I’m looking for the best cheap shares to add to my Stocks and Shares ISA today. Here are two I’m looking to buy when I have spare cash to invest.

Spire Healthcare

I’m considering adding more Spire Healthcare (LSE:SPI) shares to my portfolio as impatience with NHS waiting lists grows.

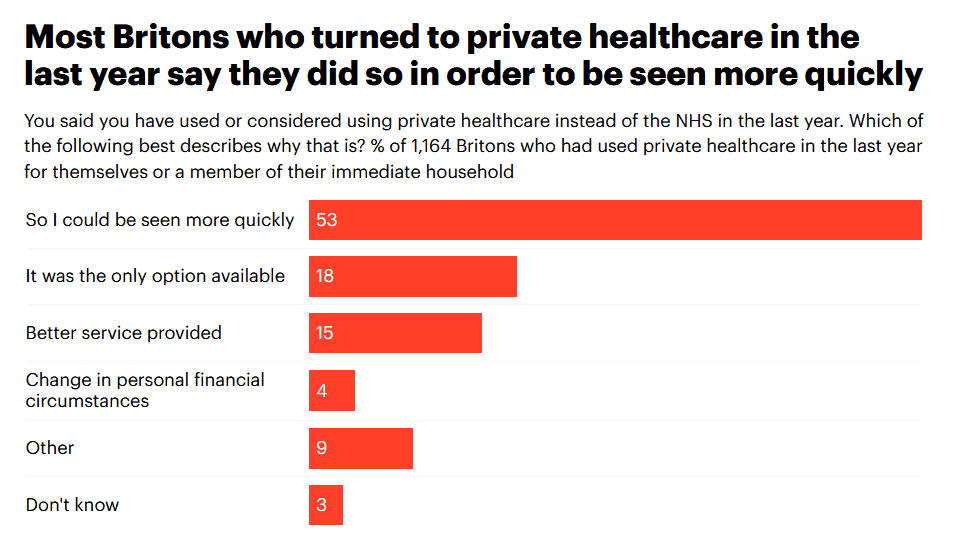

According to a YouGov survery, a whopping one in eight Britons have used private healthcare in the past 12 months. This has been driven overwhelmingly by a desire to be seen more quickly, as the chart below shows.

Data last week showed NHS waiting times have hit a new record high of 7.22m. And the number is tipped by some to keep soaring as people seek delayed medical treatment following the end of the coronavirus crisis.

So providers like Spire Healthcare can expect to remain extremely busy in the months and years ahead. In 2022 the business provided services for some 926,500 patients in total. This pushed revenues 8.3% higher year on year to a shade under £2bn.

The company faces pressures in the form of significant staff shortages. But despite this threat, City analysts are still expecting it to enjoy spectacular earnings growth over the next few years.

A 48% bottom-line improvement is predicted for 2023 alone. This leaves the business trading on a price-to-earnings growth (PEG) ratio of 0.7.

Any reading below 1 indicates that a stock is undervalued by the market. And it makes Spire one of the hottest value shares to buy right now, in my opinion.

Team17 Group

Consolidation in the video games industry continues to heat up. So now could be a good time to buy shares in a winning software developer such as Team17 Group (LSE:TM17).

Today was the turn of Angry Birds producer Rovio Entertainment to be snapped up by a bigger rival. Japanese industry titan Sega will acquire the business for a cool £625m.

Of course there’s no guarantee that Team17 will become a takeover target. But there’s an intriguing similarity between the UK company and Rovio: their expertise in mobile gaming.

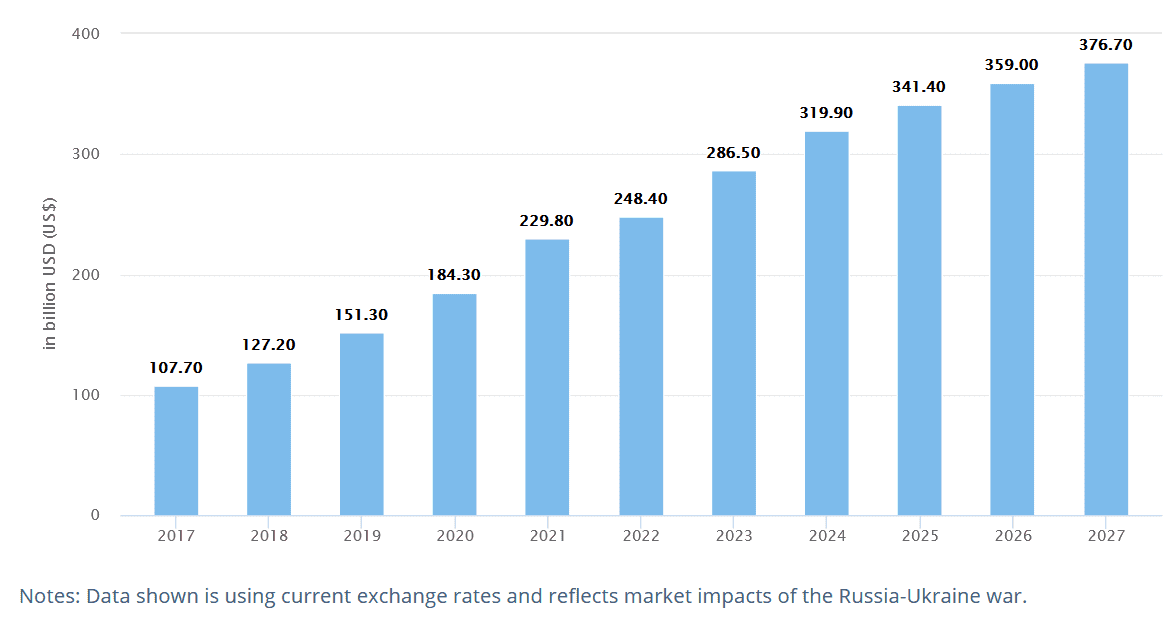

This segment continues to outperform the broader video games market. And it’s tipped to continue doing so. Analysts at Statista expect mobile games revenues to rise at an annualised rate of 7.08% between 2023 and 2027.

Encouragingly, Team17 is increasing spending to boost its position here. In 2021 it acquired StoryToys, which makes education and entertainment apps for children. It followed this last year with the purchase of dedicated mobile game developer The Label.

Competition in the video games market is intense. But thanks to titles like Worms, Overcooked! and The Escapists, Team17 has a good record of succeeding in the face of this threat. In fact it has grown profits for seven years on the trot.

Today, the AIM-listed business trades on a forward price-to-earnings (P/E) ratio of 14.8 times. Given its scope for strong long-term profits growth — and the sky-high valuations of many other tech shares — I think Team17 shares look ultra cheap.