It’s been a difficult 18 months for most growth stocks. The valuations many reached at the end of 2021 were ultimately unsustainable. However, now that share prices have fallen, I think some look incredibly attractive considering their future growth potential.

Here’s two excellent stocks I’m buying in May or have just bought. Both are very distinctive businesses.

Fantasy figurines

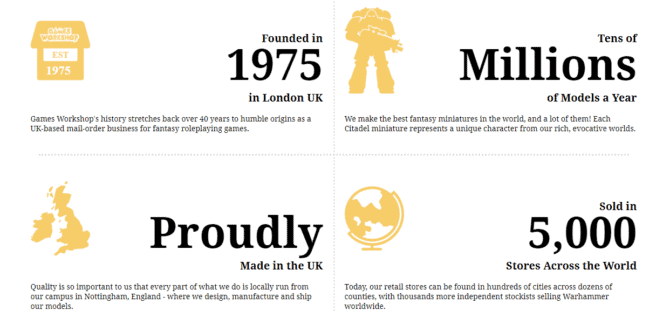

Nottingham-based Games Workshop (LSE: GAW) is the manufacturer of tabletop wargames. Its Warhammer 40,000, which is set in the grim darkness of the 41st millennium, is the most popular miniature wargame in the world.

As such, the company has a large and loyal following. Famous fans include Ed Sheeran and actors Henry Cavill and Vin Diesel. Indeed, British star Cavill has referred to Warhammer miniatures as “plastic crack” due to their (harmless) addictiveness.

Beyond selling figurines, the company is focused on growing its business through digital content, licensing and intellectual property. And major progress was made here back in December when it announced that Amazon Studios (along with Henry Cavill) would be creating a Warhammer series.

This is a potentially very lucrative deal and could bring many more fans into the company’s Warhammer universe.

Back to the here and now though, inflation is a concern. The company’s miniatures are already pricey, and even more so after a 6% average price increase on some products in March.

In a recent trading update, the figurine maker said that business in the three months to the end of February had been in line with expectations. But that period obviously didn’t include the latest price increases.

Over five years, the firm has increased its net profit at a compound annual growth rate (CAGR) of 33%. But I think profits should keep rising long term from the relationship with Amazon.

The shares are down 18% since September 2021. I intend to add to my holding in May.

European tech giant

Dutch firm ASML (NASDAQ: ASML) has a monopoly on the fabrication of extreme ultraviolet lithography (EUV) equipment. Its $200m machines are used to print every advanced microchip on earth right now.

As the company points out: “If you have a relatively new smartphone, one of the latest gaming consoles or a smart watch, it’s likely you’ve benefited directly from EUV lithography technology.”

Incredibly, China spends as much money importing microchips as it does oil, which immediately presents some risk here. In line with the US, the Dutch government has already placed export restrictions on the company’s EUV machines to China. If that was extended to all its equipment, that could impact profits.

For now though, the company continues to grow strongly. In Q1 it reported net sales of €6.7bn, a gross margin just north of 50%, and net income of €2bn. It expects 2023 revenue to grow over 25% year on year.

By 2030, it expects sales to leap to €44bn-€60bn from €18.6bn in 2021.

One telling fact is that ASML’s equipment is so complex that the firm provides its own specially trained staff to help operate it. They remain at the customer’s site for the duration of its lifespan. So this is a unique company that’s quite literally light years ahead of the competition.

The stock is down 30% since September 2021. I recently bought the dip myself.