FTSE 250 stocks have taken a tumble over the past year, with the index down 10%.

That’s mostly due to rampant UK inflation compressing profit margins and high interest rates making debt costly to service.

What should a stock-picker like me do? Well, imagine a seagull scouring the shore for fish left behind by a retreating tide.

Should you invest £1,000 in Big Yellow Group Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Big Yellow Group Plc made the list?

I’m doing the same, only in search of stocks that have fallen victim to indiscriminate doom-and-gloom selling.

Space invaders

I like Safestore (LSE:SAFE) and Big Yellow (LSE:BYG), the UK’s biggest providers of self-storage space.

These real estate investment trusts (REITs) saw their share prices rocket during Covid. People needed storage space like never before, as they redecorated their houses, built home offices and welcomed their adult children back to live with them.

The fact that the pandemic boosted bottom lines in the sector was no surprise. Industry insiders have spoken openly about the four D’s that drive storage demand: death, divorce, disaster and downsizing.

From February 2020 to January 2022, Safestore and Big Yellow’s stock prices rallied by around 60%. Since then, both have seen their prices collapse by a third.

Clutter conundrum

Beyond the short-term factors that help and hinder the self-storage industry, I see a secular trend that could keep the sector buoyant.

Consider that in modern Britain, the average worker only needs to work for two minutes to buy a pint of milk. In the 1950s, it took eight minutes.

Productivity growth means we can afford to consume a lot more than our grandparents could with the same number of hours worked.

There’s one thing that has got much less accessible: space. Back in 1930, the typical house price in the UK was equivalent to three times the average yearly earnings. That number has increased to 10 times.

In short, we can afford more consumer goods but we have less space in which to keep them.

Take my pick

In my view, Safestore and Big Yellow are equally compelling ways to play this trend.

The US has around seven times as many self-storage units per head of the population than we do in the UK. That shows the spectacular growth potential for the sector here.

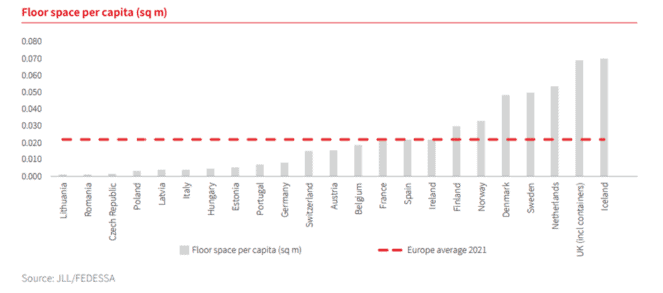

And Europe provides expansion potential too. Big Yellow is UK-only for now. And while Safestore has 29 outlets in France, nine in the Netherlands, seven in Spain and six in Belgium, the graph below shows how underdeveloped the self-storage industry is in Europe compared with Britain.

That means growth opportunities, especially in capital cities like Paris or Madrid where living in tiny flats is the norm for many.

Big Yellow has better brand recognition in the UK. The company’s also trading for less than its competitor, with a price-to-book ratio of 1, compared with Safestore’s 1.2.

Bubble wrap-up

Self-storage tends to do well in times of upheaval.

Still, a long recession in the UK could make cost-conscious households choose to sell or even bin items they have no room to store.

Regardless of that risk, I’ve made space in my portfolio for Safestore shares, investing 5% of my portfolio in the REIT.

I like Big Yellow too, but my position in Safestore provides me with enough exposure to the sector for now.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.