The FTSE 100 is packed with cheap blue-chip stocks offering high dividend yields, as well as exciting growth-oriented companies. Here are three I’d buy for this year’s Stocks and Shares ISA.

Dividend master

Legal & General (LSE: LGEN) helps over 10m people with savings, retirement and life insurance. These industries are set for steady worldwide growth in the coming decades due to economic development and ageing populations.

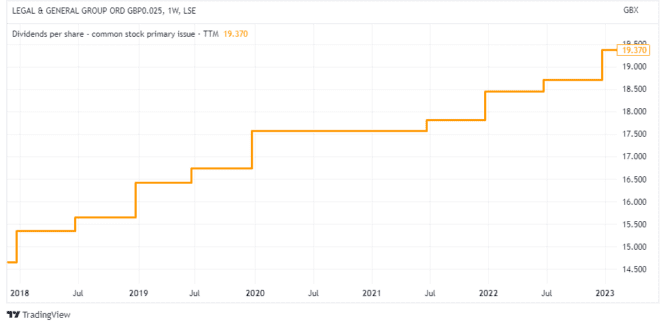

The big attraction of this stock is the 8% dividend yield. While no payout is guaranteed, the insurer does have a tremendous track record of growing its dividend. It stands at 19.4p per share today.

It’s worth noting that the stock can be volatile when global financial issues flare up. That was proved recently when the US banking crisis unfolded. The stock dropped 14% in one week in March.

But I view such dips as buying opportunities, so I dutifully topped up my holding recently.

The shares trade on a price-to-earnings (P/E) ratio of just 6.9. That’s around half the FTSE 100 average, which I reckon makes this a bargain buy.

Clearer skies ahead

The pandemic hurt Rolls-Royce (LSE: RR) more than most. The company needs planes powered by its engines to be flying in order to book revenue from after-sales services. When global civil aviation was grounded indefinitely in 2020, the engine-maker’s finances were severely impacted.

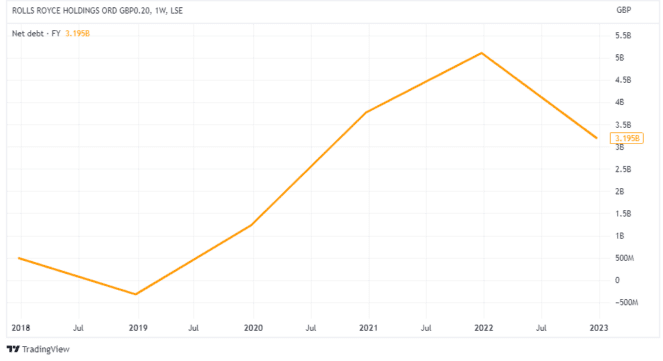

It took on a huge amount of debt, a big chunk of which remains today.

Net debt was still over £3bn at the end of 2022, even after disposals helped reduce it. Rolls did generate positive cash flows last year, but much more will be needed to pay down that level of debt. This remains a concern.

Nevertheless, I see growth opportunities ahead. Its Defence division is poised to expand as the ongoing war in Ukraine pushes military budgets higher.

Plus, the millions of extra Chinese tourists expected to travel in the years ahead should provide a major tailwind. There are almost 600 Rolls-Royce Trent family engines in China, which all need constant servicing. Will this fleet grow over time? I think it will.

Longer term, nations will inevitably need much more low-carbon power. So I see great promise in its nascent Small Modular Reactor (SMR) business. If approved, these mini nuclear reactors could be providing power to the national grid by 2029.

I’m intending to become a shareholder soon.

The future

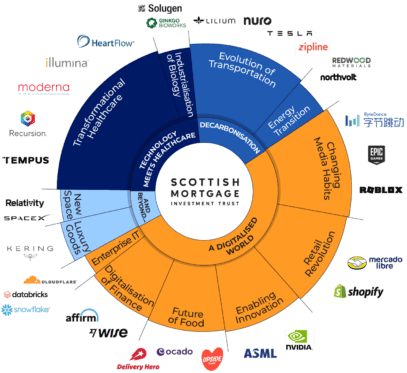

My final pick is Scottish Mortgage Investment Trust (LSE: SMT). Its portfolio contains around 100 disruptive growth stocks that the trust’s managers think could be massive long-term winners.

This style of investing is currently out of favour, and there’s a risk it could be for a while yet. However, I think the portfolio’s underlying theme of rapid technological change is as powerful as ever.

For example, take ChatGPT, the wildly popular artificial intelligence chatbot. It was trained on 10,000 graphics processing units (GPUs) made by Nvidia, which is one of the trust’s largest holdings.

The top portfolio position today is mRNA pioneer Moderna, which is hoping to have personalised cancer and heart disease vaccines ready by 2030. It has $18bn in cash to fund such revolutionary ambitions.

Scottish Mortgage shares are down 30% in 12 months and I’ve been scooping them up lately.