Ocado (LSE: OCDO) shares have been falling for a while now. Two years ago, they were trading for £20. Today, they’re at £5. That’s a stomach-churning drop for investors holding this FTSE 100 stock over that period.

For context, the Footsie is up 13% in two years, and that’s not including dividends.

But after such a dramatic collapse, could Ocado shares actually now be worth buying? Here’s what the charts are telling me.

Should you invest £1,000 in Rolls-Royce right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Rolls-Royce made the list?

Weakening tailwinds

The company was a major beneficiary of the pandemic. As people stayed home and shopped online, its grocery delivery business boomed. In fact, it didn’t have the capacity to meet all the demand that suddenly came its way.

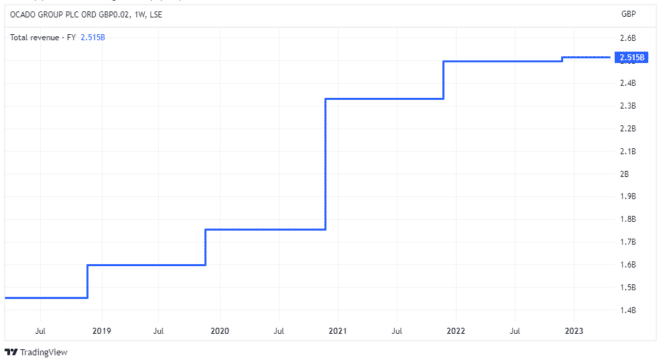

Covid obviously pulled forward a lot of the company’s anticipated future sales. But as the world has gradually returned to normality, revenue growth has understandably plateaued.

Last year, Ocado Retail — its joint venture with Marks and Spencer — saw sales fall 3.8% year on year to £2.2bn. This was despite active customer numbers rising and record sales over Christmas.

Management attributed this decline to soaring inflation, which led to lower overall basket volumes. As a result, the division posted a full-year loss of £4m.

Big group losses

As well as retail, Ocado has its rapidly-growing Solutions business. This builds and operates robotic warehouses for other retailers. It has so far signed deals with 12 global partners, including supermarket giant Kroger in the US.

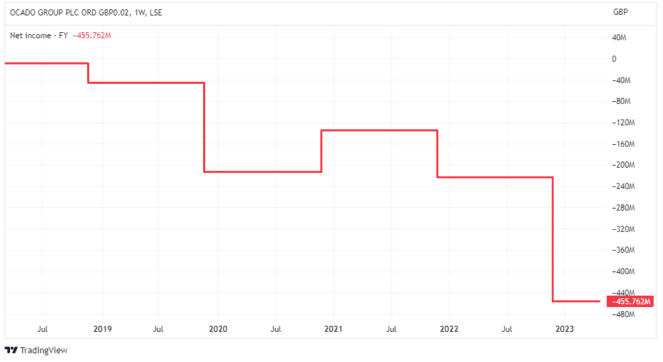

At a group level, Ocado posted a net loss of £455m last year, which was much wider than anticipated.

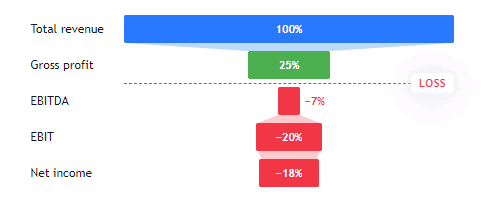

Also worrying is that EBITDA turned negative for the first time in a few years. In this revenue-to-profit-conversion graphic we can see how unprofitable the company is.

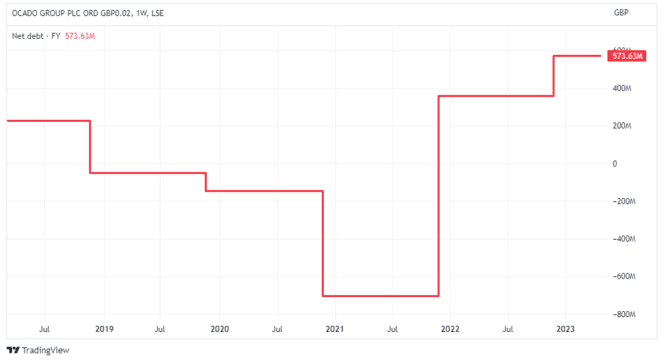

To make matters worse, net debt has risen recently. It now stands at approximately £576m.

Will I buy the shares?

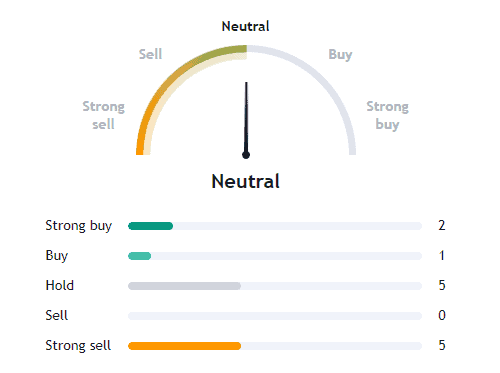

Based on 13 analyst ratings, Ocado stock is an overall ‘hold’ (or neutral). Here, we can see that three analysts covering the stock rate it as a buy or strong buy. Meanwhile, five have it as a strong sell. So this is a stock that divides opinion quite strongly.

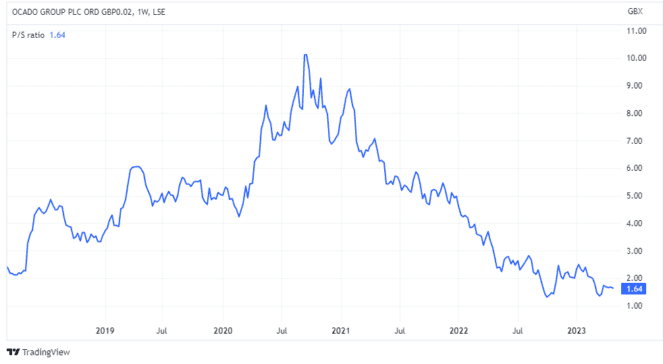

If I were ever going to invest in Ocado, now would be the time. On a price-to-sales (P/S) basis, the stock is the cheapest it’s been in many years. The P/S is just 1.6 today.

To be fair, I like what the firm is trying to do with its Solutions division. I find it refreshing that a FTSE 100 company is focusing so strongly on automation underpinned by advanced software. It’s no secret that the London Stock Exchange has been desperate to attract more such tech-enabled businesses.

However, I can’t ignore what the charts are telling me here. They paint a worrying picture.

In my experience, slowing growth, steep losses, deteriorating margins and rising debt aren’t conducive to great long-term shareholder returns. So I can understand why the stock has sold off so heavily since 2021.

Ocado has been in business for 23 years and still isn’t profitable. I have no idea when or if profits will ever materialise. So, as things stand today, I won’t be investing in the shares.