Rolls-Royce (LSE:RR.) shares were one of the pandemic’s biggest losers. Investors in the aerospace and defence business had become accustomed to disappointment since the share price collapsed in early 2020.

However, since the start of January, the stock has skyrocketed 54%. Backed by encouraging recent financial results, could this mark the beginning of a sustained recovery for the FTSE 100 company?

Let’s explore three catalysts for further growth in the share price.

Should you invest £1,000 in HSBC right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if HSBC made the list?

A return to the skies

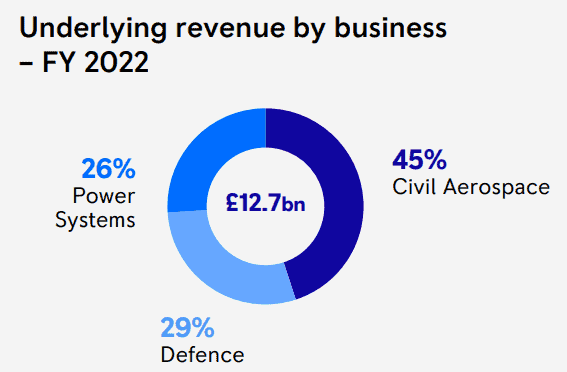

Accounting for 45% of underlying revenue in FY22, the Civil Aerospace division is the lifeblood of Rolls-Royce’s business.

In essence, this arm generates most of its income from manufacturing and servicing its family of large commercial aircraft engines.

In that context, the near-term market backdrop seems promising. The International Air Transport Association (IATA) recently reported February’s global passenger traffic reached 85% of 2019 levels.

That chimes with Rolls-Royce’s aim to revive its large engine flying hours this year to 80%-90% of 2019 levels.

Indeed, many analysts expect a recovery in international travel will continue to materialise as the year progresses, aided by China’s easing of pandemic-related restrictions.

The longer-term outlook is less clear. A new era of higher flight prices due to decarbonisation efforts might hurt the Rolls-Royce share price.

That said, this brings opportunities too. After all, in a world first, the company successfully completed a test run of an aircraft engine powered by hydrogen, partnering with easyJet last year.

Geopolitical tensions

The Russo-Ukrainian war has driven military spending higher across the West. As defence budgets increase, Rolls-Royce has benefitted. Nearly a third of the firm’s revenue comes from its Defence arm. Last year, the division’s order intake soared to £5.4bn from £2.3bn in 2021.

The company has revenue sources spanning transport, combat, naval, and submarine technologies. Its main customers are the US and UK governments.

A recent deepening of the AUKUS defence pact is a promising development. Australia has been highlighted by the firm as a key export market.

Elevated geopolitical tensions generally create volatility in the stock market. However, there’s a persuasive case to be made that Rolls-Royce could be a rare beneficiary.

Nuclear power

Finally, the business is developing clean energy solutions such as Small Modular Reactors (SMRs) in pursuit of future revenue sources. On this front, there’s good news both at home and abroad for Rolls-Royce.

Rishi Sunak recently pushed for the UK to deliver the world’s first ‘mini’ nuclear power plant. In addition, Finland and Sweden have expressed interest in the deployment of Rolls-Royce’s SMRs. So too has Ukraine as the country looks forward to a post-war recovery effort.

And the company’s ambitions aren’t restricted to planet Earth either. Backed by the UK Space Agency, Rolls-Royce is pioneering research into the potential application of a small modular reactor on the Moon.

Should I buy more?

There are plenty of reasons to believe Rolls-Royce has strong upside potential. However, debt remains a concern and I think there’s also a risk some investors could take profits after the stunning recent rally.

I invested at lower prices than today, but I remain bullish on the company’s prospects in 2023. Accordingly, I’ll wait for share price dips before adding to my position.