Rolls-Royce (LSE:RR) shares have been red-hot in recent months, going from strength to strength. But the FTSE 100 stock has plateaued since March.

So what could drive the share price forward in the coming years? Could it be Rolls-Royce’s entry into the nuclear space?

Let’s take a look.

Going nuclear

Rolls has three main business segments — civil aviation, power systems, and defence. Collectively, these enterprises account for the vast majority of the engineering giant’s revenue.

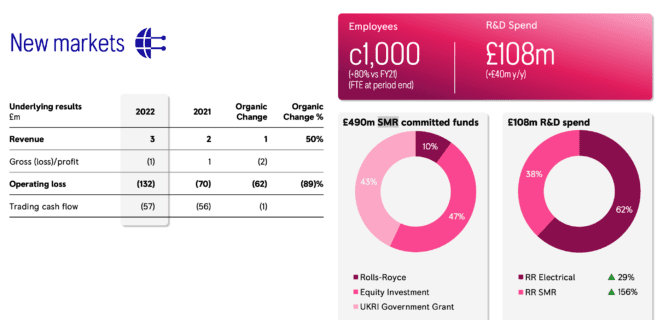

However, Rolls has ‘New Markets’ and they are the “development, manufacture and sales of small modular reactors (SMR) and new electrical power solutions“.

For some, the jury is out on the future profitability of the modular nuclear reactor programme — the plan was given government approval and funding last year.

Unsurprisingly, at this moment, it only provides a fraction of the company’s overall revenues. However, the SMR programme has demonstrated proof of concept.

In theory, Rolls would ‘mass produce’ these small reactors, with a capacity of 470MW, and sell them for around £2bn.

The big plus is that by producing these facilities in greater numbers and using a single model, state investors can reduce the risk of costly overruns that have bugged the construction of conventional nuclear power plants. Just look at Hinkley Point — 10 years late and it’s expected to cost almost twice as much as originally anticipated.

But there are challenges. First among them are reports that the UK government is preparing to invite international bids for next-generation nuclear power projects, thus removing its backing for Rolls-Royce’s product in development.

With billions of forecast development costs, it would be disastrous if the government started to favour other companies — the share price would really suffer.

However, in all honesty, I don’t think that’s going to happen. As Chancellor, Rishi Sunak came to Rolls’ rescue during the pandemic. I don’t think he’d want to risk it all now he’s PM.

| 2022 performance by segment | Revenue (£m) | Operating profit (£m) |

| Civil aerospace | 5,686 | 143 |

| Defence | 3,660 | 432 |

| Power systems | 3,347 | 281 |

| New market | 3 | (132) |

| Other (including corporate) | (5) | (72) |

| Totals | 12,691 | 652 |

What matters more?

The nuclear programme is interesting but, in reality, other sectors are more important — for now at least. In the near term, I’m hoping to see more signs of the recovery in civil aviation. This is Rolls’ biggest sector and a post-pandemic recovery will propel the company forward.

As Rolls earns through flight performance hours — not just engine sales — China’s reopening is likely to play a major part in this recovery. The country accounted for 40% of wide-body traffic reduction in 2022 versus 2019 — that’s because wide-body jets, which are more typically fitted with Rolls engines, are frequently used on domestic flights.

So would I buy more Rolls-Royce stock? Yes! But it’s not because of the SMR programme. It’s because civil aviation is getting back on track and the stock is down 48% versus pre-pandemic levels.

Despite the risks in the SMR space, I’m not fearing a share price meltdown.