Share prices have been volatile across the FTSE 100 since the beginning of 2023. Scottish Mortgage Investment Trust’s (LSE:SMT) share price has been especially choppy as worries over the tech sector have risen.

At 653p each as I write, Scottish Mortgage shares have fallen 10% since 1 January.

Should you invest £1,000 in Anglo American right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Anglo American made the list?

Could it be argued that the trust’s shares are now too cheap to miss? After all, as I write, it trades at a 21% discount to its net asset value (NAV) of 824.3p per share.

Strength in depth

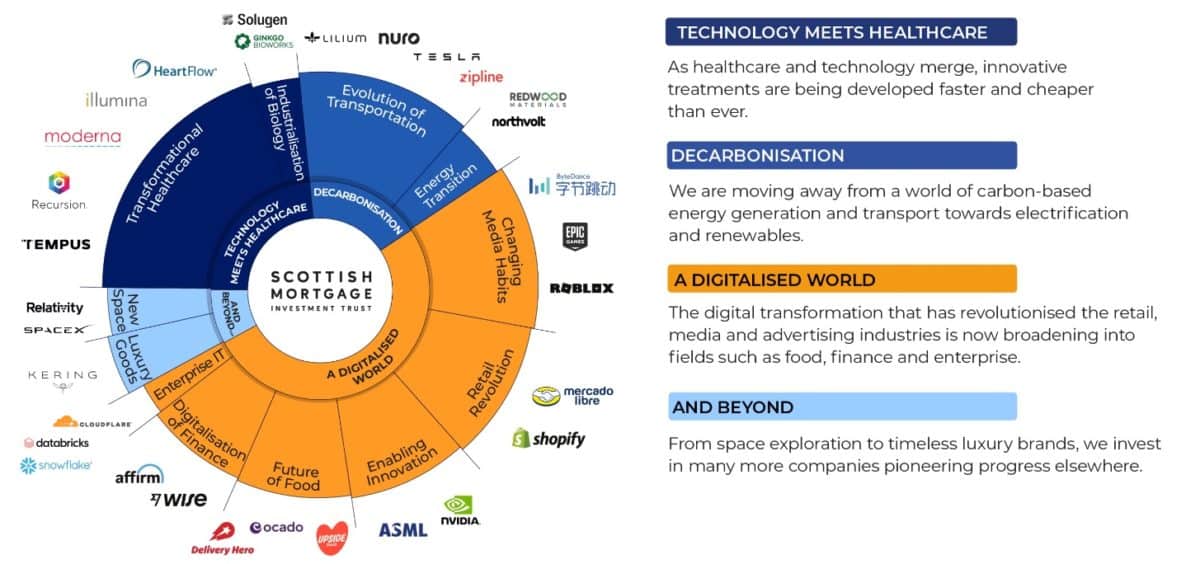

To its shareholders, Scottish Mortgage shares provide a convenient way to get exposure to many hot growth sectors.

As the chart below shows, the trust holds companies that operate in several fast-growing sectors. From electric vehicle maker Tesla to food delivery business Ocado, it gives investors ways to make money from multiple money-making growth trends.

These include the move to cleaner energy technologies and power sources, to the growth of artificial intelligence (AI) and e-commerce.

Encouragingly, the business has cast its net and far and wide in building its portfolio. Instead of investing in just a handful of businesses, it has ploughed capital into more than 100 listed and private companies.

This helps to spread the risk, as does Scottish Mortgage’s decision to invest in companies across the globe. This protects the returns the trust makes from weakness in one or two regions.

Frothy valuations

Yet, in my opinion, the dangers of owning Scottish Mortgage shares still outweigh the potential benefits. Even though the trust trades at a meaty discount to its NAV, I think its share price is in danger of falling further.

Plenty of the tech companies that it’s invested in continue to trade on gigantic valuations.

Earnings forecasts have been trimmed sharply across the sector. So even though many share prices have fallen from the heights they reached during the pandemic, a large number continue to trade on sky-high price-to-earnings (P/E) ratios.

More bad news

This is especially concerning given the steady flow of disappointing news from the tech industry. It’s possible that earnings forecasts could be subject to further heavy downgrades.

Last week, Samsung announced it was slashing microchip production on the back of slumping demand. The South Korean business saw operating profit tank 96% year on year during the first quarter.

I’m also mindful of other bad news at other key Scottish Mortgage holdings. Take Moderna, for instance, which is the trust’s single-largest holding. As I type, a chunky 7.9% of the trust’s capital is invested here.

Last week, the pharmaceuticals giant said of its mRNA-1010 flu vaccine continued to miss key testing standards. Ongoing failure here could spell big trouble for Moderna and, by extension, for its investors.

As I say, Scottish Mortgage shares provide its shareholders with great exposure to many white-hot growth sectors. But, on balance, the risks here are too great to encourage me to invest. I’d rather buy other FTSE 100 stocks right now.