on balance, I believe there are better cheap FTSE stocks to buy right now.