Despite not being listed here in the UK, there continues to be a lot of investor interest in NIO (NYSE:NIO). The Chinese electric vehicle (EV) manufacturer has been flagged by some as being an undervalued buy right now. Having fallen 39% in the past year, NIO stock trades just above $8. But do the charts support this view or not?

Concern from the beginning

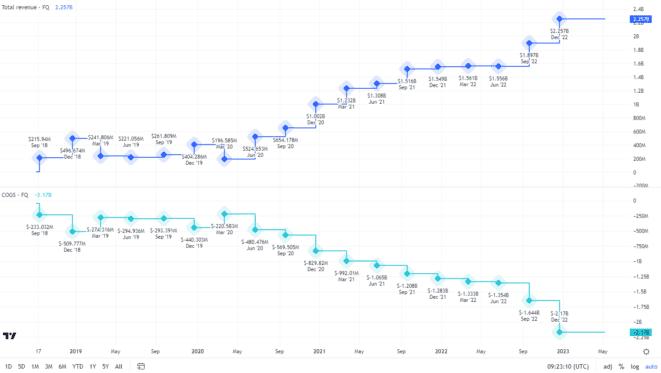

At a basic level, it’s important to see if NIO is getting the obvious things right. For a business to grow and be profitable, revenue needs to be rising. At the same time, the cost of goods sold needs to be smaller than the incoming money, in order to have a profit left over at the end.

For NIO, the dark blue line shows the quarterly growth in revenue over the past few years. It’s promising as revenue is climbing. This shows that customer demand is there. However, the cost of goods sold (light blue) shows the problem. The fact that it’s rising isn’t an issue, due to higher production levels.

The issue is that the cost is too high relative to revenue. For example, in the last reported quarter, revenue was $2.25bn but cost of goods sold was $2.17bn. When you add in other indirect costs, it pushes NIO to a loss overall.

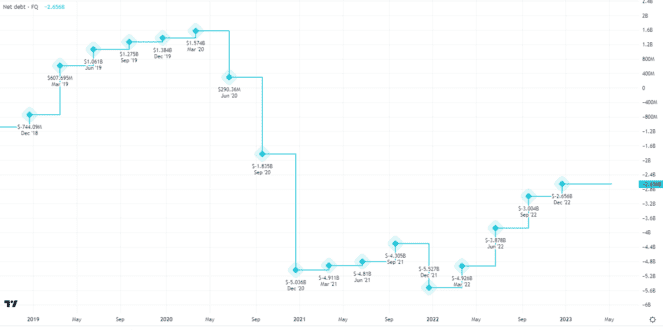

Positive progress on debt

A point worth noting is the fact that NIO is reducing the net debt levels. With traditional growth stocks, debt is taken on to help fuel performance. However, it needs to be managed carefully, as too much debt can destroy a business. Ideally, a company should start to pay down debt as soon as possible in order to aid cash flow.

The net debt for NIO has been reducing since the start of 2022. It has halved since December 2021. This is a good sign for investors. It means that NIO is less vulnerable to higher interest rates and the cost of raising new money. It also shows investors that it has better cash flow to manage funds by itself.

Interpreting the share price

The share price chart over the past five years is quite telling. The current price is back at levels seen in 2020. Yet the business is in a much more advanced position than it was back then. From that angle, I do see why some investors think that now is a good time to buy NIO stock.

The fall in the share price over the past year reflects the fact that despite revenue growing, costs aren’t under control. However, demand tells me that if NIO focuses on controlling expenses, a profit can be made in the future.

Thanks to lowering debt as well, the business is in a strong position going forward. On that basis, I feel investors should consider taking a small stake in NIO.