Investing in artificial intelligence (AI) companies could be a great way to supercharge returns from my Stocks and Shares ISA.

OpenAI’s chatbot ChatGPT, launched in November, highlights the huge AI potential. It could transform all our everyday lives, much the same as tech revolutions like the mobile phone and the internet at the turn of the century.

But not everyone is raving about the AI revolution. Indeed, concerns from the public, politicians, and even tech industry leaders are growing. They could potentially hamper growth of this bright new sector.

In an open letter, the Future of Life Institute has claimed that “AI systems with human-competitive intelligence can pose profound risks to society and humanity”. The organisation has called for a six-month pause on the development of systems more powerful than ChatGPT’s latest version (GPT-4).

The 27,500 signatories to the letter isn’t a colossal number. But the calibre of some of these names suggests the AI sceptic movement carries considerable weight. These include Tesla, Twitter and SpaceX chief exec Elon Musk, Apple co-founder Steve Wozniak, and Skype co-creator Jaan Tallinn.

The stocks on my radar

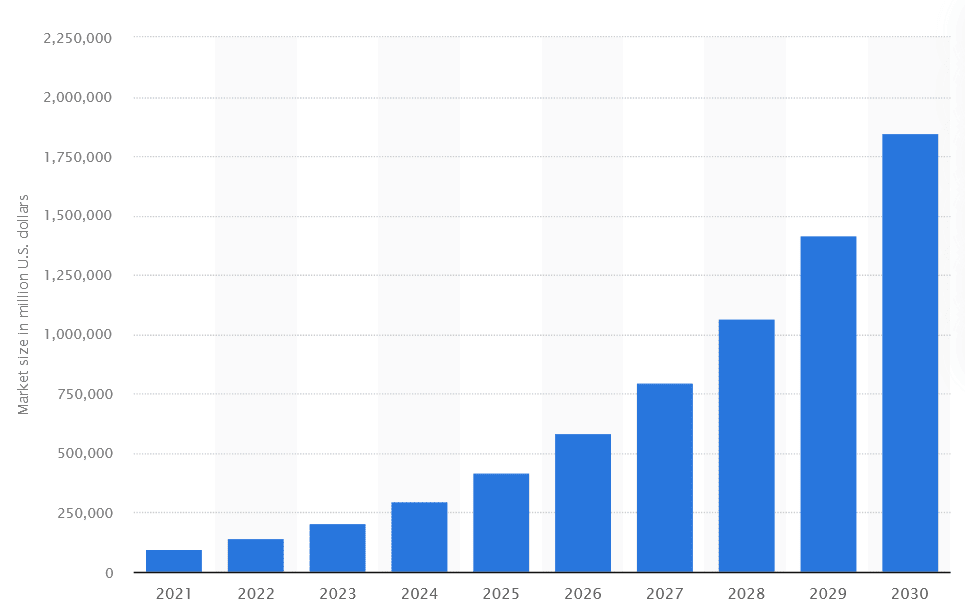

Yet despite this counter movement, investor interest in AI stocks continues to boom. And it isn’t difficult to see why. A report by Next Move Strategy Consulting suggests the global market will be worth around $2trn by 2030. That’s represents growth of 789% from current levels.

So although concerns over AI is growing, I’m still considering building a position in some AI stocks. Here are two on my watchlist today.

Microsoft

Chief executive of Microsoft (NASDAQ: MSFT) Satya Nadella has described AI as “the defining technology of our times.” So it’s perhaps no surprise the firm is investing heavily here. Earlier this year, it ploughed a whopping $10bn into ChatGPT-creator AI.

Who would bet against the US tech colossus being correct? Since its founding in 1975, Microsoft has been at the forefront of innovation. This is why it’s the third-biggest company on the planet by market-cap.

The Nasdaq company’s pivot closer to AI is already yielding encouraging results too. For instance, in March, its ChatGPT-enhanced Bing search engine passed 100m daily users for the first time.

Microsoft faces enormous competition from Alphabet and Amazon, to name just a couple of its competitors. But the tech giant has the edge right now and this makes it an attractive buy to me.

Dotdigital Group

In the UK, marketing firm Dotdigital Group (LSE: DOTD) is also an AI stock that has grabbed my imagination. Its technologies allow online businesses to automate their marketing campaigns and customer engagement strategies.

With e-commerce set for further sustained growth, profits here could rise strongly. This is especially the case in emerging markets where internet shopping is expanding from a lower base. Dotdigital sells its products across Europe, the US and Asia.

Latest financials showed revenues up 9% in the six months to December. And international sales are growing especially strongly. I’d invest here despite the risk that near-term revenues could disappoint if consumer spending cools.